7 Ways to Shift Your Money Mindset & Stop Feeling Stuck

You’ve tried the budgeting apps. You’ve downloaded the free printables. You’ve made the spreadsheet, the plan, the goals.

And yet—you still feel stuck.

That’s not because you’re bad with money. It’s because money isn’t just about math—it’s about mindset.

The way you think about money—what you believe you’re capable of, what you feel you “deserve,” how you respond to mistakes—impacts every decision you make.

And if you’ve never taken time to really look at your money mindset, it might be the reason your progress keeps stalling out.

The good news? Mindset isn’t fixed. And neither is your future.

In this post, I’m sharing 7 practical ways to start shifting your money mindset so you can stop feeling stuck—and finally feel like you’re moving forward.

And if you want to go even deeper, my Transform Your Money Mindset guide walks you through this process step by step. No fluff, no “just manifest it” advice—just real talk, real strategies, and real growth.

Let’s dive in.

RECOMMENDED READ: What Is a Money Mindset & Why It’s Sabotaging Your Budget

1. Acknowledge What You’ve Learned About Money

Most of us were never formally taught how to manage money. But that doesn’t mean we didn’t learn anything.

We picked things up from the people around us—what they said, what they avoided, what they struggled with. And a lot of that learning happened without us even realizing it.

Maybe you grew up hearing:

- “We can’t afford that.”

- “Money doesn’t grow on trees.”

- “Rich people are greedy.”

- “You have to work hard just to get by.”

Or maybe no one talked about money at all—and that silence taught you it was stressful, shameful, or not your responsibility.

Before you can shift your money mindset, you have to get honest about the beliefs you’re still carrying.

Because whether or not they still serve you, they’re shaping your financial decisions every day.

Here’s a simple way to start – take 5–10 minutes and write down:

- What you saw growing up around money

- What you were told (or not told)

- How it made you feel

Awareness is the first step. Once you know what’s been driving your behavior, you can start to choose differently.

You don’t have to carry forward everything you were handed. You get to rewrite the story.

If you’re ready to dig into this deeper, the Transform Your Money Mindset guide walks you through this process with journal prompts, reflection exercises, and step-by-step support.

2. Get Clear on the Story You’re Telling Yourself

We all have an internal narrative when it comes to money.

Some of it is loud and obvious—like “I’m just not good with money.” Other parts are quieter, running in the background without us noticing.

But those stories shape the way we save, spend, earn, and react.

Here are a few common money stories:

- “I’ll always be broke.”

- “I never follow through on a budget.”

- “People like me don’t get ahead.”

- “If I make more money, something bad will happen.”

- “I’m not responsible enough to manage a lot of money.”

These thoughts might not feel like full-on beliefs—but when they go unchecked, they become patterns.

And patterns become habits.

And habits are what shape our results.

So let’s get honest.

Start by asking:

- What do I really believe about myself and money?

- What do I believe I’m capable of?

- Where did that belief come from—and is it actually true?

Journaling is powerful here. So is simply noticing when those old stories come up and saying, “Oh, there’s that thought again.”

Because once you see the story, you can stop letting it run the show.

Ready to go deeper? Inside the Transform Your Money Mindset guide, there’s an entire section devoted to uncovering and rewriting the beliefs that are keeping you stuck—so you can finally start building a story that actually supports your goals.

3. Challenge a Scarcity Mentality

A scarcity mindset tells you there’s never enough.

Not enough money.

Not enough time.

Not enough opportunity.

Not enough of you to go around.

And when that belief is running the show, it’s easy to fall into fear-based decisions—hoarding, avoiding, or sabotaging anything that feels too good to be true.

The problem is, scarcity thinking feels responsible. It tricks you into believing that being cautious = being smart.

But there’s a big difference between being financially aware and being ruled by fear.

Challenging scarcity doesn’t mean ignoring your current situation. It means learning to believe that things can change. That money can flow. That progress is possible. That you are allowed to have more than just “barely enough.”

Try this simple mindset shift:

- Instead of asking “What can I cut?” ask “What can I create or redirect?”

- Instead of “There’s never enough,” try “What I have today can lead to more tomorrow.”

And when you feel yourself slipping into panic or lack, pause and ask:

- What am I afraid will happen?

- What do I actually need right now?

- What would I do differently if I trusted that more is coming?

You don’t have to fake abundance. You just have to stay open to possibility.

Inside the Transform Your Money Mindset guide, I walk you through exactly how to shift from scarcity into a grounded, realistic sense of abundance—one that supports better decisions, not reckless ones.

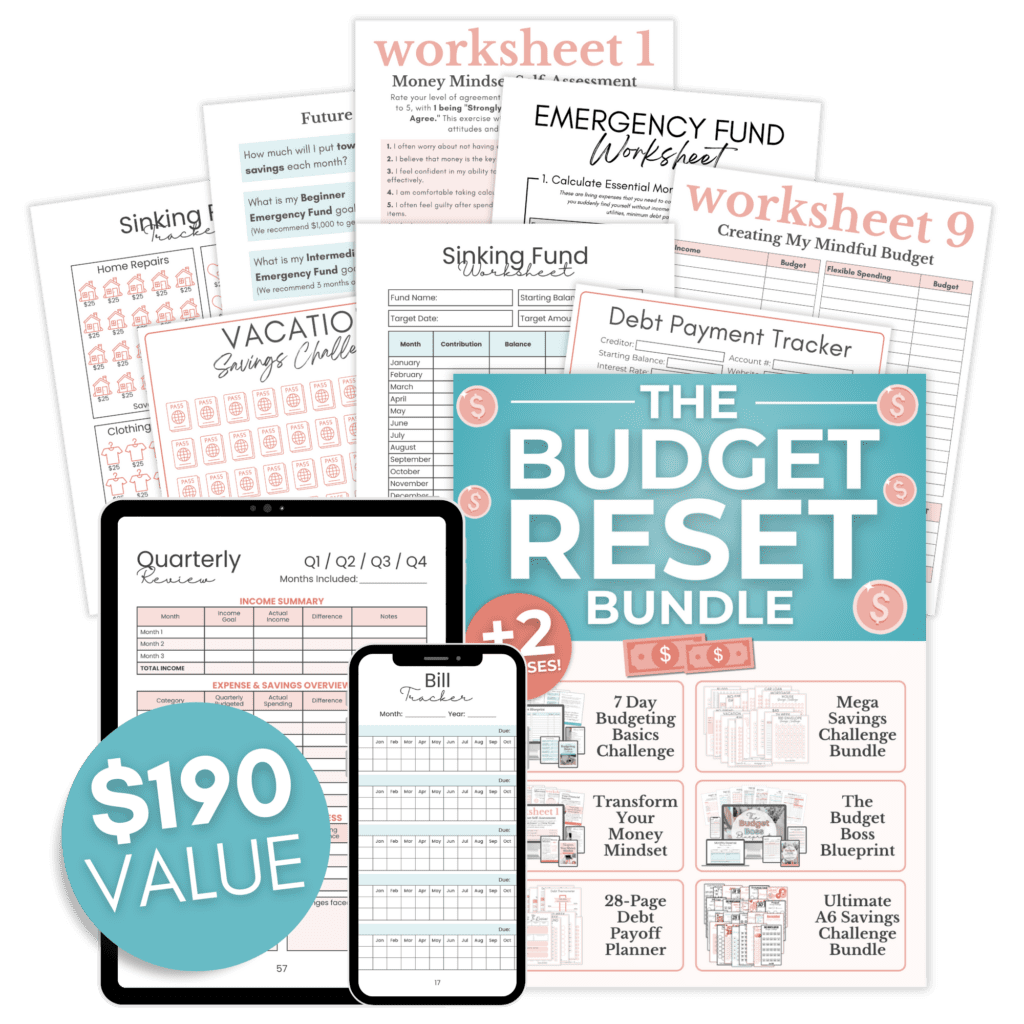

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

4. Stop Using Shame as a Budgeting Tool

Let’s be honest—most of us have tried to “shame” ourselves into better financial habits at some point.

We overspend and say things like:

- “I’m so irresponsible.”

- “I’ll never get this right.”

- “Why do I keep doing this?”

It might feel like tough love…but shame doesn’t create change. It creates avoidance.

You don’t need to beat yourself up to get back on track. You need clarity, compassion, and a plan that meets you where you are.

Try shifting your inner dialogue from judgment to curiosity:

- Instead of “I blew my budget—again,” ask “What threw me off this month?”

- Instead of “I’m bad with money,” try “What would help me feel more in control next time?”

You’re not behind. You’re just learning.

Progress happens when you stop punishing yourself for not being perfect and start asking better questions about what you need, what’s working, and what needs support.

If this is a hard pattern to break, you’re not alone.

That’s why the Transform Your Money Mindset guide includes journal prompts and reflection exercises specifically designed to help you move from guilt to growth—because the real goal isn’t perfection, it’s peace.

5. Define What “Success” with Money Actually Looks Like for You

One of the most common reasons people feel stuck with money? They’re chasing a version of success that doesn’t even belong to them.

We see messages everywhere about building wealth, buying the dream house, reaching six figures, or retiring by 35. And while those things might be great for some people—they might not reflect what you actually want.

So let’s reframe the goal.

Ask yourself:

- What would “peace” look like in my finances?

- What would financial stability feel like day to day?

- What do I want more of—and what do I want less of—in my money life?

For some, success might look like paying off debt and finally sleeping through the night. For others, it might mean traveling without guilt or saying yes to last-minute invitations without checking their bank app.

There’s no one-size-fits-all version of success. But when you define it for yourself, your progress will start to feel like progress—because it’s aligned with your real values.

Inside the Transform Your Money Mindset guide, there’s a full section that helps you clarify your financial priorities, name your version of success, and create a mindset that supports your goals—not just the ones trending online.

6. Practice Self-Trust With Small Wins

If you’ve ever said, “I can’t stick to a budget,” or “I always fall off track,” what you might actually be struggling with is self-trust.

And self-trust doesn’t come from big, dramatic gestures. It comes from following through—even in small ways.

The shift happens when you stop trying to change everything overnight and start stacking up tiny wins:

- Transferring $10 to savings

- Saying no to one impulse purchase

- Writing down what you spent for the day

- Opening that bill you’ve been avoiding and making a plan

Those small actions don’t just move the needle financially—they remind you that you can do this.

Every time you keep a promise to yourself, you build trust. And when you trust yourself, you’re less likely to spiral, sabotage, or give up when life gets messy.

If you’ve been stuck in a cycle of starting and stopping, this is where you begin:

Pick one thing. Follow through. Then do it again.

Inside the Transform Your Money Mindset guide, there are simple action steps and habit-building tools designed to help you create momentum that feels good—so your mindset has something solid to stand on.

7. Surround Yourself With Supportive Messages & Tools

Mindset work is powerful—but it’s also fragile when you’re first starting out.

You might spend time journaling, shifting your beliefs, and setting better goals…but then spend the rest of the day scrolling past financial advice that makes you feel behind or ashamed.

That’s why it’s so important to protect your progress by surrounding yourself with voices, tools, and environments that support your growth.

This might look like:

- Following creators who teach money skills with compassion, not judgment

- Unsubscribing from influencers who push unrealistic financial milestones

- Reading content that reflects where you are—not just where you “should” be

- Using tools that help you stay engaged without feeling overwhelmed

You don’t have to do this alone.

You just need the right kind of support—one that meets you with encouragement, structure, and a little bit of grace.

That’s exactly why I created the Transform Your Money Mindset guide. It’s not about pretending you’re wealthy or repeating affirmations you don’t believe. It’s about getting honest about your habits, beliefs, and goals—and learning how to shift them in a way that actually lasts.

You can do this. And you don’t have to wait until everything’s perfect to begin.

Final Thoughts: Your Mindset Isn’t Fixed—And Your Future Isn’t Either

If you’ve been feeling stuck with money, you’re not alone. But you’re also not stuck forever.

Your money mindset isn’t who you are—it’s just a set of beliefs you’ve been carrying. And the good news is, beliefs can change.

Every time you take a small, intentional step—whether it’s setting a boundary, shifting a thought, or saving a few dollars—you’re building a new relationship with money. One that’s based on self-trust, not shame.

You don’t have to overhaul everything today.

Just pick one mindset shift that resonated with you and start there.

If you’re ready to dive deeper into the work that actually creates change, the Transform Your Money Mindset guide will walk you through the full process—reflecting on your past, creating clarity around your future, and taking real action in the present.

And if you need help organizing your money so your mindset shifts have something to anchor to, download my free Ultimate Budget Makeover Planner below. It’s the perfect way to build structure, clarity, and progress—starting right where you are.

You’re not behind.

You’re just getting started. And I’m cheering for you every step of the way.