We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Creating an emergency fund budget is like building a financial safety net that can catch you when life throws unexpected challenges your way.

Imagine the peace of mind that comes with knowing you’re prepared for emergencies without having to rely on credit cards or loans.

Whether it’s a sudden car repair, a medical emergency, or an unexpected job loss, having an emergency fund can make all the difference in your financial stability and stress levels.

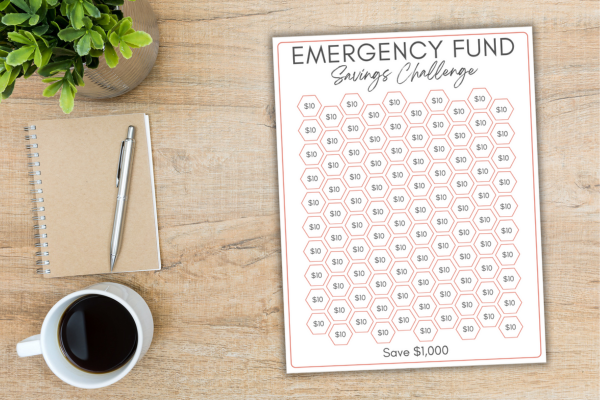

Studies show that only 39% of Americans can cover a $1,000 emergency expense without borrowing, highlighting the importance of being financially prepared. Don’t be part of that statistic—take control of your finances today!

In this guide, I’ll walk you through the essential steps to create a realistic emergency fund budget. We’ll discuss how to determine the right amount for your needs, practical tips for saving, and tools that can help you stay on track.

Whether you’re just starting out or looking to boost your existing savings, this post will equip you with the knowledge to make sound financial decisions.

Let’s dive in and secure your financial future together!

Understanding The Importance Of An Emergency Fund

An emergency fund is like a superhero for your finances. It helps you when life surprises you with unexpected expenses, like car repairs, medical bills, or even a job loss.

Let’s dive into why having an emergency fund is so important.

What Is An Emergency Fund?

An emergency fund is a special savings account set aside for those “just in case” moments.

Unlike regular savings, this money is only for emergencies. Think of it as your financial safety net!

Why You Need An Emergency Fund

- Avoid Financial Stress: Imagine not worrying about how to pay for a sudden expense. With an emergency fund, you won’t need to stress about borrowing money or using credit cards.

- Stay on Track with Goals: When you have a safety net, you won’t have to dip into your savings for other goals, like buying a home or going on vacation. Your emergency fund helps keep your plans on track.

- Peace of Mind: Knowing you have money set aside for unexpected events can give you a sense of peace and confidence. You’ll feel prepared for whatever life throws at you!

How An Emergency Fund Prevents Debt

- No Need for Loans: When you have cash ready, you don’t need to borrow money or use credit cards with high interest rates. This saves you from debt and extra costs.

- Handle Emergencies with Ease: Whether it’s a burst pipe or a medical emergency, having money saved means you can take care of it without scrambling for cash.

In short, an emergency fund is your ticket to financial freedom and peace of mind. It keeps you safe from financial stress and helps you stay focused on your goals.

Let’s start building your emergency fund today so you can enjoy life without worries!

How Much Should You Save?

Figuring out how much to save in your emergency fund can feel like a big puzzle. But don’t worry—I’m here to help you piece it all together!

Let’s break it down so you can set a goal that fits your life.

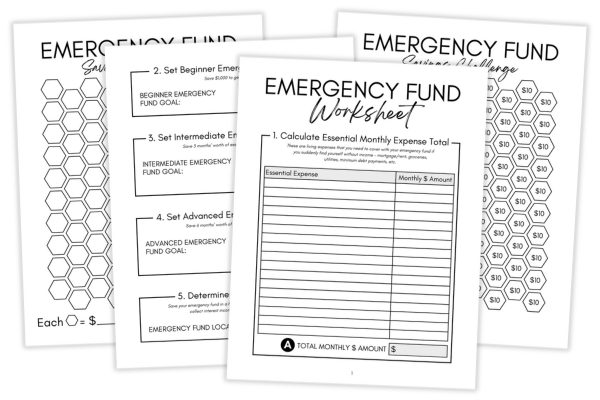

Factors To Consider When Determining Your Savings Goal

- Monthly Expenses: Start by knowing how much money you need each month. This includes rent or mortgage, utilities, groceries, and any other regular bills. A good emergency fund should cover at least three to six months of your living expenses.

- Job Stability: Think about how steady your job is. If your job is super secure, you might aim for three months of expenses. If your job changes a lot, saving six months or more is a good idea.

- Family Needs: If you have a family or dependents, you might need to save more. Consider how many people rely on your income and any extra expenses they might have.

Calculating Your Monthly Expenses

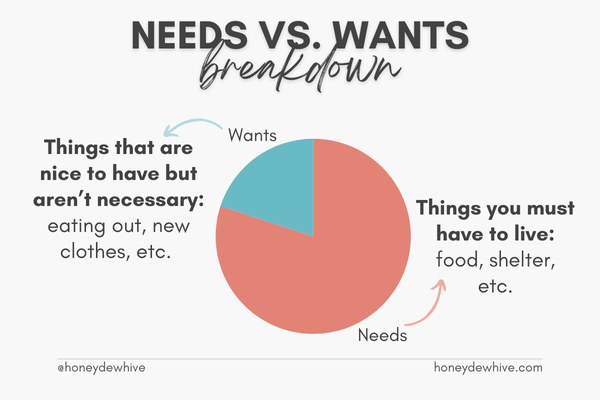

- List Your Essentials: Write down your essential bills and expenses. These are the things you can’t live without, like rent, food, and transportation.

- Add Them Up: Calculate the total cost of these essentials for one month. This is your baseline for figuring out how much to save.

- Multiply by 3 to 6 Months: Take your monthly expenses and multiply by the number of months you want to cover. This will give you your emergency fund goal.

Recommended Savings Benchmarks

- 3 Months of Expenses: This is a good starting point if you have a steady job and no dependents.

- 6 Months of Expenses: Aim for this if your job is less stable or if you have a family to support.

- More Than 6 Months: Consider saving more if you’re self-employed or work in an industry with frequent job changes.

Remember, it’s okay to start small and build your emergency fund over time. The important thing is to get started!

Even saving a little each month can add up to a big safety net.

Let’s set a realistic emergency fund budget and get you on the path to financial security.

Steps To Create A Realistic Emergency Fund Budget

Creating a realistic emergency fund budget might sound tricky, but it’s easier than you think!

Follow these simple steps, and you’ll be well on your way to building a solid financial safety net.

1. Assess Your Current Financial Situation

- Look at Your Income: Start by figuring out how much money you make each month. This includes your paycheck, any side hustle income, and other sources of money.

- List Your Expenses: Write down all your monthly expenses, like rent, utilities, groceries, and entertainment. This helps you see where your money is going.

- Identify Savings Opportunities: Look for areas where you can cut back. Maybe there’s a subscription you don’t use or a habit you can change to save more.

2. Identify Potential Savings Sources

- Set Savings Goals: Decide how much you want to save each month for your emergency fund. Even small amounts add up over time!

- Use Found Money: Whenever you get extra money, like a tax refund or gift, put some into your emergency fund. It’s an easy way to boost your savings.

- Budget for Savings: Treat your savings like a bill. Add it to your budget so it’s a regular part of your financial plan.

RECOMMENDED READ: 9 PROVEN MONEY SAVING TECHNIQUES FOR EVERY BUDGET

3. Set A Realistic Savings Timeline

- Start with a Goal: Decide how much you want in your emergency fund and how long you think it will take to save it.

- Create Milestones: Break your goal into smaller steps. Celebrate when you hit each one to stay motivated!

- Adjust as Needed: If life changes, it’s okay to adjust your plan. The important thing is to keep saving.

By following these steps, you’ll create an emergency fund budget that fits your life and helps you reach your financial goals.

Remember, building your emergency fund is a journey. Start small, stay consistent, and you’ll get there!

Practical Tips To Boost Your Emergency Fund

Ready to supercharge your emergency fund? Here are some practical tips to help you save faster and reach your goals.

With a little creativity and discipline, you can watch your savings grow in no time!

Cutting Unnecessary Expenses

- Review Your Spending: Take a close look at your monthly expenses and see where you can cut back. Maybe there’s a streaming service you barely use or a few takeout dinners you can skip.

- Meal Prep: Planning your meals for the week can save you a ton of money. Cook in batches and pack lunches for work or school instead of eating out.

- Energy Savings: Simple changes like turning off lights, unplugging devices, and using energy-efficient bulbs can reduce your utility bills.

Increasing Your Income Through Side Hustles Or Gigs

- Freelancing: If you have a skill like writing, graphic design, or programming, consider taking on freelance projects. Websites like Fiverr or Upwork can help you find gigs.

- Part-Time Jobs: Look for part-time work that fits your schedule. It could be anything from babysitting to working at a local store on weekends.

- Sell Unwanted Items: Have a garage sale or list items online that you no longer need. It’s a quick way to make extra cash for your emergency fund.

Automating Savings Contributions

- Set Up Automatic Transfers: Arrange for a portion of your paycheck to go directly into your emergency fund. This way, you save without even thinking about it!

- Round-Up Savings: Some banks and apps let you round up your purchases to the nearest dollar and put the difference into savings. It’s a simple way to save a little extra.

- Use Savings Apps: Consider using apps that help you save by automatically transferring small amounts of money into your emergency fund.

By following these tips, you can quickly boost your emergency fund and feel more secure about your financial future.

Remember, every little bit counts, and staying consistent is key. You’ve got this!

Tools & Resources For Emergency Fund Planning

Building an emergency fund doesn’t have to be hard! With the right tools and resources, you can make saving easier and more fun.

Here are some great options to help you plan and manage your emergency fund effectively.

Budgeting Apps & Tools To Track Expenses

- EveryDollar: This is a great app for those who love keeping things simple. It helps you plan out where every dollar of your income goes, making sure you stay on track with your budget

- YNAB (You Need a Budget): YNAB helps you give every dollar a job. It’s great for building discipline and ensuring you’re saving for your emergency fund.

- PocketGuard: With PocketGuard, you can easily see how much money you have left to spend after bills, goals, and necessities. It’s perfect for keeping your savings on track!

RECOMMENDED READ: 4 BEST BUDGETING APPS FOR IPHONE USERS

Online Calculators For Savings Goals

- Emergency Fund Calculator: Many financial websites offer calculators to help you figure out how much you need to save. Just enter your monthly expenses and desired savings period, and the calculator will do the rest!

- Savings Goal Calculator: Use this tool to see how much you need to save each month to reach your goal by a certain date. It’s a great way to stay motivated and on track.

Books & Courses On Personal Finance Management

- The Total Money Makeover by Dave Ramsey: This book offers simple, actionable advice to help you take control of your finances and build a solid emergency fund.

- I Will Teach You to Be Rich by Ramit Sethi: Ramit’s book provides practical tips on saving, investing, and managing money effectively.

- Online Courses: Websites like Coursera and Udemy offer personal finance courses that cover everything from budgeting to investing. These courses can provide valuable insights and strategies for building your emergency fund.

Using these tools and resources, you can create a realistic emergency fund budget and watch your savings grow.

With the right plan and a little discipline, you’ll be ready for whatever life throws your way!

Frequently Asked Questions About An Emergency Fund Budget

1. How much should I budget for an emergency fund?

It’s recommended to budget for three to six months’ worth of living expenses in your emergency fund.

This amount can cover your essential needs, like rent, groceries, and utilities, in case of unexpected events.

2. What is the average emergency fund in the US?

The average emergency fund in the US varies, but many households have around $5,000 to $10,000 saved.

However, this amount can depend on personal circumstances, income, and expenses.

3. Is a $5,000 emergency fund enough?

A $5,000 emergency fund can be enough for some people, depending on their monthly expenses and financial situation.

It’s a good starting point, but you should aim to save more if your living expenses are higher or if you want extra security.

Final Thoughts

Building an emergency fund budget is a crucial step toward financial stability and peace of mind.

By setting clear savings goals, cutting unnecessary expenses, and using the right tools, you can create a safety net that protects you from life’s unexpected events.

Remember, starting small is better than not starting at all—consistency is key. Celebrate each milestone as your fund grows, reinforcing the positive impact of your financial discipline.

Take action today to secure your financial future and live worry-free. Evaluate your expenses, set achievable goals, and explore additional income streams to accelerate your savings journey.

Your future self will thank you for the financial security and independence you create by building a solid emergency fund.

Embrace the empowerment that comes with being prepared for whatever life throws your way, and enjoy the freedom of a life less burdened by financial worries.

Let’s make 2024 the year you transform your financial health and build the safety net you deserve!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!