We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Budgeting is the cornerstone of financial health, but with today’s technology, you have more options than ever to manage your money.

The big question is: Should you embrace the digital revolution with apps and spreadsheets, or stick to the tried-and-true method of paper and pen?

Both digital and paper budgeting have their unique advantages and challenges, and the right choice depends on your personal preferences, habits, and financial goals.

In this article, I’ll guide you through the key differences between digital and paper budgeting, comparing everything from convenience and costs to the overall user experience.

Whether you’re tech-savvy and love the idea of automation, or you find comfort in the tactile nature of writing things down, by the end of this post, you’ll have a clear understanding of which method will best support your journey toward financial success.

Let’s explore the pros and cons of each so you can confidently choose the budgeting approach that suits you best!

Understanding Digital Budgeting

Digital budgeting is all about using technology to manage your money.

Instead of writing things down on paper, you use apps, software, or even simple spreadsheets to keep track of your income, expenses, and savings goals.

Let’s take a closer look at what digital budgeting is all about and why it might be a great choice for you.

What Is Digital Budgeting?

Digital budgeting means using electronic tools to create and maintain your budget.

Whether it’s an app on your phone or a spreadsheet on your computer, these tools help you organize your finances in a way that’s easy to update and keep track of.

You can enter your expenses, set savings goals, and even get reminders when bills are due. Everything you need is right there at your fingertips.

Popular Digital Budgeting Tools

There are lots of digital tools out there to help you budget. Some popular ones include apps like EveryDollar, You Need A Budget (YNAB), and Goodbudget.

These apps connect to your bank accounts, track your spending automatically, and even categorize your expenses for you.

If you prefer something simpler, you can use a spreadsheet like Google Sheets or Excel to create your own budget.

No matter which tool you choose, digital budgeting makes it easier to see where your money is going.

Benefits Of Digital Budgeting

One of the biggest benefits of digital budgeting is how convenient it is. With digital tools, you can update your budget anytime, anywhere.

Because everything is online, you can check your budget from your phone, tablet, or computer.

Plus, these tools often offer real-time updates, so you always know exactly how much money you have left to spend.

Another great thing about digital budgeting is that it can help you stay on track.

Many apps send you notifications if you’re close to overspending or if a bill is due soon. This way, you’re less likely to forget about an important payment or go over your budget.

Common Challenges Of Digital Budgeting

While digital budgeting has many perks, it’s not without its challenges. Some people find it tricky to use new technology, especially if they’re not familiar with budgeting apps or spreadsheets.

There’s also the concern about security—keeping your financial information safe online is important, so it’s crucial to choose a trusted app or tool with strong security features.

Another downside is that digital budgeting can sometimes feel less personal. You’re typing numbers into a screen instead of physically writing them down, which might make it harder for some people to connect with their budget.

If you’re someone who likes a more hands-on approach, digital budgeting might feel a bit too distant.

Is Digital Budgeting Right For You?

Digital budgeting is perfect for people who love technology and want a quick, easy way to manage their money.

If you’re comfortable with using apps or spreadsheets, and you like the idea of having your budget available at all times, then digital budgeting could be a great fit for you.

But if you prefer a more personal touch or aren’t as comfortable with tech, you might want to explore paper budgeting or a mix of both methods.

Exploring Paper Budgeting

Paper budgeting is the traditional way to manage your money, using pen and paper to track your income, expenses, and savings goals.

While it may seem old-fashioned, many people still love the hands-on, personal feel of paper budgeting.

Let’s dive into what paper budgeting is all about and why it might be the right choice for you.

What Is Paper Budgeting?

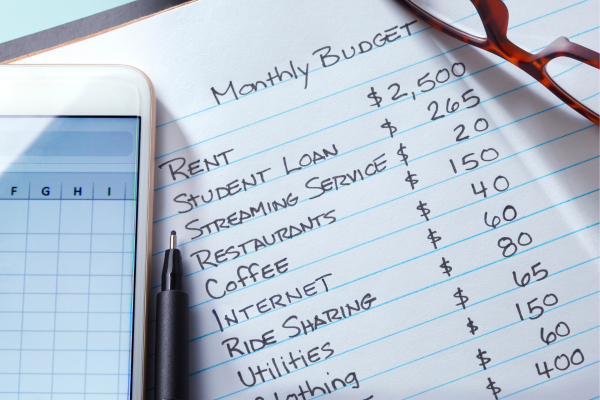

Paper budgeting is exactly what it sounds like—using physical tools like notebooks, ledger books, or printable planners to create and maintain your budget.

You write down your income, list your expenses, and calculate how much you can save each month.

It’s a simple, straightforward way to manage your money, and it doesn’t require any technology or apps.

Types Of Paper Budgeting Methods

There are a few popular ways to budget on paper.

One classic method is the cash envelope system, where you set aside cash for different spending categories like groceries, entertainment, and bills.

Each envelope holds the money for a specific category, and when the envelope is empty, you know you’ve reached your limit for the month.

Another popular method is using a budget planner. These planners are specially designed notebooks that help you organize your finances.

They often come with sections for income, expenses, savings goals, and even debt repayment.

You can also create your own budget using a simple notebook or download printable budgeting worksheets to guide you.

Benefits Of Paper Budgeting

One of the biggest benefits of paper budgeting is the tactile experience. Writing things down by hand can help you feel more connected to your finances.

It’s a bit like journaling—you’re more mindful of what you’re spending and saving.

Plus, there’s something satisfying about physically crossing off bills or highlighting areas where you’ve saved money.

Paper budgeting also helps you avoid screen time. If you’re someone who spends a lot of time on your phone or computer, paper budgeting gives you a break from screens.

It’s a more relaxed, focused way to manage your money.

Another advantage is personalization. With paper budgeting, you can make your budget look exactly how you want.

You can use colorful pens, add stickers, or draw charts to make it fun and engaging. It’s your budget, so you can make it as creative as you like!

Common Challenges Of Paper Budgeting

While paper budgeting has its perks, it also has a few challenges. For one, it requires manual tracking.

You’ll need to keep up with all your receipts, bills, and expenses, and update your budget regularly. This can be time-consuming, especially if you have a busy schedule.

Another challenge is the risk of losing your records. If you misplace your budget notebook or spill something on your planner, all your hard work could be lost.

Unlike digital tools that automatically save your information, paper budgeting relies on you to keep everything safe and organized.

Is Paper Budgeting Right For You?

Paper budgeting is perfect for people who enjoy a hands-on approach to managing their money.

If you like the idea of physically writing things down and want a break from screens, paper budgeting might be a great fit.

It’s also a good option if you’re looking for a more personal, customizable way to handle your finances.

However, if you’re worried about the time it takes or the possibility of losing your records, you might want to consider digital budgeting or a mix of both methods.

Digital vs. Paper Budgeting: Comparing Costs & Convenience

When choosing between digital and paper budgeting, it’s important to think about both the costs and how convenient each method is for your lifestyle.

Let’s break down the differences in cost, time, and accessibility to help you figure out which budgeting method works best for you.

Cost Comparison: Free Digital Tools vs. Purchasing Paper Supplies

One of the biggest factors to consider is cost. Many digital budgeting tools are free or very affordable.

For example, apps like EveryDollar are free to use, while others like YNAB (You Need A Budget) might charge a small monthly or yearly fee.

If you prefer using spreadsheets, programs like Google Sheets are completely free and can be customized to fit your budgeting needs.

On the other hand, paper budgeting can come with some upfront costs. You might need to buy a budget planner, notebook, or printable worksheets.

If you choose the cash envelope system, you’ll need to get envelopes or a special wallet to organize your cash.

While these costs aren’t huge, they can add up, especially if you like to buy new supplies regularly.

Time Investment: Setting Up & Maintaining Your Budget

Another key factor is the time it takes to set up and maintain your budget.

Digital budgeting tools often save you time because they automate many of the tasks that would otherwise be done manually.

For instance, digital tools can automatically track your spending, categorize your expenses, and update your budget in real-time.

This means less time spent on math and more time focusing on your financial goals.

Paper budgeting, on the other hand, requires more manual effort. You’ll need to write down every transaction, add up your expenses, and calculate your savings by hand.

While some people find this process calming and enjoyable, others might find it time-consuming.

If you have a busy schedule, digital budgeting might be the more convenient option.

Accessibility: Budgeting On The Go vs. Needing Physical Materials

When it comes to convenience, accessibility plays a big role.

Digital budgeting tools are easy to access from anywhere. Whether you’re at home, at work, or out shopping, you can check your budget from your phone, tablet, or computer.

This makes it easy to stay on top of your finances no matter where you are.

In contrast, paper budgeting requires you to have your budget notebook or planner with you if you want to update it on the go.

If you forget your planner at home, you won’t be able to track your spending until you get back.

For people who are often on the move or prefer to update their budget throughout the day, digital budgeting offers more flexibility.

The Impact Of Budgeting Consistency On Financial Success

No matter which method you choose, consistency is key to successful budgeting.

Digital budgeting tools can help you stay consistent by sending reminders, automatically updating your budget, and making it easy to track your spending regularly.

This can be especially helpful if you’re just starting out or if you’ve struggled to stick to a budget in the past.

With paper budgeting, consistency depends more on your personal discipline.

You’ll need to remember to update your budget regularly and keep track of all your receipts and expenses.

If you enjoy the routine of writing things down and find it helps you stay mindful of your spending, paper budgeting could be a great way to stay consistent.

Which Is More Cost-Effective & Convenient For You?

When comparing costs and convenience, digital budgeting tends to be more affordable and easier to maintain, especially for people with busy lives or those who prefer automation.

Paper budgeting, while more hands-on and potentially more time-consuming, offers a personal touch that some people find invaluable.

The choice between digital and paper budgeting ultimately depends on your preferences, lifestyle, and what you value most in a budgeting method.

Assessing Your Personal Preferences & Needs

Choosing between digital and paper budgeting isn’t just about the tools; it’s also about what feels right for you.

To find the method that works best, it’s important to think about your personal preferences, your financial goals, and how you like to manage your money.

Let’s explore a few key questions that can help you figure out which budgeting style is a better fit for your life.

Identifying Your Financial Goals & Habits

Start by thinking about your financial goals. Are you focused on paying off debt, saving for a big purchase, or just trying to get a better handle on your spending?

If you’re working towards specific goals, you’ll want a budgeting method that helps you track your progress easily.

Digital tools often have features that make it simple to set goals and monitor them in real-time.

On the other hand, paper budgeting allows you to customize your goals and track them in a way that feels more personal.

Next, consider your spending habits. Do you tend to make a lot of small purchases throughout the day, or do you stick to a more predictable spending pattern?

If your spending is unpredictable, digital budgeting might be more convenient because it can automatically track your transactions.

But if you prefer to write things down and review your spending at the end of each day, paper budgeting could be more your style.

Understanding Your Comfort Level With Technology

How comfortable are you with technology? If you’re tech-savvy and enjoy using apps and gadgets, digital budgeting will likely feel natural and easy to use.

Many digital tools are designed to be user-friendly, with simple interfaces and helpful features that guide you through the budgeting process.

Plus, if you like exploring new apps or customizing spreadsheets, digital budgeting offers lots of options to fit your needs.

However, if you find technology confusing or prefer to keep things simple, paper budgeting might be a better choice.

There’s no need to worry about software updates, app crashes, or losing data with paper budgeting. Everything is right there on paper, and you can organize it however you like.

If you enjoy the feeling of putting pen to paper and prefer a low-tech approach, paper budgeting might be just what you need.

Evaluating How Much Control & Flexibility You Want

Think about how much control you want over your budgeting process.

Digital budgeting tools often automate many tasks, like tracking expenses and categorizing purchases. This can save you time, but it also means that some decisions are made for you by the app.

If you’re okay with that and like the idea of having your budget mostly automated, digital budgeting could be a great fit.

On the other hand, if you prefer to have full control over every detail of your budget, paper budgeting offers that flexibility.

You decide how to categorize your expenses, how to track your spending, and how to set up your budget layout.

This hands-on approach can be especially helpful if you have specific ways you like to manage your money or if you enjoy the creative process of designing your budget.

Consideration Of Your Lifestyle: On-the-Go vs. At-Home Budgeting

Finally, think about your lifestyle. Are you often on the go, or do you spend most of your time at home?

If you’re always moving, whether it’s for work, school, or family activities, digital budgeting might be more convenient.

You can update your budget from anywhere, whether you’re in a coffee shop, at the grocery store, or on a trip.

Digital tools let you carry your budget with you, making it easy to stay on top of your finances no matter where you are.

But if you prefer to budget at home, in a calm, quiet setting, paper budgeting can be a relaxing and enjoyable routine.

You can set aside time each week to sit down with your planner, review your finances, and update your budget.

This process can become a peaceful habit, helping you feel more connected to your financial goals.

Finding The Right Fit For You

By considering your financial goals, comfort with technology, desire for control, and lifestyle, you can find the budgeting method that’s right for you.

Whether you choose digital or paper budgeting—or even a mix of both—the most important thing is to pick a method that you’ll stick with and that helps you reach your financial goals.

After all, the best budget is the one that works for you!

Making The Right Choice For You

Now that you’ve explored both digital and paper budgeting, it’s time to decide which method is right for you.

Each has its own strengths, and the choice comes down to what fits best with your lifestyle, financial goals, and personal preferences.

Let’s review the key differences and help you make the decision that will set you up for budgeting success.

Recap Of The Key Differences Between Digital & Paper Budgeting

Digital budgeting is all about convenience and automation. It’s perfect for those who are comfortable with technology and want a quick, easy way to manage their finances.

With digital tools, you can track your spending in real-time, set up automatic updates, and access your budget from anywhere.

It’s a great choice if you’re always on the go or if you like the idea of having your financial information at your fingertips.

Paper budgeting, on the other hand, offers a more hands-on, personalized approach. It’s ideal for people who enjoy the tactile experience of writing things down and want full control over how their budget is organized.

Paper budgeting can be a calming, focused activity, allowing you to connect more deeply with your finances. It’s a good fit if you prefer a low-tech method and like to review your budget in a more traditional way.

Factors To Consider When Choosing Your Budgeting Method

When making your choice, think about what matters most to you.

Do you value the ability to update your budget on the go, or do you prefer to sit down at home with a pen and paper?

Are you looking for a method that saves you time, or do you enjoy the process of writing things down and reflecting on your spending?

Your answers to these questions will help guide you to the right budgeting method.

Another important factor is your financial goals. If you’re working towards specific milestones, like paying off debt or saving for a big purchase, you’ll want a budgeting method that helps you stay on track.

Digital tools can be great for setting reminders and monitoring progress, while paper budgeting allows you to customize your goal tracking in a way that feels personal and motivating.

How To Combine Digital & Paper Budgeting For A Hybrid Approach

If you’re having trouble deciding between digital and paper budgeting, why not try both? A hybrid approach lets you enjoy the best of both worlds.

For example, you could use a digital tool to track your daily spending and set up automatic updates, while keeping a paper planner to record your monthly budget and reflect on your financial goals.

This way, you get the convenience of digital tools with the personal touch of paper budgeting.

A hybrid system can also help you stay flexible. You can use digital tools when you’re on the go and switch to paper budgeting when you’re at home and have more time to focus.

This combination can make budgeting feel less like a chore and more like a balanced part of your routine.

Tips For Starting & Sticking To Your Chosen Budgeting Method

Once you’ve chosen your budgeting method, the most important thing is to stick with it.

Here are a few tips to help you stay consistent:

- Set a regular schedule: Whether you’re using a digital tool or a paper planner, set aside time each week to review and update your budget. Consistency is key to staying on track.

- Make it enjoyable: Add a personal touch to your budgeting process. If you’re using paper, decorate your planner with colors or stickers. If you’re going digital, choose a tool with a design you like.

- Start small: If you’re new to budgeting, don’t overwhelm yourself by tracking every single expense. Start with a few categories and build from there as you get more comfortable.

- Celebrate your progress: No matter which method you choose, take time to celebrate your budgeting wins. Whether it’s sticking to your budget for a month or reaching a savings goal, acknowledging your success will keep you motivated.

Finding Your Perfect Fit

Choosing between digital and paper budgeting is a personal decision, and there’s no right or wrong answer.

The best choice is the one that fits your life and helps you stay consistent with managing your money.

Whether you decide to go all-in on digital, stick with paper, or mix both methods, remember that the goal is to find a system that supports your financial goals and makes budgeting a positive experience.

Final Thoughts

In the end, the decision between digital and paper budgeting is a personal one, shaped by your unique financial needs, lifestyle, and preferences.

Digital budgeting offers the convenience of automation, real-time tracking, and access from anywhere, making it ideal for those who are always on the go or prefer a more streamlined process.

On the other hand, paper budgeting provides a hands-on, tangible experience that can make your finances feel more personal and grounded, perfect for those who enjoy the act of writing things down and feel more in control with physical records.

Ultimately, there’s no one-size-fits-all solution when it comes to budgeting. The best method is the one that aligns with your habits and helps you stay consistent in managing your money.

Don’t be afraid to experiment with both approaches to see which one feels right for you. Remember, you can even create a hybrid system that combines the best of both worlds!

Whatever path you choose, the most important thing is to start—because the first step toward financial freedom is taking control of your budget.

Ready to make your choice? Dive into budgeting today and pave the way to a more secure financial future!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!