How to Stop Living Paycheck to Paycheck (Without Feeling Overwhelmed)

For a lot of people, living paycheck to paycheck just feels…normal. The money comes in. The bills get paid.

And then—somehow—it’s all gone.

There’s no buffer. No savings. And if something unexpected happens? Instant panic.

That constant stress starts to feel like part of life.

But here’s the truth: it doesn’t have to be.

You don’t need a six-figure income or perfect budgeting skills to start building breathing room. You just need a few small shifts—practical ones and mindset ones.

In this post, I’m sharing 7 realistic ways to help you stop living paycheck to paycheck. These are strategies that work in real life—when you’re busy, overwhelmed, and just trying to keep your head above water.

You don’t have to do all of them today. Just start where you are. Pick one small step.

That’s how everything starts to change.

1. Get Clear on Where Your Money Is Going

This is the part most people want to skip—but it’s where the magic starts. Because if you don’t know where your money is actually going, it’s almost impossible to change anything.

And let’s be honest…most of us are way off when we guess.

We think we’re spending $300 on groceries—it’s more like $550. We think we’re spending $50 on “extras”—but a few small swipes at Target and Starbucks add up fast.

This step isn’t about judgment. It’s about awareness.

Start with just the last 30 days:

- Pull up your bank and credit card statements

- Categorize everything (bills, food, shopping, debt payments, etc.)

- Don’t panic—just total it up

Even if the numbers feel a little (or a lot) uncomfortable, don’t quit here.

Knowing your real numbers gives you the power to start making decisions that actually help.

Tip: If you’ve never done this before, keep it super simple. Use highlighters, sticky notes, or print out your statements and go old-school.

Or, use the printable trackers inside the Budget Reset Bundle—they’re designed to help you map it all out without getting overwhelmed.

The goal isn’t perfection. It’s clarity.

And once you have that? You’re already one step ahead of where you were last month.

2. Build a Budget That’s Actually Livable

This is where most people give up—not because budgeting doesn’t work, but because the budget they’re using doesn’t fit their real life.

If your budget only covers bills and groceries, but doesn’t leave room for things like birthdays, takeout, or that last-minute school fundraiser…it’s going to fall apart.

RECOMMENDED READ: How to Create a Budget That Actually Works for Your Life

A livable budget doesn’t mean saying no to everything—it means planning for what actually happens.

Here’s how to make that shift:

- Start with your non-negotiables: rent, utilities, debt payments

- Then add your real variable expenses: groceries, gas, etc.

- Now budget for the often-forgotten stuff:

- Eating out

- Fun money

- Annual expenses

- Holidays + gifts

- Random “life happens” costs

You don’t need a fancy system to start—just a plan that reflects your actual spending patterns, not an idealized version of what you wish they were.

Not sure which budgeting method to use? Try one of these:

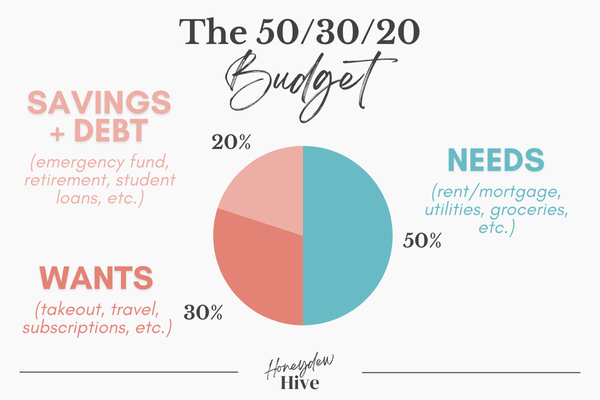

- 50/30/20 Budget: Great for flexibility and quick-start planning

- Budget by Paycheck: Ideal if you’re paid weekly or biweekly

- Zero-Based Budget: Every dollar has a job (best if you like structure)

Whichever method you choose, make sure it’s something you can keep up with. A livable budget is one you’ll actually use—not abandon after two weeks.

If you need help mapping it all out, the Budget Reset Bundle includes done-for-you templates and worksheets that make creating a personalized, livable budget feel way less intimidating.

3. Create a Mini Buffer (Even $20 Helps)

One of the hardest parts about living paycheck to paycheck is that there’s no margin. No room for surprise expenses. No breathing room. Just stress.

That’s why building a buffer—even a tiny one—is one of the most powerful things you can do.

And no, it doesn’t have to start with hundreds of dollars. Start with $5. Or $10. Or the coins at the bottom of your purse.

Here’s what a buffer does:

- Covers small “life happens” expenses (like a forgotten field trip fee or a $15 copay)

- Helps you avoid overdraft fees

- Gives you peace of mind that you’re not starting at zero every payday

The key is consistency, not size.

Set up a small weekly transfer to savings. Use cash-back apps and move the rewards into your buffer. Sell something you’re not using. Every dollar adds up.

Tip: Use a visual tracker to watch your buffer grow—it’s weirdly motivating.

If you need a place to start, the Budget Reset Bundle includes printable savings challenges and emergency fund trackers that make it so much easier to stick with it—even when money is tight.

Remember: $20 in your buffer might not seem like much. But it’s $20 more than you had last week—and it’s proof that things are shifting.

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

4. Shift Out of Survival Mode With Small Mindset Tweaks

When you’re living paycheck to paycheck, you’re not just fighting numbers—you’re fighting mental fatigue. The constant pressure. The second-guessing. The guilt every time you spend money, even on something small.

And here’s the thing: you can’t budget your way out of survival mode without shifting how you think about money.

This doesn’t mean you need affirmations or toxic positivity. It means gently challenging the thoughts that are keeping you stuck.

Start with these small mindset shifts:

- Instead of: “I’m just bad with money.”

Try: “I’m still learning how to manage money in a way that works for me.” - Instead of: “I’ll never get ahead.”

Try: “I’m creating small wins that will add up over time.” - Instead of: “Budgeting is restrictive.”

Try: “Budgeting gives me clarity, not control.”

These tiny mindset tweaks help pull you out of panic mode and into a place where you can make clearer, more confident decisions.

If you’ve never worked on your money mindset before—or if you’ve tried, but it didn’t really stick—I highly recommend the Transform Your Money Mindset guide. It’s packed with practical prompts and perspective shifts that can help you feel more empowered and less defeated when it comes to money.

Because financial change isn’t just about spreadsheets. It starts in your thoughts, too.

5. Automate What You Can

When money is tight, the last thing you want is more mental work. That’s where automation comes in—and it’s seriously underrated.

Even small automations can help reduce stress, prevent late fees, and keep your money moving in the right direction (without you having to think about it every day).

Here are a few ways to make automation work for you:

- Automate bill payments so nothing gets missed

- Set up a recurring transfer of $5 or $10 to your savings account each payday

- Split your paycheck—send a portion straight to savings if your employer allows it

- Use reminders or calendar alerts for non-monthly expenses like car registration, subscriptions, or seasonal bills

You don’t have to automate everything. Just pick one or two things that regularly trip you up and remove the friction.

Bonus: The less you’re scrambling to remember or react to, the easier it is to stay consistent—and consistency is what creates real financial change.

Want a simple system to stay on track week after week? The Budget Reset Bundle includes tools that help you build an easy rhythm without needing to reinvent the wheel every month.

6. Make a Weekly Money Date With Yourself

One of the biggest shifts that helped me—and so many others—was turning money check-ins into a habit, not a reaction.

That’s where a weekly money date comes in.

No, it doesn’t have to be anything fancy. You don’t need to light a candle or create a playlist (unless you want to).

It’s just 15–20 minutes, once a week, to sit down and look at what’s happening with your money—before it gets chaotic.

Here’s what to do during your money date:

- Check your account balances

- Review what came in and what went out

- Look at what’s coming up in the next 7 days (bills, birthdays, grocery runs)

- Adjust your budget if needed

That’s it.

It’s not about judgment or guilt—it’s about awareness and intention.

Pair it with your favorite drink, do it at the same time every week, and treat it like a quick catch-up with your future self.

It’s one of the best things you can do to stay out of paycheck-to-paycheck mode long term.

Tip: Use the trackers in the Budget Reset Bundle to make your weekly money date even easier—so you’re not starting from scratch each time.

7. Accept That Progress Won’t Be Perfect

Here’s something no one talks about enough: Even when you’re doing everything “right,” life will still throw you curveballs.

You’ll have weeks where you overspend. Unexpected bills will pop up. You’ll forget about something or just…feel tired and order pizza instead.

That doesn’t mean you failed. It means you’re human.

Progress isn’t a straight line. It’s more like a messy, wobbly path with a lot of course-correcting along the way.

What matters most is that you keep going.

- You can adjust your budget mid-month.

- You can restart your savings tracker after a bad week.

- You can bounce back from setbacks without beating yourself up.

The people who stop living paycheck to paycheck aren’t perfect—they’re just persistent.

So if this week was a mess? Try again next week.

If you feel behind? You’re not—you’re just getting started.

Give yourself grace. Keep showing up. You’re building something that will last longer than a single mistake.

Final Thoughts: You Deserve to Feel Safe With Your Money

If you’re stuck in the paycheck-to-paycheck cycle, I want you to know this: You’re not doing it wrong. You’re not behind. And you’re definitely not alone.

Most of us were never taught how to manage money in a way that actually works for real life. But that changes the moment you decide to take even one step forward.

You don’t need to do everything all at once. Start with one habit. One mindset shift. One small win.

Because little by little, you can build real breathing room—mentally and financially.

If you’re ready for extra support, here are two amazing places to start:

- The Budget Reset Bundle gives you practical tools to organize your income, expenses, savings goals, and more—all in one simple system.

- Transform Your Money Mindset will help you work through the limiting beliefs, emotional spending patterns, and mental blocks that have kept you stuck.

And if you’re not sure where to begin? Grab my free Ultimate Budget Makeover Planner below—it’s a great first step toward clarity and control.

You’ve got this. And I’m cheering you on.