We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Saving money can sometimes feel like a tough task, but it doesn’t have to be!

Whether you’re living paycheck to paycheck or just looking to make your money go further, having some handy money saving techniques up your sleeve can make all the difference.

In this post, I’ll share nine proven money saving techniques that work for every budget. These tips are simple, practical, and easy to follow, so you can start saving money right away.

Let’s dive in and discover how you can keep more of your hard-earned cash in your pocket!

Technique 1: Create A Budget & Stick To It

One of the best money saving techniques is to create a budget and stick to it. A budget helps you see where your money is going and makes it easier to save.

Here’s how you can create a budget:

- List your income: Write down all the money you earn each month. This includes your salary, any side jobs, or other sources of income.

- List your expenses: Write down everything you spend money on. This includes rent, groceries, bills, and even small things like coffee.

- Categorize your spending: Group your expenses into categories like housing, food, entertainment, and transportation.

- Set spending limits: Decide how much money you want to spend in each category. Make sure your total spending is less than your income.

- Track your spending: Keep track of what you spend each day. This helps you stay within your limits.

Helpful tips:

- Use budgeting tools and apps like YNAB (You Need A Budget) or my Ultimate Budget Makeover Planner to make it easier.

- Review your budget regularly and make adjustments if needed.

Creating and sticking to a budget is one of the most effective money saving techniques. It helps you control your spending and find more ways to save.

Technique 2: Track Your Spending

Another key money saving technique is to track your spending. Knowing where your money goes helps you find areas where you can save.

Here’s how you can track your spending:

- Keep a spending journal: Write down everything you buy each day. This can be in a notebook or on your phone.

- Use a tracking app: Apps like PocketGuard or Spending Tracker make it easy to record your expenses.

- Review your spending: Look at your spending journal or app at the end of each week. See if there are any patterns or areas where you spend too much.

Helpful tips:

- Set a reminder to record your expenses every day.

- Compare your spending to your budget to see if you’re staying on track.

Tracking your spending is a simple but powerful money saving technique. It helps you see where your money is going and makes it easier to cut back on unnecessary expenses.

Technique 3: Reduce Unnecessary Expenses

One of the easiest money saving techniques is to cut out unnecessary expenses. This means spending less on things you don’t really need.

Here’s how you can reduce unnecessary expenses:

- Identify non-essential spending: Look at your spending journal or app and find things you can do without. This might include dining out, subscription services, or impulse buys.

- Cut back on extras: Instead of eating out, cook at home. Cancel subscriptions you don’t use. Try free activities instead of paid ones.

- Set limits: Decide how much you want to spend on non-essential items each month and stick to it.

Helpful tips:

- Review your bank statements to spot recurring charges you might have forgotten about.

- Make small changes first, like cutting out one coffee shop visit a week, and see how it adds up.

By reducing unnecessary expenses, you can save a lot of money without feeling deprived.

This money saving technique is all about making smarter choices with your money so you can save more for the things that really matter.

Technique 4: Shop With A List

One of the best money saving techniques is to shop with a list. Having a list helps you avoid impulse buys and stick to your budget.

Here’s how you can shop with a list:

- Plan your purchases: Before you go to the store, write down everything you need to buy. This can be for groceries, clothes, or anything else.

- Stick to your list: When you’re shopping, only buy what’s on your list. Avoid adding extra items to your cart.

- Make a meal plan: For groceries, plan your meals for the week and list the ingredients you need. This helps you buy only what you’ll use.

Helpful tips:

- Check your pantry and fridge before making your grocery list to avoid buying things you already have.

- Try to shop once a week to reduce the chances of making extra trips and buying unnecessary items.

Shopping with a list is a simple and effective money saving technique. It helps you stay focused, avoid overspending, and make sure you’re buying what you really need.

Technique 5: Take Advantage Of Discounts & Coupons

A great money saving technique is to use discounts and coupons whenever you can. They can help you save a lot on things you already buy.

Here’s how you can take advantage of discounts and coupons:

- Look for coupons: Check online, in newspapers, and in store flyers for coupons on items you need. Websites like Coupons.com and RetailMeNot are good places to start.

- Use discount codes: When shopping online, always search for discount codes before you check out. Many websites offer promo codes for first-time buyers or seasonal sales.

- Join loyalty programs: Sign up for store loyalty programs to get exclusive discounts and rewards points. These can add up to big savings over time.

Helpful tips:

- Use apps like Honey or Rakuten to find and apply coupons automatically when shopping online.

- Keep an eye out for sales and stock up on non-perishable items when they are discounted.

By using discounts and coupons, you can save money on everyday purchases.

This money saving technique helps you get more for your money without cutting back on the things you need or love.

Technique 6: Cook At Home More Often

Cooking at home more often is a fantastic money saving technique. It’s cheaper than eating out and can be a lot healthier too.

Here’s how you can cook at home more often:

- Plan your meals: Decide what you’ll cook for the week and make a shopping list of ingredients you need. This helps you avoid last-minute takeout.

- Try simple recipes: Start with easy recipes that don’t take much time to prepare. There are lots of beginner-friendly recipes online.

- Prep in batches: Cook larger portions and save leftovers for another meal. This saves time and ensures you always have something ready to eat.

Helpful tips:

- Use a slow cooker or Instant Pot for easy, one-pot meals.

- Get the whole family involved in cooking to make it fun and share the workload.

Cooking at home is a great way to reduce your food expenses. Plus, you get to enjoy tasty, homemade meals that you can feel good about.

Technique 7: Buy Second-Hand

One of the best money saving techniques is to buy second-hand items. You can find great deals on things that are still in good condition, and it’s better for the environment too!

Here’s how you can buy second-hand:

- Shop at thrift stores: Visit local thrift stores to find clothes, furniture, and other items at a fraction of the cost of new ones.

- Browse online marketplaces: Websites like eBay, Craigslist, and Facebook Marketplace have lots of second-hand items for sale.

- Check out garage sales: Look for garage or yard sales in your neighborhood. You can often find hidden gems at super low prices.

Helpful tips:

- Always inspect items carefully before buying to make sure they’re in good condition.

- Don’t be afraid to negotiate the price, especially at garage sales.

Buying second-hand is a smart money saving technique that helps you get what you need without spending a lot. Plus, it can be fun to hunt for bargains and find unique items!

Technique 8: Save On Utilities

Saving on utilities is a practical money saving technique that can make a big difference in your monthly expenses. Simple changes at home can help you lower your bills.

Here’s how you can save on utilities:

- Use energy-efficient appliances: Switch to energy-efficient light bulbs and appliances. They use less power and can save you money in the long run.

- Unplug electronics: Unplug devices and chargers when you’re not using them. Even when turned off, they can still use electricity.

- Adjust thermostat settings: In the winter, keep your thermostat a few degrees lower and wear a sweater. In the summer, set it a bit higher and use fans to stay cool.

Helpful tips:

- Wash clothes in cold water and hang them to dry instead of using the dryer.

- Take shorter showers to save on water heating costs.

Saving on utilities is a simple and effective money saving technique. By making these small changes, you can reduce your energy usage and save money every month.

Technique 9: Automate Your Savings

Automating your savings is a powerful money saving technique. It ensures you save consistently without having to think about it.

Here’s how you can automate your savings:

- Set up automatic transfers: Arrange for a set amount of money to be automatically transferred from your checking account to your savings account each month. This way, you’re saving money before you have a chance to spend it.

- Use a High-Yield Savings Account (HYSA): Open a High-Yield Savings Account that offers higher interest rates than regular savings accounts. This helps your money grow faster while it’s sitting in the bank.

- Start small and increase over time: If you’re new to saving, start with a small amount and gradually increase it as you get more comfortable.

RECOMMENDED READ: STEP-BY-STEP GUIDE TO THE 100 ENVELOPE SAVINGS CHALLENGE

Helpful tips:

- Choose a specific day each month for your automatic transfer, like the day after you get paid.

- Review your savings regularly and adjust the amount if you can save more.

Automating your savings is a simple yet effective money saving technique. By setting it and forgetting it, you make sure you’re consistently putting money away for the future.

Plus, with a HYSA, you’ll earn more interest and watch your savings grow even faster.

Frequently Asked Questions About Money Saving Techniques

Below are some of the most commonly asked questions about saving money:

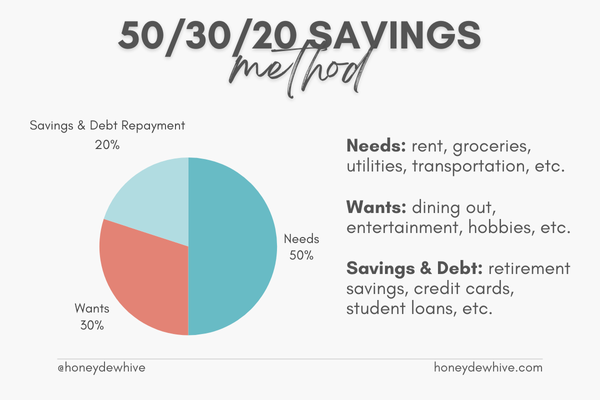

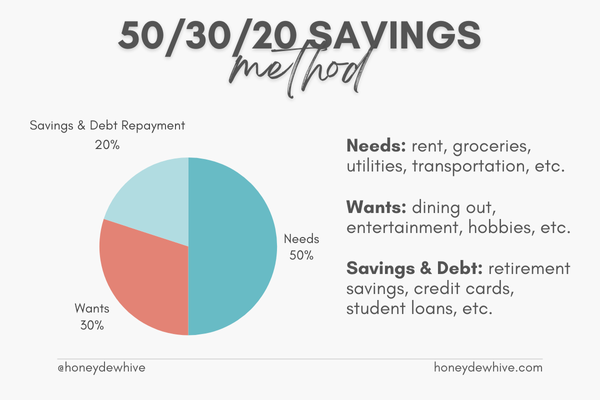

1. What is the 50/30/20 savings method?

The 50/30/20 savings method is a simple budgeting rule to help you manage your money better. Here’s how it works:

- 50% of your income goes to needs: This includes essentials like rent, groceries, utilities, and transportation.

- 30% of your income goes to wants: These are non-essential expenses like dining out, entertainment, and hobbies.

- 20% of your income goes to savings and debt repayment: This portion should be saved or used to pay off any debts.

This method helps you balance your spending and saving, making it easier to manage your finances.

2. What is the 30 day rule to save money?

The 30 day rule is a simple strategy to avoid impulse buying and save money. Here’s how it works:

- When you see something you want to buy, wait 30 days before purchasing it.

- After 30 days, if you still want the item and can afford it, go ahead and buy it.

- Often, you’ll find that the urge to buy has passed, and you can save the money instead.

This rule helps you make more mindful spending decisions and avoid unnecessary purchases.

3. What is the 40/30/20/10 saving rule?

The 40/30/20/10 saving rule is another budgeting method that divides your income into four categories:

- 40% of your income goes to needs: Essential expenses like housing, groceries, and bills.

- 30% of your income goes to wants: Non-essential items like entertainment, dining out, and hobbies.

- 20% of your income goes to savings and investments: Money set aside for savings, investments, or retirement.

- 10% of your income goes to debt repayment or charity: Paying off debts or donating to causes you care about.

This rule helps you allocate your income efficiently, ensuring you save and pay off debts while enjoying some flexibility for wants.

4. How to save $10,000 in a year?

Saving $10,000 in a year might seem challenging, but it’s achievable with a plan. Here’s how you can do it:

- Break it down: Save $833.33 each month or about $192.31 each week.

- Create a budget: Track your income and expenses to find areas where you can cut back.

- Set up automatic transfers: Automate your savings by setting up monthly transfers to a savings account.

- Reduce unnecessary expenses: Cut out non-essential spending, such as dining out or subscription services.

- Find extra income: Consider side gigs or selling items you no longer need to boost your savings.

By following these steps and staying disciplined, you can reach your goal of saving $10,000 in a year.

Final Thoughts

These nine money saving techniques can help you take control of your finances, no matter your budget.

From creating a budget to automating your savings, each tip is designed to make saving money easier and more effective.

By starting small and making simple changes, you can build better financial habits and see real results. Remember, every little bit adds up, and these money saving techniques can make a big difference over time.

I encourage you to start with one or two techniques and see how they work for you.

Feel free to share your own money saving tips in the comments below, and don’t forget to follow Honeydew Hive for more helpful personal finance advice.

Happy saving!

Want More Honeydew Hive?

If you enjoyed these money saving techniques and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!