We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Creating a monthly budget can be a game-changer for your financial health!

Did you know that only 41% of Americans use a budget? I’m here to show you how to create a monthly budget that actually works.

Whether you’re trying to save more, pay off debt, or simply manage your money better, this guide will provide you with all the tools and tips you need.

Let’s dive in and take control of your finances!

Understanding The Importance Of A Monthly Budget

Creating a monthly budget is super important for managing your money and reaching your financial goals.

But why does budgeting matter so much? Let’s break it down!

Why Budgeting Matters

Budgeting helps you understand exactly where your money goes. Without a budget, it’s easy to spend more than you earn and end up in debt.

A budget keeps you on track, ensuring you don’t overspend and helping you save for the future.

It gives you control over your finances, making it easier to plan for big expenses and unexpected costs.

The Benefits Of Having A Monthly Budget

There are so many benefits to having a monthly budget:

- Financial Awareness: You know exactly how much you earn and spend each month.

- Savings Growth: By setting aside money each month, you can build up your savings.

- Debt Reduction: A budget helps you allocate funds to pay off debt faster.

- Stress Reduction: Knowing your finances are under control can reduce money-related stress.

- Goal Achievement: Budgeting helps you set and achieve both short-term and long-term financial goals.

Common Misconceptions About Budgeting

Many people think budgeting is too hard or only for those who struggle with money. But that’s not true!

Budgeting is for everyone. Here are some common misconceptions:

- “Budgeting is too restrictive.” Actually, a budget gives you the freedom to spend money on what truly matters to you.

- “I don’t make enough money to need a budget.” No matter how much you make, budgeting helps you manage it better.

- “Budgeting is time-consuming.” With so many budgeting apps and tools, it’s easier and quicker than ever to create and maintain a budget.

Understanding the importance of a monthly budget is the first step towards financial success.

By recognizing why budgeting matters, enjoying its benefits, and debunking common misconceptions, you’re well on your way to taking control of your finances and building a secure future.

Setting Financial Goals

Setting financial goals is a key part of creating a monthly budget that works. Financial goals give you something to aim for and help you stay motivated.

Let’s dive into how you can set clear and achievable goals for your budget!

Short-Term vs. Long-Term Goals

First, it’s important to understand the difference between short-term and long-term goals:

- Short-Term Goals: These are things you want to achieve within the next year. Examples include saving for a vacation, buying a new gadget, or paying off a small debt.

- Long-Term Goals: These goals take more time, usually several years. Examples include saving for a down payment on a house, building a retirement fund, or paying off a large loan.

How To Prioritize Your Financial Goals

Not all goals are equal, so you need to prioritize them. Here’s how you can do it:

- List Your Goals: Write down all the financial goals you can think of, both short-term and long-term.

- Rank Your Goals: Decide which goals are most important to you. Think about which ones will have the biggest impact on your life.

- Set Deadlines: Give each goal a deadline. This helps you stay focused and makes your goals more concrete.

- Break Down Goals: Break big goals into smaller, more manageable steps. This makes them less overwhelming and easier to achieve.

Examples Of Realistic Financial Goals

Setting realistic goals is crucial. Here are some examples to get you started:

- Short-Term: Save $500 for an emergency fund in 3 months. This goal is specific, achievable, and has a clear deadline.

- Medium-Term: Pay off $2,000 in credit card debt within a year. This helps you focus on reducing debt step by step.

- Long-Term: Save $10,000 for a house down payment in 3 years. This goal is big, but breaking it down into monthly savings makes it easier to manage.

Setting financial goals helps you create a focused and effective monthly budget.

By understanding the difference between short-term and long-term goals, prioritizing them, and setting realistic targets, you can achieve financial success and make your dreams a reality!

Tracking Your Income & Expenses

Tracking your income and expenses is a vital part of creating a monthly budget that works. It helps you see exactly where your money is coming from and where it’s going.

Let’s explore the best ways to keep track of your finances!

Methods To Track Your Income

First, you need to know how much money you’re making. Here are some methods to track your income:

- Pay Stubs: If you have a regular job, use your pay stubs to see your monthly income. Don’t forget to include any extra income from bonuses or side jobs.

- Bank Statements: Look at your bank statements to see deposits from different income sources.

- Income Tracking Apps: There are many apps available that can help you track your income easily. These apps can link to your bank account and update your income automatically.

Categorizing Your Expenses

Next, it’s important to categorize your expenses. This helps you see where you’re spending your money and find areas where you can save. Here’s how you can do it:

- Fixed Expenses: These are expenses that stay the same each month, like rent, mortgage, and car payments.

- Variable Expenses: These change from month to month, like groceries, utilities, and entertainment.

- Discretionary Expenses: These are non-essential expenses, like dining out, hobbies, and subscriptions.

Tools & Apps For Tracking Finances

Using tools and apps can make tracking your finances much easier. Here are some popular options:

- Budgeting Apps: Apps like Credit Karma, YNAB (You Need A Budget), and EveryDollar can help you track your income and expenses. They offer features like budget planning, expense categorization, and financial goal setting.

- Spreadsheets: If you prefer a manual method, you can use a spreadsheet to track your finances. Create columns for income, expenses, and savings, and update it regularly.

- Expense Trackers: These apps allow you to record your spending on the go. You can categorize expenses, set spending limits, and get reports on your spending habits.

Tracking your income and expenses is a crucial step in managing your money and creating a successful monthly budget.

By using the right methods and tools, you can keep a close eye on your finances and make informed decisions about your spending and saving.

Creating Your Monthly Budget

Creating a monthly budget might seem challenging, but it’s easier than you think!

By following a few simple steps, you can set up a budget that helps you manage your money effectively. Let’s get started!

Steps To Create A Monthly Budget

- List Your Income: Write down all sources of income. Include your salary, side jobs, and any other money you receive monthly.

- List Your Expenses: Make a list of all your monthly expenses. Don’t forget to include fixed expenses (like rent), variable expenses (like groceries), and discretionary expenses (like entertainment).

- Subtract Expenses from Income: Calculate your total expenses and subtract them from your total income. This will show you how much money you have left over or if you’re spending more than you make.

- Adjust as Needed: If your expenses are higher than your income, look for areas where you can cut back. If you have extra money, decide how you want to save or spend it.

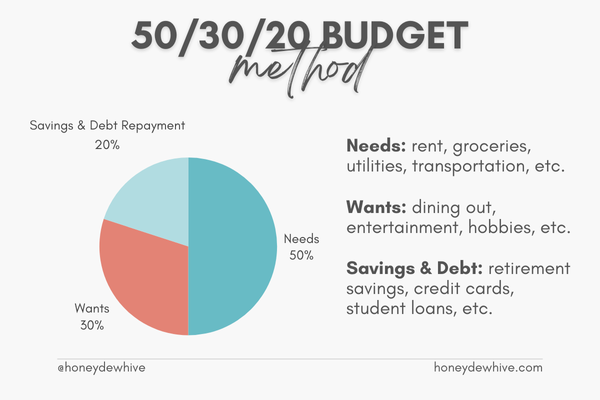

Using The 50/30/20 Rule

A simple way to create a balanced budget is to use the 50/30/20 rule. Here’s how it works:

- 50% Needs: Spend 50% of your income on needs like housing, utilities, groceries, and transportation.

- 30% Wants: Allocate 30% of your income for wants like dining out, hobbies, and entertainment.

- 20% Savings: Save 20% of your income for future goals, emergencies, and retirement.

This rule helps you divide your money in a way that covers all your essentials while still allowing for fun and savings.

RECOMMENDED READ: 10 SIMPLE BUDGETING METHODS FOR BEGINNERS

Adjusting Your Budget For Irregular Income

If your income changes from month to month, budgeting can be a bit trickier. Here’s what you can do:

- Average Your Income: Look at your income over the past few months and calculate an average. Use this average to plan your budget.

- Prioritize Expenses: Focus on covering your needs first. Set aside money for rent, utilities, and groceries before spending on wants.

- Save Extra Income: During months when you earn more, save the extra money. This can help cover your expenses during months when your income is lower.

Creating your monthly budget is all about understanding your income, listing your expenses, and making adjustments to stay on track.

By using simple rules like the 50/30/20 rule and planning for irregular income, you can create a budget that works for you and helps you reach your financial goals.

Tips For Sticking To Your Budget

Sticking to your monthly budget can be tough, but with a few practical tips, you can stay on track and make your budget work for you.

Here are some simple and easy-to-follow tips to help you succeed!

Practical Strategies To Stay On Track

- Set Realistic Goals: Make sure your budget goals are achievable. If they’re too hard, you might get discouraged and give up. Start small and build up gradually.

- Track Your Spending: Keep an eye on your daily spending. Use a notebook, an app, or a spreadsheet to record every expense. This helps you see where your money is going and stay within your budget.

- Use Cash for Certain Expenses: For things like groceries or entertainment, try using cash. When the cash is gone, you know you’ve hit your limit for that category.

- Review Your Budget Regularly: Check your budget at least once a week. This helps you see if you’re on track and make adjustments if needed.

How To Handle Unexpected Expenses

Life is full of surprises, and sometimes unexpected expenses pop up.

Here’s how to handle them without breaking your budget:

- Build an Emergency Fund: Set aside some money each month for emergencies. Aim for at least $500 to start. This fund will help you cover unexpected costs without ruining your budget.

- Reallocate Funds: If an unexpected expense comes up, see if you can cut back in other areas. Maybe you can skip dining out this month or spend less on entertainment.

- Use Savings Sparingly: If you need to dip into your savings, try to replace the money as soon as possible. This keeps your savings intact for future emergencies.

Tips For Adjusting Your Budget As Needed

Your financial situation can change, and your budget should be flexible enough to adapt.

Here’s how to adjust your budget when needed:

- Review Monthly: At the end of each month, review your budget. Look at what worked and what didn’t. Make adjustments based on your spending patterns and upcoming expenses.

- Stay Flexible: If you get a raise or a new expense, update your budget. Don’t be afraid to make changes that reflect your current financial situation.

- Celebrate Small Wins: Did you stay within your budget for groceries this month? Celebrate it! Recognizing small successes can keep you motivated to stick to your budget.

By setting realistic goals, tracking your spending, handling unexpected expenses, and adjusting your budget as needed, you can make sure your monthly budget works for you.

Remember, the key to sticking to your budget is to stay flexible and keep your financial goals in mind.

Common Budgeting Mistakes To Avoid

Creating a monthly budget is a fantastic step towards better financial health, but it’s easy to make mistakes along the way.

Let’s look at some common budgeting mistakes and how to avoid them so you can make the most of your budget!

Overspending In Certain Categories

One of the most common mistakes is overspending in certain categories like dining out or entertainment. Here’s how to avoid it:

- Set Clear Limits: Make sure each category in your budget has a clear spending limit. Stick to these limits to avoid overspending.

- Use Cash Envelopes: For categories where you tend to overspend, try using cash envelopes. Once the cash is gone, you can’t spend any more in that category.

- Track Regularly: Keep an eye on your spending throughout the month. If you’re getting close to your limit, cut back on non-essential expenses.

Neglecting To Save For Emergencies

Skipping out on saving for emergencies is a big mistake. Unexpected expenses can pop up at any time. Here’s what you can do:

- Start Small: Aim to save at least $500 for emergencies. It doesn’t have to be a huge amount to start with.

- Automate Savings: Set up automatic transfers to your emergency fund each month. This makes saving easier and ensures you’re always setting money aside.

- Prioritize Saving: Treat your emergency fund like a necessary expense. It’s just as important as paying rent or buying groceries.

Underestimating Irregular Expenses

Irregular expenses, like car repairs or holiday gifts, can throw off your budget if you’re not prepared for them. Here’s how to handle these:

- Plan Ahead: Make a list of irregular expenses you expect throughout the year. Estimate how much you’ll need and divide that amount by 12. Save a little each month so you’re ready when these expenses come up.

- Create a Sinking Fund: Set up a separate savings account for irregular expenses. This helps you keep track of how much you’ve saved for upcoming costs.

- Adjust Your Budget: When an irregular expense is coming up, adjust your budget for that month to accommodate it. This might mean cutting back in other areas temporarily.

Avoiding these common budgeting mistakes will help you create a more effective and realistic monthly budget.

By setting clear spending limits, saving for emergencies, and planning for irregular expenses, you’ll be better prepared to manage your finances and reach your financial goals.

Using Budgeting Tools & Apps

Budgeting apps and tools can make managing your finances a breeze. They help you keep track of your income and expenses, set financial goals, and stick to your budget.

Let’s explore some popular budgeting apps and tools, their benefits, and how to choose the right one for you!

Overview Of Popular Budgeting Apps

Here are a few popular budgeting apps that can help you manage your monthly budget:

- Credit Karma: Credit Karma is a free app that connects to your bank accounts, tracks your spending, and categorizes your expenses. It also provides alerts for bill payments and unusual spending.

- YNAB (You Need A Budget): YNAB is great for those who want to be proactive with their budgeting. It helps you assign every dollar a job and focuses on getting you out of the paycheck-to-paycheck cycle.

- EveryDollar: Created by Dave Ramsey, EveryDollar uses a zero-based budgeting approach. It’s easy to use and lets you track your spending and plan your monthly budget.

Benefits Of Using Digital Tools

Using digital tools and apps for budgeting has many advantages:

- Convenience: You can access your budget anytime, anywhere, from your phone or computer.

- Automatic Tracking: Many apps automatically track your income and expenses, saving you time and effort.

- Real-Time Updates: Get instant updates on your spending and see how it affects your budget.

- Goal Setting: Most apps allow you to set and track financial goals, helping you stay focused and motivated.

- Insights and Reports: Apps provide insights and detailed reports on your spending habits, helping you make informed decisions.

How To Choose The Right Tool for You

Choosing the right budgeting app or tool depends on your personal needs and preferences. Here are some tips to help you decide:

- Identify Your Needs: Think about what features are most important to you. Do you need an app that syncs with your bank account? Or do you prefer manually entering expenses?

- Consider Your Budget: Some apps are free, while others have a monthly or yearly fee. Decide how much you’re willing to spend on a budgeting tool.

- Ease of Use: Choose an app that is easy to use and understand. The more user-friendly it is, the more likely you are to stick with it.

- Read Reviews: Look at user reviews and ratings to see what others think about the app. This can give you a better idea of its pros and cons.

- Try a Few: Don’t be afraid to try a few different apps to see which one you like best. Most apps offer a free trial period, so take advantage of that.

Using budgeting apps and tools can greatly simplify managing your monthly budget.

By choosing the right app for your needs, you can stay on top of your finances, set and achieve goals, and make smarter spending decisions.

Frequently Asked Questions About Creating A Monthly Budget

Below I’ve answered some of the most commonly asked questions about creating a monthly budget:

1. What is a good monthly budget?

A good monthly budget is one that helps you manage your money effectively and meet your financial goals. It should include all your income, track all your expenses, and allocate money for savings.

A balanced budget often follows the 50/30/20 rule: 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

The key is to make sure your budget is realistic and flexible, allowing you to adjust as needed.

2. How do I create a budget for the month?

Creating a budget for the month is simple if you follow these steps:

- List Your Income: Write down all your sources of income for the month.

- List Your Expenses: Make a list of all your monthly expenses, including fixed expenses (like rent) and variable expenses (like groceries).

- Categorize Your Expenses: Divide your expenses into categories such as needs, wants, and savings.

- Allocate Funds: Use the 50/30/20 rule or another budgeting method to allocate your income to each category.

- Track Your Spending: Keep track of your spending throughout the month to make sure you’re sticking to your budget.

- Adjust as Needed: Review your budget regularly and make adjustments based on your spending and any changes in your financial situation.

3. How to budget $4,000 a month?

Budgeting $4,000 a month can be managed well with a clear plan:

- List Your Income: Start with your total monthly income of $4,000 (after taxes).

- Categorize Expenses: Use the 50/30/20 rule as a guide:

- Needs (50%): Allocate $2,000 for essential expenses like rent, utilities, groceries, and transportation.

- Wants (30%): Allocate $1,200 for non-essential expenses like dining out, entertainment, and hobbies.

- Savings (20%): Allocate $800 for savings and debt repayment.

- Track and Adjust: Keep an eye on your spending throughout the month and adjust as needed to stay within your budget.

4. What is a minimalist budget?

A minimalist budget is a simple and intentional way to manage your money. It focuses on cutting out non-essential expenses and prioritizing what truly matters.

Here’s what it typically involves:

- Essentials Only: Spend money mainly on necessities like housing, food, utilities, and transportation.

- Reduce Wants: Cut back or eliminate spending on non-essentials like dining out, subscriptions, and impulse purchases.

- Prioritize Savings: Allocate a significant portion of your income to savings and paying off debt.

- Simplify Finances: Use simple tools and methods to track your income and expenses, avoiding complex financial systems.

A minimalist budget helps you save more, spend less, and focus on what’s important, leading to a more intentional and stress-free financial life.

Final Thoughts

Creating a monthly budget that actually works is all about understanding your financial goals, tracking your income and expenses, and sticking to your plan.

By avoiding common mistakes and utilizing the right tools, you can achieve financial stability and peace of mind.

Ready to take the next step? Start creating your monthly budget today and watch your financial situation transform!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!