We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Living frugally doesn’t mean giving up the things you love—it’s about making smart choices that add up over time!

Imagine saving money every day with simple, actionable tips that fit seamlessly into your daily routine.

Whether you’re just starting your frugal living journey or looking for fresh ideas to cut costs, these 31 tips will empower you to take control of your finances without feeling deprived.

From small, everyday adjustments to bigger lifestyle changes, you’ll discover how easy it can be to stretch your dollars further.

The best part? Frugal living is not just about saving money; it’s about creating a more mindful and intentional way of life.

You’ll find that with a little creativity and consistency, you can achieve financial freedom while still enjoying the things that matter most.

So, let’s dive in and explore how you can start saving money every single day!

Mastering The Basics Of Frugal Living

Mastering the basics of frugal living is like building a strong foundation for your financial future.

These simple steps will help you get started on the right foot, so you can save money every day without feeling overwhelmed.

Start With A Budget

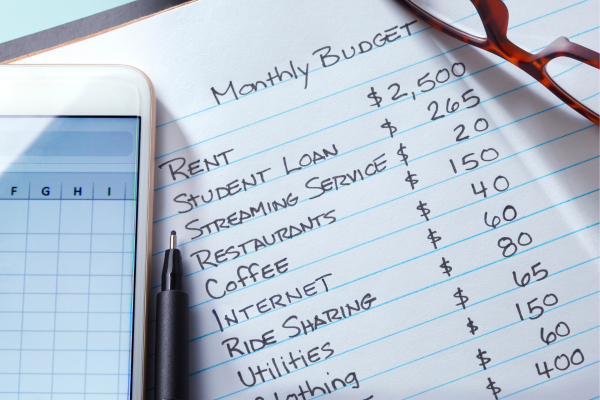

The first step to living frugally is to know where your money is going. That’s where a budget comes in!

A budget is a plan that shows how much money you have coming in and how much is going out. It helps you see exactly what you’re spending your money on and where you can cut back.

To get started, list all your income sources, then write down your expenses—everything from rent and groceries to entertainment and coffee runs.

Once you see it all laid out, it’s easier to spot areas where you can save.

Don’t worry if your budget isn’t perfect at first; it’s all about making small changes and adjusting as you go.

Track Your Expenses

Creating a budget is just the beginning—tracking your expenses is what keeps you on track.

By keeping an eye on your spending, you’ll know exactly where your money is going each day.

This can be as simple as writing down your purchases in a notebook or using an app that tracks your spending for you.

When you track your expenses, you’ll quickly notice patterns, like that daily coffee habit that’s costing you more than you realized.

Knowing where your money goes helps you make smarter decisions and stay committed to your frugal living goals.

Set Clear Financial Goals

Why are you choosing to live frugally? Setting clear financial goals gives you a reason to save and a target to aim for.

Whether it’s building an emergency fund, saving for a vacation, or paying off debt, having a goal makes it easier to stick to your budget and make wise spending choices.

Write down your goals and break them into smaller, manageable steps. For example, if your goal is to save $1,000 in six months, figure out how much you need to save each week to get there.

Having these goals in mind will keep you motivated and focused on your journey to financial freedom.

Create A Savings Plan

A savings plan is your roadmap to reaching your financial goals.

One of the easiest ways to save money is to automate it—set up regular transfers from your checking account to your savings account.

This way, saving becomes a habit, and you won’t even have to think about it! Even small amounts add up over time.

For example, if you save just $10 a week, that’s over $500 in a year!

RECOMMENDED READ: 9 PROVEN MONEY SAVING TECHNIQUES FOR EVERY BUDGET

A savings plan helps you build a cushion for unexpected expenses and gives you peace of mind knowing you’re prepared for the future.

Prioritize Needs Over Wants

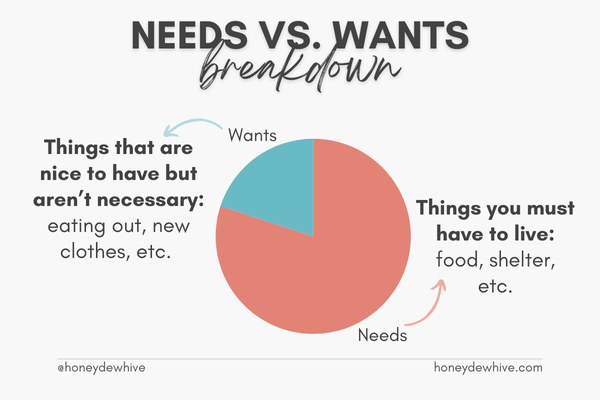

One of the biggest challenges in frugal living is learning to tell the difference between needs and wants.

Needs are things you can’t live without, like food, shelter, and clothing. Wants are things that are nice to have but aren’t essential, like that new gadget or dining out at a fancy restaurant.

By focusing on your needs first, you can make sure your money is going to the most important things.

This doesn’t mean you can never enjoy your wants, but it does mean being mindful about your spending.

Before making a purchase, ask yourself, “Do I really need this?” This simple question can help you make smarter choices and keep more money in your pocket.

Smart Shopping Strategies

Shopping smart is one of the easiest ways to save money and live frugally.

By making a few simple changes to how you shop, you can keep more money in your wallet without feeling like you’re missing out.

Here are some smart shopping strategies to help you get started.

1. Embrace Coupons & Discounts

Who doesn’t love a good deal? Using coupons and discounts is a simple way to save money on the things you buy every day.

You can find coupons in newspapers, online, or even through apps that make it easy to search for deals.

Many stores also offer loyalty programs that give you discounts just for shopping there regularly.

And don’t forget about sales! Waiting for a sale to buy what you need can save you a lot. It might take a little extra time to find the best deals, but the savings are worth it.

2. Buy In Bulk

Buying in bulk is a great way to save on items you use often.

Things like toilet paper, laundry detergent, and non-perishable foods are usually cheaper when you buy them in larger quantities.

Stores like warehouse clubs offer bulk items at a lower price per unit, which means you get more for your money.

Just be sure to only buy what you know you’ll use before it expires, so you don’t waste any of your savings.

3. Shop Secondhand

You don’t always have to buy new to get something great. Shopping secondhand can save you a lot of money on clothes, furniture, and other items.

Thrift stores, online marketplaces, and garage sales are all great places to find gently used items at a fraction of the cost of new ones.

Not only is shopping secondhand good for your wallet, but it’s also better for the environment because it reduces waste.

4. Switch To Generic Brands

Brand names aren’t always better. Many generic brands offer the same quality as their name-brand counterparts, but at a much lower price.

This is especially true for grocery and household items.

Next time you’re shopping, give the store brand a try—you might be surprised at how much you can save without sacrificing quality.

5. Plan Your Shopping Trips

Going shopping without a plan can lead to impulse buys and overspending. That’s why it’s important to plan your shopping trips.

Before you go to the store, make a list of what you need and stick to it. This helps you avoid buying things you don’t really need.

Also, try to shop when you’re not hungry—people tend to buy more when they’re hungry, especially snacks and other non-essential items.

6. Use Cashback Credit Cards

If you use a credit card to make purchases, why not earn some money back while you’re at it?

Cashback credit cards offer rewards for the money you spend, giving you a percentage of your purchases back as cash.

Just make sure to pay off your balance each month so you don’t end up paying more in interest than you’re getting back in rewards.

Over time, those cashback rewards can add up to some serious savings!

Reducing Household Expenses

Reducing household expenses is a key part of living frugally.

By making a few small changes around your home, you can save money every month without feeling like you’re giving up too much.

Here are some easy ways to cut down on those household bills and keep more cash in your pocket.

7. Cut The Cord

Cable TV can be expensive, and with so many streaming options available today, you might not even need it.

Cutting the cord and switching to streaming services can save you a lot of money each month.

Many streaming platforms offer a wide variety of shows and movies at a fraction of the cost of cable.

Plus, some even offer free trials or free content, so you can enjoy your favorite entertainment without breaking the bank.

If you still want access to live TV, consider an over-the-air antenna to pick up free local channels.

8. Use Energy Wisely

One of the easiest ways to reduce your household expenses is to be mindful of your energy use.

Simple changes, like turning off lights when you leave a room, unplugging electronics when they’re not in use, and using energy-efficient bulbs and appliances, can make a big difference in your electric bill.

You can also save by adjusting your thermostat—set it a few degrees lower in the winter and a few degrees higher in the summer.

Every little bit adds up, and you’ll see the savings on your next utility bill.

9. DIY Home Repairs

When something breaks around the house, it can be tempting to call a professional right away. But doing minor home repairs yourself can save you a lot of money.

There are plenty of online tutorials and videos that can help you learn how to fix things like leaky faucets, clogged drains, or squeaky doors.

Of course, it’s important to know your limits—if the repair is too complex or dangerous, it’s best to call in an expert.

But for simple fixes, a little DIY can go a long way in reducing your household expenses.

10. Lower Your Thermostat

Heating and cooling costs can take up a big chunk of your household budget. One easy way to save is by lowering your thermostat.

In the winter, try keeping it a few degrees cooler and wearing a sweater or using blankets to stay warm.

In the summer, use fans and keep blinds closed during the hottest part of the day to help your home stay cool without cranking up the air conditioning.

You can also save by installing a programmable thermostat, which automatically adjusts the temperature based on your schedule.

11. Use Water Efficiently

Saving water is not only good for the environment, but it’s also great for your wallet.

You can reduce your water bill by fixing any leaks right away, installing low-flow showerheads and faucets, and being mindful of how much water you use.

For example, turn off the tap while brushing your teeth, take shorter showers, and only run the dishwasher or washing machine with full loads.

These simple changes can lead to big savings on your water bill over time.

Frugal Food & Dining Tips

Eating well doesn’t have to cost a lot. With a few smart strategies, you can enjoy delicious meals every day without breaking the bank.

Here are some frugal food and dining tips that will help you save money while still enjoying great food.

12. Meal Planning

Meal planning is one of the best ways to save money on food.

By planning your meals for the week, you can make sure you only buy what you need, which means less waste and fewer last-minute takeout orders.

Start by looking at what you already have in your pantry and fridge, then plan meals around those ingredients.

Make a shopping list based on your meal plan, and stick to it when you go to the store.

With a little planning, you’ll find that you can eat well and save money at the same time.

13. Cook At Home

Eating out is fun, but it can also be expensive. Cooking at home is a great way to save money while still enjoying your favorite meals.

When you cook at home, you can control the ingredients and portion sizes, which can also be healthier.

Plus, cooking doesn’t have to be complicated—simple meals like pasta, stir-fries, and soups can be quick and easy to make.

If you’re short on time during the week, consider cooking larger portions on the weekends and freezing leftovers for quick meals later on.

14. Grow Your Own Food

Growing your own food is a fun and rewarding way to save money on groceries.

Even if you don’t have a big garden, you can still grow herbs, tomatoes, or lettuce in small pots on a windowsill or balcony.

Homegrown produce is not only fresher, but it’s also cheaper than buying it at the store. Plus, gardening can be a relaxing hobby that gets you outside and active.

Whether you start small with a few herbs or go big with a vegetable garden, growing your own food is a great way to cut down on grocery costs.

15. Buy Seasonal Produce

Buying fruits and vegetables in season is another great way to save money.

Seasonal produce is often cheaper because it’s more plentiful and doesn’t have to be shipped long distances. Plus, it’s usually fresher and tastes better!

Try to plan your meals around what’s in season in your area, and take advantage of sales at your local farmers’ market or grocery store.

You can also buy extra when prices are low and freeze or preserve it for later use.

16. Batch Cooking

Batch cooking is a smart way to save both time and money.

By cooking large portions of meals and dividing them into smaller portions, you can have ready-to-eat meals in the freezer for busy days.

This helps you avoid the temptation of ordering takeout when you’re short on time or energy.

Dishes like soups, stews, casseroles, and pasta sauces are perfect for batch cooking because they freeze well and can be easily reheated.

Not only does batch cooking save you money, but it also reduces the stress of figuring out what’s for dinner every night.

17. Limit Food Waste

Food waste is like throwing money in the trash. To make the most of your grocery budget, try to use up all the food you buy.

This might mean getting creative with leftovers or finding new ways to use ingredients that are about to go bad.

For example, you can turn stale bread into croutons or breadcrumbs, and overripe fruit can be used in smoothies or baking.

Keeping an eye on expiration dates and rotating your pantry items so that older ones are used first can also help reduce waste.

By making the most of what you have, you’ll save money and reduce waste at the same time.

Transportation & Commuting Hacks

Transportation can be a major expense, but there are plenty of ways to save money on getting around.

With a few smart transportation and commuting hacks, you can cut down on costs and keep more money in your wallet.

Here are some tips to help you save on transportation.

18. Carpool Or Use Public Transit

If you’re tired of paying for gas and dealing with traffic, carpooling or using public transit can be great alternatives.

Carpooling with coworkers or friends can help you split the cost of gas and reduce the wear and tear on your vehicle. Plus, it’s more environmentally friendly!

If carpooling isn’t an option, consider using public transportation like buses or trains.

Public transit is often cheaper than driving, and you won’t have to worry about parking or maintenance costs.

Plus, you can use the time on public transit to relax, read, or catch up on emails.

19. Maintain Your Vehicle

Taking good care of your car can save you a lot of money in the long run.

Regular maintenance, like oil changes, tire rotations, and checking fluid levels, can help prevent costly repairs down the road.

Keeping your tires properly inflated can also improve your gas mileage, which means fewer trips to the pump.

It’s also a good idea to keep an eye on your car’s performance—if something doesn’t seem right, get it checked out sooner rather than later.

A little preventive care can go a long way in reducing your transportation expenses.

20. Consider Biking Or Walking

For short trips, biking or walking can be a great way to save money and get some exercise at the same time.

If you live close to work, the grocery store, or other places you visit regularly, consider leaving the car at home and biking or walking instead.

Not only will you save money on gas and parking, but you’ll also improve your health and reduce your carbon footprint.

Plus, biking or walking can be a fun and relaxing way to start and end your day.

21. Drive Smart

If you do need to drive, adopting fuel-efficient driving habits can help you save money on gas.

Simple changes, like avoiding rapid acceleration and braking, can improve your gas mileage.

It’s also a good idea to reduce the amount of time your car spends idling—if you’re going to be stopped for more than a minute or two, turn off the engine to save fuel.

And don’t forget to keep your car light—extra weight in the trunk or backseat can reduce your fuel efficiency.

By driving smart, you can stretch your gas dollars further.

22. Work From Home

If your job allows it, working from home even a few days a week can significantly reduce your commuting costs.

You’ll save money on gas, parking, and even wear and tear on your vehicle. Plus, working from home can give you back some of your time—no more sitting in traffic or rushing to catch the bus.

If you’re interested in working from home, talk to your employer about the possibility of telecommuting.

Even if you can’t work from home every day, reducing your commute even a little can add up to big savings over time.

Entertainment On A Budget

Having fun doesn’t have to cost a lot of money.

With a little creativity, you can enjoy plenty of entertainment on a budget without feeling like you’re missing out.

Here are some great ideas for having a good time while keeping your spending in check.

23. Take Advantage Of Free Events

Many communities offer free events that are both fun and budget-friendly.

Keep an eye out for local festivals, outdoor concerts, movie nights in the park, and farmers’ markets.

These events are often free to attend and can be a great way to enjoy your community while spending little to no money.

RECOMMENDED READ: 10 NO SPEND WEEKEND IDEAS

Check your local newspaper, community website, or social media for a list of upcoming events.

You’ll be surprised at how many free activities are happening right in your area.

24. Use The Library

Your local library is a treasure trove of free entertainment.

You can borrow books, movies, music, and even digital resources like eBooks and audiobooks—all for free!

Many libraries also offer free events and classes, such as story times for kids, book clubs, and workshops on various topics.

If you’re looking for something new to read or watch, or if you want to learn a new skill, the library is a great place to start.

Plus, it’s all budget-friendly, so you can enjoy as much as you want without spending a dime.

25. Host Potlucks

Going out to eat with friends can get expensive, but you can still enjoy a fun meal together by hosting a potluck.

Ask each friend to bring a dish, and you’ll have a delicious meal with plenty of variety at a fraction of the cost of dining out.

Potlucks are also a great way to try new recipes and enjoy each other’s cooking. You can even make it a themed event, like a taco night or a dessert potluck.

Not only will you save money, but you’ll also create lasting memories with your friends.

26. Explore Nature

Nature is one of the best (and cheapest) forms of entertainment.

Whether you enjoy hiking, biking, or just going for a walk, spending time outdoors is a great way to have fun without spending money.

Visit a local park, take a walk along a nature trail, or have a picnic by the lake. If you’re feeling adventurous, try camping or stargazing.

Being in nature is not only relaxing, but it’s also good for your health. And the best part? It’s all free!

27. Cancel Unused Subscriptions

It’s easy to sign up for multiple streaming services, magazines, or other subscriptions, but if you’re not using them, they can quickly add up.

Take some time to review your subscriptions and cancel any that you’re not using regularly. You might be surprised at how much you’re spending on things you don’t really need.

Instead, focus on the subscriptions that you actually use and enjoy.

By cutting out the extras, you’ll have more money to spend on the entertainment you truly love.

Saving On Personal Care & Health

Taking care of yourself is important, but it doesn’t have to be expensive.

There are plenty of ways to save on personal care and health without compromising on quality.

Here are some simple tips to help you look and feel great while keeping your budget in check.

28. Cut Your Own Hair

Haircuts can be pricey, especially if you’re getting them regularly. Learning to cut your own hair, or having a family member help, can save you a lot of money over time.

There are plenty of online tutorials that can guide you through the process, whether you’re trimming bangs or giving yourself a simple cut.

If you’re not ready to go full DIY, consider visiting a beauty school for a discounted haircut—students get hands-on experience while you save money.

Either way, you’ll keep more cash in your pocket while still looking your best.

29. Use Generic Brands

When it comes to personal care products, brand names aren’t always necessary.

Generic or store brands often offer the same quality as their more expensive counterparts but at a much lower price.

This is especially true for items like shampoo, toothpaste, and over-the-counter medications.

Next time you’re shopping, give the generic version a try. You might find that it works just as well, if not better, than the name brand, all while helping you save on your personal care budget.

30. Exercise For Free

Staying fit doesn’t have to involve an expensive gym membership. There are plenty of free ways to get in shape and stay healthy.

Take advantage of outdoor activities like walking, running, or biking in your neighborhood or at a local park.

You can also find free workout videos online that cover everything from yoga to strength training.

Many apps offer free trials or basic versions of their fitness programs, which can help you stay active without spending a lot.

By finding ways to exercise for free, you’ll keep both your body and your budget in good shape.

31. Practice Preventive Care

One of the best ways to save on health costs is to practice preventive care.

This means taking steps to stay healthy now, so you can avoid costly medical bills later.

Eating a balanced diet, getting regular exercise, and getting enough sleep are all important for maintaining good health.

Regular check-ups with your doctor and dentist can also catch any issues early before they become more serious and expensive to treat.

By taking care of your health now, you’ll save money in the long run and enjoy a better quality of life.

Final Thoughts

Incorporating these 31 frugal living tips into your daily routine can make a world of difference in your financial well-being.

By making small, consistent changes, you’ll see your savings grow and your financial stress diminish.

Remember, the key to successful frugal living is not about depriving yourself—it’s about being intentional with your spending and finding joy in the simple things.

Whether it’s through smarter shopping habits, reducing household expenses, or finding free ways to entertain yourself, every little bit counts.

Over time, these savings will add up, giving you the financial flexibility to pursue your larger goals, whether that’s paying off debt, saving for a big purchase, or building a robust emergency fund.

Start implementing these tips today, and watch as you transform your financial future one small step at a time.

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!