How to Pay Off Debt Fast: 7 Proven Strategies

If you’re feeling crushed under the weight of your debt, you’re not alone—and you’re definitely not stuck.

Whether it’s credit cards, student loans, medical bills, or a mix of everything, the pressure to get out of debt quickly can feel overwhelming.

You want a way out, but most days, it feels like you’re barely making a dent.

Here’s the truth: you absolutely can pay off debt fast—but it takes more than just wishing and minimum payments. It takes a strategy, consistency, and the right tools to keep you focused and motivated.

The good news? You don’t need a huge income or perfect financial habits to make serious progress.

In this post, I’m walking you through 7 proven strategies to pay off debt faster, plus the exact tools I recommend to make it easier along the way.

These are the same approaches that helped me pay off over $30,000 of debt, and they can work for you too.

Let’s dig in—and get you one step closer to debt-free.

Strategy #1: Get Clear on What You Owe

Before you can pay off debt fast, you need to get brutally honest about where you stand. That means writing down every single debt you owe—even the ones you’ve been avoiding.

Grab a notebook, a spreadsheet, or my Ultimate Debt Payoff Planner and list out:

- Who you owe (lender or creditor)

- Total balance

- Interest rate

- Minimum monthly payment

- Due date

This step might feel uncomfortable, especially if the numbers are bigger than you hoped—but it’s also empowering. Because once you know the full picture, you can start making a real plan to tackle it.

Many people stay stuck in debt simply because they haven’t organized the details. Clarity is the first step to progress—and it’s how you stop feeling overwhelmed and start taking action.

If you want a done-for-you tool to help organize all your debts in one place and track your progress every month, my Ultimate Debt Payoff Planner makes it simple.

Just plug in your numbers, and you’ll have a clear plan in front of you—on paper, where it matters.

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

Strategy #2: Pick a Payoff Method (Snowball or Avalanche)

Once you know exactly what you owe, it’s time to choose your game plan.

Two of the most effective methods for paying off debt quickly are the debt snowball and the debt avalanche—and both work, as long as you stay consistent.

❄️ Debt Snowball

With this method, you focus on paying off your smallest debt first, regardless of the interest rate. As soon as it’s paid off, you roll that payment into the next smallest, and so on.

It’s all about momentum—you get quick wins that help you stay motivated.

🔥 Debt Avalanche

Here, you focus on the debt with the highest interest rate first, while still making minimum payments on the others.

It saves you more money in the long run, but it can take a little longer to feel like you’re making progress.

There’s no one-size-fits-all answer—the best method is the one you’re most likely to stick with.

If you want a tool to do the math for you and clearly show how fast you can make progress, try my Debt Snowball Google Sheets Spreadsheet.

It auto-calculates your monthly snowball and tracks every payoff milestone so you always know where you stand.

Whether you go snowball or avalanche, it helps you stay focused—and that’s what gets results.

Strategy #3: Cut Unnecessary Expenses and Redirect to Debt

If you’re serious about paying off debt fast, one of the most effective things you can do is free up extra cash—and that starts with cutting the expenses that don’t actually serve you.

Take a hard look at your monthly spending and ask: What can I cut, cancel, or pause (just for now) so I can throw more at my debt?

Here are a few quick wins:

- Cancel unused subscriptions or memberships

- Cook at home instead of ordering takeout

- Pause online impulse shopping (you know the late-night Target scroll…)

- Swap out name-brand groceries for store brands

- Skip the drive-thru coffee and brew at home

These small changes might not feel like much at first, but when you intentionally redirect even $100–$200 a month toward your debt, you’ll start seeing real movement. That momentum is powerful.

The key is not just cutting expenses—but reassigning those dollars with purpose.

This is where having a visual plan helps. My Ultimate Debt Payoff Planner is designed to track what you’re saving and how it’s being used to chip away at your debt.

When you see the progress stacking up, it gets a whole lot easier to say no to that third streaming service.

Strategy #4: Use Savings Challenges to Pay Off Debt

Who says paying off debt can’t be a little fun?

If you struggle with staying motivated or just want to shake up your routine, try using a savings challenge—but instead of saving for a vacation or emergency fund, use it to pay down debt.

Here’s how it works:

- Choose a challenge that fits your lifestyle (like saving $10/week or rounding up every purchase)

- Track your progress visually (coloring in boxes, checking off icons, etc.)

- Once you hit your goal, make an extra debt payment with the total amount saved

This approach turns something stressful into something satisfying. You get little wins along the way—and watching that payoff total grow is a major motivation boost.

If you want to keep it simple, you can use my Mega Savings Challenge Bundle to find a challenge that works with your budget.

Or, if you’re already using my Ultimate Debt Payoff Planner, you can set a specific “challenge tracker” just for bonus payments.

Either way, you’re making progress in a way that feels creative and intentional.

Strategy #5: Increase Your Income (Even Just a Little)

Cutting expenses can only take you so far—if you want to pay off debt faster, the next level is bringing in a little extra income.

And no, that doesn’t mean picking up a second job or working 80 hours a week. Even an extra $100–$500 a month can make a huge difference when you put it straight toward your debt.

RECOMMENDED READ: How to Get Paid to Write From Home (Even With Zero Experience)

Here are a few beginner-friendly ways to earn more:

- Pick up a weekend side hustle like pet sitting, delivery driving, or flipping thrift finds

- Sell things you’re no longer using (clothes, gadgets, home decor)

- Offer a simple service—think resume editing, tutoring, or virtual assistant work

- Use gig platforms to get started quickly without needing a business plan

This isn’t about adding stress to your life—it’s about finding a manageable way to speed up your progress and create some breathing room.

If you’re not sure where to start, check out my blog post on 10 Profitable Side Hustles You Can Start This Weekend for easy ideas that don’t require special skills or tons of time.

Every extra dollar you earn is another step closer to being debt-free—and that’s worth showing up for.

Strategy #6: Automate Your Extra Payments

One of the easiest ways to pay off debt faster—without relying on willpower—is to automate your progress. When you set it and forget it, you remove the temptation to spend that money elsewhere.

Start by making sure all of your minimum payments are on autopay so you never miss a due date. Then, set up a second automatic payment—even if it’s small—to go toward your focus debt every month.

This could be $25, $100, or whatever extra you can consistently spare.

Why it works:

- It eliminates the “I forgot to make that extra payment” problem

- You’re less likely to spend what you never see in your checking account

- It keeps you moving forward even during busy or stressful seasons

You can also use visual tracking tools like the Debt Snowball Google Sheets Spreadsheet to pre-plan your payments and see how every extra dollar shortens your payoff timeline.

When the process is automated and visible, your results start compounding faster than you expect.

Strategy #7: Track Your Wins and Stay Motivated

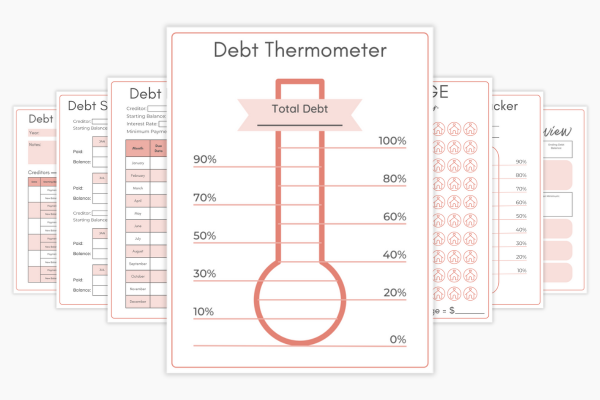

Paying off debt fast isn’t just about numbers—it’s about mindset. And one of the most powerful ways to stay in the game is to track your progress and celebrate your wins along the way.

It might not seem like a big deal to pay off $100 here or $500 there, but those mini milestones add up fast—and they deserve to be recognized.

When you can see how far you’ve come, it’s easier to stay focused, even when the process feels slow.

Here are a few simple ways to stay motivated:

- Use a visual debt tracker (color in progress bars, check off milestones)

- Keep a running total of how much debt you’ve paid off

- Celebrate with small rewards at key milestones ($1,000 paid off = treat yourself to your favorite takeout or a guilt-free night off from budgeting)

Tools like my Ultimate Debt Payoff Planner and Debt Snowball Spreadsheet are designed to make your progress tangible.

They give you a way to see every dollar working for you—and that’s the kind of motivation that keeps you going when you’re tempted to give up.

You don’t have to wait until you’re completely debt-free to feel successful. Every payment is a win—track it, celebrate it, and keep moving forward.

Final Thoughts: Fast Is Possible—With the Right Plan

Paying off debt fast doesn’t mean cutting out everything you love or living under extreme restrictions. It means getting focused, being intentional, and using strategies that actually move the needle.

When you combine clarity, consistency, and the right tools, you can absolutely make progress faster than you think.

The truth is, you don’t need a perfect budget or a massive income—you just need a plan that works for your life.

That’s exactly why I created the Ultimate Debt Payoff Planner and the Debt Snowball Spreadsheet—to help you stay organized, track every win, and stay motivated for the long haul.

And if you’re starting from scratch and need help getting your entire budget under control first, don’t miss my free Ultimate Budget Makeover Planner.

It’s packed with simple, printable worksheets to help you take charge of your income, spending, and savings—so you can free up more money to pay off debt even faster.

If you’re ready to take the first real step toward becoming debt-free, pick the strategy that feels most doable and start today. Your future self will thank you.