How to Use Sinking Funds to Stay Ahead of Big Expenses

You know that “surprise” bill that somehow shows up every year?

A birthday. A car repair. Back-to-school shopping. Or the holidays (which shockingly happen every December, and yet…here we are again).

These things aren’t emergencies. They’re predictable—but irregular—expenses.

And when you don’t plan for them, they derail everything.

That’s where sinking funds come in.

They’re one of the most powerful tools for creating financial peace—especially if you’re tired of living paycheck to paycheck or relying on credit cards every time life gets a little expensive.

In this post, I’ll walk you through:

- What sinking funds are

- How they actually work in real life

- Where to keep them (cash or digital)

- And how to set up a simple, no-stress system you can stick to

You’ll also find links to two of my favorite tools:

- The Budget Boss Blueprint to map everything out

- And the Ultimate Cash Stuffing Starter Kit if you want to organize your sinking funds in a stylish A6 binder setup

Let’s break it all down—one category (and one step) at a time.

What Is a Sinking Fund (and Why You Need One)?

A sinking fund is money you set aside on purpose for an expense you know is coming—but not every month.

It’s different from your emergency fund. Emergency funds are for the truly unexpected.

Sinking funds are for the predictable “surprises”—like car repairs, holiday gifts, or your annual Amazon Prime renewal.

Instead of letting those big bills throw your budget into chaos, you break them down and start saving in advance.

Here’s a quick example: Let’s say you want $600 for holiday gifts this year. If you start saving in January, that’s just $50 a month.

Set it aside every month, and by December? You’re ready—no credit card needed.

It’s that simple.

Sinking funds help you:

- Stay ahead of your expenses instead of scrambling

- Reduce guilt and stress around spending

- Create a more consistent monthly budget

- Finally feel like you’re making progress with your money

Whether you save digitally or use a cash envelope system, the goal is the same: you’re telling your money where to go—before life makes the decision for you.

How Sinking Funds Help You Stay in Control

Let’s be honest—most budgeting stress doesn’t come from the regular bills. It’s the ones that pop up out of nowhere…except they’re not really surprises.

And when you don’t plan for them, it feels like you’re always falling behind. That’s exactly why sinking funds are a game-changer.

Here’s how they help you stay in control of your money:

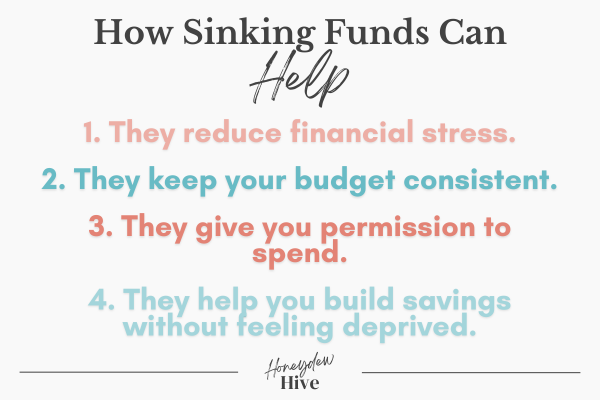

✅ They reduce financial stress

You’re not blindsided by that $300 car repair or your kid’s sports registration fee. You already set money aside for it.

✅ They keep your budget consistent

Instead of having one expensive month that wrecks your progress, you spread the cost out over time—making your budget more balanced and predictable.

✅ They give you permission to spend

Yes, really. Because when you’ve planned ahead, you can spend without guilt. That vacation or holiday gift? It’s already covered.

✅ They help you build savings without feeling deprived

Even small amounts—$10 here, $25 there—add up fast when they’re tied to a purpose.

Sinking funds don’t just organize your money—they protect your peace. And if you’ve never tried them before, this is your sign to start.

How to Start a Sinking Fund (Even If You’re on a Tight Budget)

You don’t need extra money to start a sinking fund. You just need a plan—and a few dollars at a time.

Here’s how to set one up in four simple steps:

Step 1: Pick 1–3 upcoming expenses you know are coming.

Start with the big ones you always seem to forget:

- Car maintenance

- Christmas gifts

- Back-to-school supplies

- Annual membership fees

Don’t overdo it. One well-funded category is more powerful than five half-funded ones.

Step 2: Decide how much you need—and by when.

Let’s say you want $300 for holiday shopping in 6 months. That’s $50/month or $25 every two weeks.

Breaking it down this way makes it feel doable.

Step 3: Set up a way to track your progress.

Use a notebook, a spreadsheet, or printable trackers inside the Budget Boss Blueprint—whatever helps you stay consistent.

Step 4: Add to it every time you get paid.

Even if it’s just $10 or $15. Every bit moves you closer. You can stuff a cash envelope, transfer it into a separate account, or use a budgeting app.

If you love the idea of using cash (and want everything set up for you), the Ultimate Cash Stuffing Starter Kit includes printable envelopes, sinking fund trackers, paycheck breakdowns, and more to help you automate your goals.

You don’t need to have it all figured out. You just need to get started.

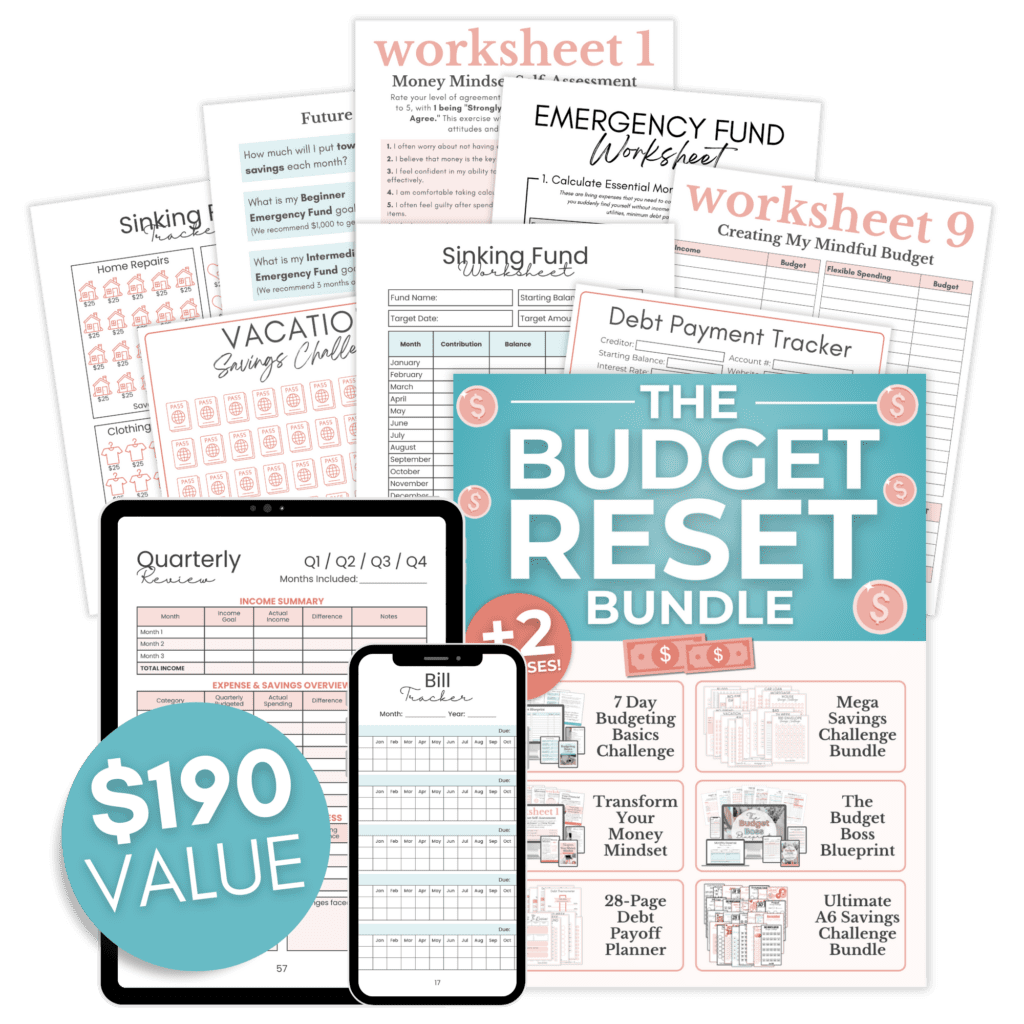

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

Most Common Sinking Fund Categories

Not sure where to start? Here are some of the most popular (and practical) sinking fund categories that can save your future self a ton of stress.

You definitely don’t need all of these—just choose what makes sense for your life right now:

- 🚗 Car Repairs & Maintenance

- 🎄 Christmas & Holidays

- 🎂 Birthdays & Gifts

- ✈️ Vacations & Travel

- 🧾 Annual Subscriptions or Memberships

- 🏡 Home Repairs or Maintenance

- 🎒 Back-to-School Expenses

- 👚 Clothing & Shoes

- 🩺 Medical & Dental Copays

- 🐾 Pet Care

- 💇♀️ Haircuts & Self-Care

- 🧼 Household Essentials (bulk stock-ups)

- 📱 Tech Replacements (phones, tablets, etc.)

- 🪴 Home Décor or Furniture

- 🧑🏫 Kids’ Activities or Sports

- ☕ Fun Money / Treat Yourself Fund

The key is to pick categories that feel “random” when they pop up—but happen every year. These are perfect for sinking funds.

Want to organize these categories in your A6 cash binder setup?

The Ultimate Cash Stuffing Starter Kit comes with pre-filled and blank binder dividers, 6 unique sinking fund trackers, category labels, and printable envelopes—so you can personalize your system and make it totally your own.

Where to Keep Your Sinking Funds

Once you know what you’re saving for, the next step is figuring out where to keep the money.

There’s no one right answer here—just choose the option that works best for your lifestyle, your personality, and how you like to manage your money.

Here are a few popular (and beginner-friendly) options:

Cash Envelopes or A6 Binder Systems

If you’re a visual person, this is a game-changer. You can physically see your progress, which helps you stay motivated.

It’s also great if you tend to overspend when using a debit card.

The Ultimate Cash Stuffing Starter Kit includes printable envelopes, dividers, and trackers—all ready to drop into your A6 binder for easy organizing.

Multiple Bank Accounts or Sub-Savings Accounts

Many online banks allow you to open separate “buckets” or nicknamed sub-savings accounts—one for each sinking fund.

This keeps your money organized and out of sight, so you’re less likely to dip into it.

High-Yield Savings Account (HYSA)

If your sinking funds are for larger or longer-term expenses (like a vacation or a new car), consider storing them in a HYSA.

You’ll earn interest while your money sits there, and many online banks make it easy to create multiple savings goals within one account.

Tip: Just make sure your HYSA allows for multiple transfers and doesn’t charge fees for moving money around.

Budgeting Apps or Digital Cash Envelopes

Apps like YNAB or Goodbudget let you set up digital envelopes without needing to carry physical cash. Great for tech-savvy folks who still want structure but prefer digital tools.

No matter which method you choose, the most important thing is this: Keep your sinking funds separate.

That way, you’re not mixing them with your day-to-day spending money or accidentally using them for groceries.

And don’t overthink it—start with whatever system feels easiest right now. You can always adjust later.

How to Stay Consistent (and Make It Feel Fun)

Starting a sinking fund is exciting. But staying consistent with it? That’s the hard part.

Here’s the truth: saving money doesn’t have to be boring. The more fun and personalized you make the process, the more likely you are to stick with it—even on the tough weeks.

Here are a few ways to stay on track:

Make it visual

Use savings trackers to watch your progress grow. Color in boxes, fill up a jar, check off milestones—it’s surprisingly motivating.

Build it into your routine

Set a reminder every payday to move money into your sinking funds (or stuff your envelopes). Create a 10-minute “cash stuffing ritual” each week to review and reset.

Use savings challenges for short-term motivation

Mix things up with a no-spend challenge or a short-term goal like “save $150 in 10 days.” It keeps the momentum going and helps you reach your bigger goals faster.

RECOMMENDED READ: The Best Money-Saving Challenges to Grow Your Savings Faster

The Ultimate Cash Stuffing Starter Kit includes multiple savings challenges (like $500, $1,000, no-spend, 5- and 10-day “Stuff & Save” trackers), plus printable placeholders and trackers to help you celebrate every small win.

Talk about it with someone

Even if it’s just a friend, a partner, or a budgeting community online—sharing your progress helps you stay accountable and motivated.

Remember, consistency beats intensity. You don’t need to save a ton of money overnight.

You just need to keep showing up for your goals—one envelope or one transfer at a time.

Final Thoughts: Sinking Funds Are the Secret to Stress-Free Spending

Life is full of “surprise” expenses. But when you’ve planned for them with sinking funds, they don’t feel stressful—they just feel handled.

Whether you’re saving $10 a week or $100 a month, you’re building peace of mind every time you set money aside for your future self.

And that’s what smart money management is really about.

So here’s your next step:

- Pick one category.

- Set a goal.

- Start saving for it—on purpose.

If you want a tool to help you create your full monthly plan (with space for every sinking fund), grab the Budget Boss Blueprint—it’s perfect for building your budgeting system from the ground up.

And if you’re using a cash envelope system (or want to try it!), the Ultimate Cash Stuffing Starter Kit has everything you need to set up your binder, organize your categories, track your progress, and stay consistent with ease.

Need help getting started with your overall budget?

My Ultimate Budget Makeover Planner is a free printable that gives you a head start. It’s perfect for organizing your income, expenses, and goals so you can build a plan that actually works.

Click below to download your free planner and take the first step toward financial peace.

Big expenses don’t have to wreck your budget. Sinking funds give you the confidence to say, “Yep, I’ve got this.”

And you do.