We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Are you tired of feeling like your money disappears each month without knowing where it goes? Zero-based budgeting could be your solution!

This budgeting method is all about assigning every dollar a purpose, making sure your income minus expenses equals zero.

In this guide, I’ll walk you through everything you need to know about zero-based budgeting, including its benefits, how to get started, and tips for success.

Let’s dive in and take control of your finances!

What Is Zero-Based Budgeting?

Zero-based budgeting is a simple yet powerful way to manage your money.

It means that you plan out how to spend every single dollar you earn so that at the end of the month, your income minus your expenses equals zero.

This way, you know exactly where all your money goes and can make sure you’re spending it on things that really matter to you.

History & Origins Of The Concept

Zero-based budgeting isn’t a new idea. It was first used in businesses to help them be more efficient with their money.

Later, people realized it could also work great for personal finances.

By using this method, businesses and individuals alike can make sure they are not wasting money and are using it in the best possible way.

Comparison With Traditional Budgeting Methods

Traditional budgeting methods often just take what you spent last month and adjust it a little for the next month.

But zero-based budgeting starts from scratch every month. You look at all your income and expenses freshly each time.

This way, you are more aware of your spending and can make better choices.

Why It Works

Zero-based budgeting works because it forces you to pay attention to every dollar. Instead of just hoping you’ll have enough money at the end of the month, you plan ahead.

You decide where your money will go before you even get it. This helps you avoid overspending and makes sure you are saving for the future.

In simple terms, zero-based budgeting helps you take control of your money, making sure it works for you, not against you.

It’s a straightforward and effective way to manage your finances, giving you peace of mind and helping you reach your financial goals.

Benefits Of Zero-Based Budgeting

Zero-based budgeting comes with a lot of perks that can make managing your money easier and more effective.

Here are some of the main benefits:

Enhanced Financial Control

With zero-based budgeting, you get to tell your money where to go.

Every dollar has a job, so you know exactly how much you’re spending and saving.

This level of control helps you avoid unnecessary expenses and make sure your money is working for you.

Improved Spending Awareness

Zero-based budgeting makes you more aware of your spending habits.

By listing out all your expenses, you can see where your money is going and make adjustments if needed.

This awareness can help you cut back on things that aren’t important and focus on what truly matters.

Prioritization Of Financial Goals

This budgeting method helps you focus on your financial goals.

Whether you want to save for a vacation, pay off debt, or build an emergency fund, zero-based budgeting lets you prioritize these goals and plan your spending accordingly.

You can make sure you’re setting aside money for what’s important to you.

Flexibility & Adaptability

Life is full of surprises, and zero-based budgeting is flexible enough to handle them.

If your income changes or you have unexpected expenses, you can adjust your budget to fit your new situation.

This adaptability makes it easier to stay on track even when things don’t go as planned.

By using zero-based budgeting, you can gain better control over your finances, become more aware of your spending, focus on your financial goals, and adapt to changes in your income or expenses.

It’s a great way to manage your money and achieve financial peace of mind.

How To Create A Zero-Based Budget

Creating a zero-based budget might sound tricky, but it’s actually pretty simple.

Follow these steps to get started:

Step 1: Calculate Your Monthly Income

First, figure out how much money you make each month. This includes your paycheck, any side jobs, or other sources of income.

Add it all up to get your total monthly income. Knowing how much you have to work with is the first step in making a zero-based budget.

Step 2: List Your Monthly Expenses

Next, write down all the things you spend money on each month. This can include rent or mortgage, utilities, groceries, transportation, entertainment, and any other regular expenses.

Don’t forget to include savings and debt payments. Be as detailed as possible so you don’t miss anything.

Step 3: Assign Every Dollar a Job

Now that you know your income and expenses, it’s time to give every dollar a job.

Start with your most important expenses, like rent and food, and then move on to things like entertainment and savings.

Make sure every dollar from your income is assigned to an expense or a savings goal. The goal is to have your total income minus your total expenses equal zero.

Step 4: Adjust & Balance Your Budget

If your expenses are more than your income, you’ll need to make some adjustments.

Look for areas where you can cut back, like eating out less or finding cheaper entertainment options.

If your income is more than your expenses, you can add more to your savings or pay off more debt. Keep adjusting until your budget balances.

Step 5: Track & Review Your Spending

Finally, keep track of your spending throughout the month. Write down what you spend and compare it to your budget.

This helps you see if you’re staying on track or if you need to make changes. At the end of the month, review your budget and see how you did.

Make any necessary adjustments for the next month.

Creating a zero-based budget is all about planning and tracking. By following these steps, you can make sure every dollar you earn is working for you and helping you reach your financial goals.

Tips For Successful Zero-Based Budgeting

Zero-based budgeting can help you take control of your finances, but like any new habit, it takes some practice to get it right.

Here are some tips to make your zero-based budgeting journey successful:

Use Budgeting Tools & Apps

There are many great tools and apps that can make zero-based budgeting easier.

Apps like EveryDollar and YNAB (You Need A Budget) help you track your income and expenses and ensure every dollar has a job.

These tools can save you time and help you stay organized.

Set Realistic & Achievable Financial Goals

Setting goals is important, but they need to be realistic and achievable. Start with small, manageable goals like saving $50 a month or cutting back on dining out.

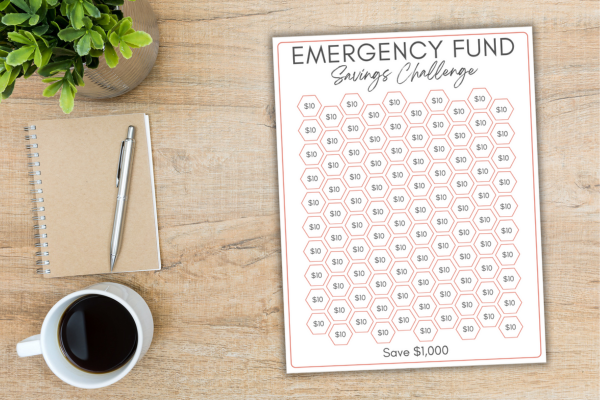

As you get more comfortable with your budget, you can set bigger goals like paying off debt or building an emergency fund.

Regularly Review & Adjust Your Budget

Life changes, and your budget should too. Make it a habit to review your budget regularly, at least once a month.

If your income changes or you have unexpected expenses, adjust your budget to reflect those changes.

Regular reviews help you stay on track and make sure your budget works for you.

Stay Disciplined & Avoid Impulse Spending

Impulse spending can quickly derail your budget. Stay disciplined by sticking to your budgeted amounts.

If you’re tempted to buy something that’s not in your budget, wait 24 hours before making the purchase. This gives you time to think about whether you really need it.

Involve Your Family Or Partner In The Budgeting Process

If you share finances with a family or partner, involve them in the budgeting process.

Discuss your financial goals and make decisions together. This ensures everyone is on the same page and helps you stay accountable.

By using these tips, you can make zero-based budgeting a part of your daily life and reach your financial goals more effectively.

Remember, the key is consistency and being open to adjustments.

Common Challenges & How To Overcome Them

Zero-based budgeting can be very helpful, but it comes with its own set of challenges. Here are some common problems people face and tips on how to overcome them:

Dealing With Irregular Income

If your income isn’t the same every month, zero-based budgeting can be tricky.

One way to handle this is by estimating your lowest monthly income and creating your budget based on that amount. When you earn more than expected, use the extra money to pay off debt or add to your savings.

This way, you’re always prepared for months when your income is lower.

Managing Unexpected Expenses

Unexpected expenses, like car repairs or medical bills, can throw off your budget.

To prepare for these surprises, create an emergency fund. Start by setting aside a small amount each month until you have enough to cover at least a few months’ worth of expenses.

This fund can help you handle unexpected costs without messing up your budget.

Staying Motivated & Consistent

Sticking to a budget can be challenging, especially when you’re just starting out.

To stay motivated, set small, short-term goals and celebrate when you achieve them. For example, reward yourself with a treat when you successfully stick to your budget for a month.

Regularly reviewing your budget and tracking your progress can also help keep you on track.

Adjusting To A New Budgeting Mindset

Zero-based budgeting requires a shift in how you think about money. It might feel strange to plan out every dollar at first, but with practice, it will become second nature.

Remind yourself why you’re doing it – whether it’s to pay off debt, save for a vacation, or achieve financial peace. Keeping your goals in mind can help you adjust to this new way of managing your money.

By understanding and addressing these common challenges, you can make zero-based budgeting work for you.

Remember, it’s all about planning, adjusting, and staying committed to your financial goals. You’ve got this!

Real Life Examples Of Zero-Based Budgeting Success

Hearing about real-life success stories can be super inspiring and show you just how powerful zero-based budgeting can be.

Here are a few examples of people who have transformed their finances using this method:

Case Study 1: Sarah’s Debt Payoff Journey

Sarah was overwhelmed with credit card debt and felt like she was never making any progress. After learning about zero-based budgeting, she decided to give it a try.

By assigning every dollar a job, she was able to see exactly where her money was going and cut back on unnecessary spending.

Sarah focused on paying off her smallest debt first and gradually worked her way up to the larger ones.

Within two years, she had paid off all her credit card debt and started building her savings.

Sarah’s story shows how zero-based budgeting can help you prioritize your financial goals and achieve debt freedom.

Case Study 2: Mark & Lisa’s Family Budget

Mark and Lisa wanted to save for their kids’ college education but found it hard to set aside money each month. They decided to try zero-based budgeting to get their finances in order.

By planning out their income and expenses together, they discovered areas where they could save money, like eating out less and cutting back on entertainment costs.

They started putting the extra money into a college savings fund.

Over time, they were able to save enough to give their kids a strong financial start for college.

Mark and Lisa’s experience highlights how zero-based budgeting can help families work together towards common financial goals.

Testimonial: Emily’s Emergency Fund

Emily was always stressed about unexpected expenses, like car repairs or medical bills. She heard about zero-based budgeting and decided to use it to build an emergency fund.

By carefully tracking her spending and making sure every dollar had a purpose, Emily managed to save up a three-month emergency fund within a year.

Now, she feels much more secure knowing she has a safety net for any financial surprises.

Emily’s testimonial demonstrates how zero-based budgeting can provide financial peace of mind.

These real-life examples show that zero-based budgeting can help you take control of your finances, pay off debt, save for important goals, and build financial security.

Whether you’re managing debt, saving for the future, or just trying to get a handle on your spending, zero-based budgeting can make a big difference.

Give it a try and see how it can transform your financial life!

Final Thoughts

Zero-based budgeting is a powerful tool that can help you take control of your finances and achieve your financial goals.

By assigning every dollar a job, you ensure that your spending aligns with your priorities and values.

Not only does zero-based budgeting give you a clear picture of where your money is going, but it also helps you make informed decisions about your financial future.

With this method, you can reduce financial stress, increase savings, and work towards your dreams with confidence.

Take the first step, create your zero-based budget, and experience the peace of mind that comes with knowing you are in control of your finances.

Happy budgeting!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!