We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Did you know that nearly 70% of Americans live paycheck to paycheck due to poor budgeting habits?

Budgeting is essential for financial stability, yet many people make common mistakes that derail their efforts.

Let’s dive into the most frequent budgeting mistakes and learn how to sidestep them to ensure your financial success.

Whether you’re new to budgeting or looking to refine your approach, this guide has got you covered!

Mistake #1: Not Tracking All Expenses

One of the biggest budgeting mistakes is not tracking all your expenses. It’s easy to forget those small purchases, but they add up quickly!

Importance Of Tracking Every Expense

Tracking every single expense is super important because it gives you a clear picture of where your money is going.

When you know how much you’re spending, you can make better decisions about your budget.

Think of it like keeping score in a game – if you don’t know the score, you can’t play your best.

Tools & Apps To Help With Tracking

Luckily, there are lots of tools and apps that can help you track your expenses easily.

Apps like YNAB (You Need A Budget) and EveryDollar let you input your expenses on the go. These apps can even link to your bank account to automatically track spending.

You can also use a simple notebook or spreadsheet if you prefer to do it by hand.

How To Create A Habit Of Recording Expenses

Creating a habit of recording your expenses can be tricky at first, but it gets easier with practice. Here are some tips to help you get started:

- Set a Daily Reminder: Pick a time each day to record your expenses, like right after dinner.

- Keep Receipts: Hold onto your receipts until you can record them. This makes it easier to remember what you spent.

- Use Your Phone: Take a quick note on your phone each time you spend money. This way, you won’t forget by the end of the day.

By making expense tracking a daily habit, you’ll soon find it becomes second nature. And once you see where your money is going, you’ll be better prepared to make smart budgeting choices.

Mistake #2: Underestimating Variable Expenses

Another common budgeting mistake is underestimating variable expenses. These are costs that can change from month to month, making them harder to predict.

Difference Between Fixed & Variable Expenses

First, let’s talk about the difference between fixed and variable expenses.

Fixed expenses are the same every month, like your rent or mortgage.

Variable expenses, on the other hand, can go up or down. Think of things like groceries, gas, or entertainment.

It’s important to budget for both types, but variable expenses can be tricky because they aren’t always the same.

Examples Of Common Variable Expenses

Here are some examples of variable expenses you might have:

- Groceries: The amount you spend on food can change each week.

- Gas: How much you drive can affect your gas bill.

- Utilities: Your water, electricity, and heating bills can vary based on the season.

- Entertainment: Going out to eat, movies, or other fun activities can add up.

Tips For Accurately Estimating Variable Expenses

To avoid underestimating these costs, try these tips:

- Look at Past Spending: Check your bank statements from the last few months to see how much you’ve been spending on variable expenses.

- Average It Out: Add up your past expenses and divide by the number of months to get an average. Use this average to plan for the future.

- Set Aside Extra Money: Put a little extra money in your budget for variable expenses. This way, if you spend more than expected, you’re covered.

By keeping a close eye on your variable expenses and planning ahead, you can avoid the budgeting mistake of underestimating these costs.

This will help you stay on track and make your budget work for you.

Mistake #3: Ignoring Irregular Expenses

A common budgeting mistake is ignoring irregular expenses. These are costs that don’t come up every month but still need to be planned for.

What Are Irregular Expenses?

Irregular expenses are those that pop up occasionally.

They aren’t part of your regular monthly bills but still need to be paid. Examples include holiday gifts, car repairs, and annual subscriptions.

Even though these costs aren’t frequent, they can really throw off your budget if you don’t plan for them.

Planning For Annual Or Bi-Annual Costs

To handle irregular expenses, you need to plan ahead. Here’s how you can do it:

- List Them Out: Make a list of all the irregular expenses you can think of. Include things like birthday presents, back-to-school supplies, and medical check-ups.

- Estimate the Costs: Figure out how much each of these expenses will cost. It doesn’t have to be exact, just a good estimate.

- Divide by 12: Take the total amount for each expense and divide it by 12. This gives you a monthly amount to set aside in your budget. For example, if you expect to spend $600 on holiday gifts, set aside $50 each month.

Setting Aside A Contingency Fund

Besides planning for known irregular expenses, it’s smart to have a contingency fund for unexpected costs.

This fund acts as a safety net for things like sudden car repairs or a surprise medical bill. Here’s how to build one:

- Start Small: Begin with a goal of saving $500 to $1,000. This can cover most minor emergencies.

- Add to It Regularly: Put a small amount into your contingency fund every month. Even $10 or $20 can add up over time.

- Keep It Separate: Keep your contingency fund in a separate account so you’re not tempted to spend it on everyday expenses.

By planning for irregular expenses and building a contingency fund, you can avoid the budgeting mistake of being caught off guard by surprise costs.

This helps keep your budget steady and your finances in good shape.

Mistake #4: Failing To Adjust Your Budget Regularly

Another budgeting mistake is failing to adjust your budget regularly. Life changes, and so should your budget!

Why Budgets Need Regular Review

Your budget isn’t something you set once and forget.

Just like you change clothes for different weather, you need to change your budget for different life events.

A regular review helps you stay on top of your finances and adjust to changes like a new job, a new bill, or even a change in your spending habits.

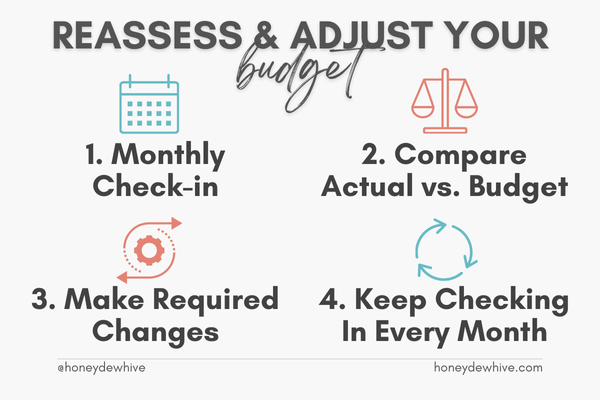

How To Reassess & Adjust Your Budget

Here’s how you can reassess and adjust your budget:

- Monthly Check-In: Take time at the end of each month to review your budget. See where you spent more or less than expected.

- Compare to Actual Spending: Look at your actual spending compared to your budget. This helps you see patterns and areas for improvement.

- Make Necessary Changes: If you spent more on groceries or gas, adjust those categories for the next month. If you got a raise, decide how to allocate that extra money – maybe more savings or paying off debt.

Signs It’s Time To Tweak Your Budget

How do you know when it’s time to tweak your budget? Here are some signs:

- Consistent Over-Spending: If you consistently overspend in certain categories, it’s time to adjust.

- Life Changes: Any big life change, like moving, a new baby, or a job change, means it’s time to review your budget.

- New Financial Goals: If you have new goals, like saving for a vacation or paying off a loan, adjust your budget to help reach those goals.

By regularly reviewing and adjusting your budget, you can avoid the mistake of sticking to an outdated plan.

This keeps your budget realistic and effective, helping you stay on track with your financial goals.

Mistake #5: Not Having A Financial Goal

One big budgeting mistake is not having a financial goal. Without a goal, it’s hard to know where you’re going or why you’re budgeting in the first place.

Importance Of Setting Financial Goals

Setting financial goals gives you a clear target to aim for. It’s like having a roadmap for your money.

Goals help you stay focused and motivated. Whether you want to save for a vacation, buy a house, or pay off debt, having a goal makes budgeting more meaningful and rewarding.

Short-Term vs. Long-Term Goals

There are two types of financial goals: short-term and long-term.

- Short-Term Goals: These are things you want to achieve in the next year or two. Examples include saving for a new phone, paying off a small debt, or building an emergency fund.

- Long-Term Goals: These take more time to achieve, like saving for college, buying a house, or retiring. Long-term goals require more planning and discipline but are equally important.

How To Incorporate Goals Into Your Budget

Incorporating goals into your budget is simple and makes a big difference:

- Identify Your Goals: Write down your short-term and long-term goals. Be specific about what you want to achieve and by when.

- Break Down the Costs: Figure out how much money you need for each goal. If your goal is to save $1,200 for a vacation in a year, you’ll need to save $100 a month.

- Allocate Funds: Adjust your budget to include savings for your goals. Set aside money each month specifically for each goal. This might mean cutting back on other expenses to make room.

By setting and incorporating financial goals into your budget, you avoid the mistake of not having a clear direction for your money.

Goals give your budget purpose and make it easier to stay committed to your financial plan.

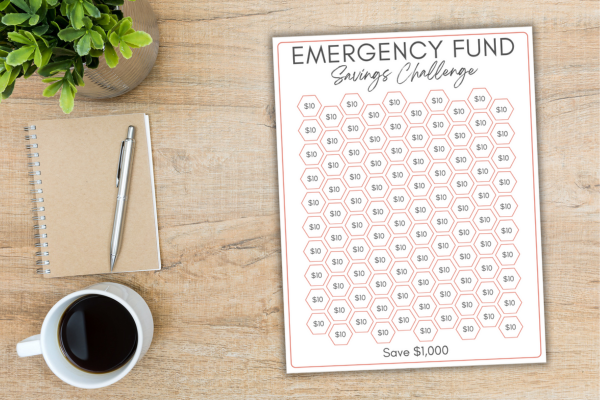

Mistake #6: Forgetting To Save For Emergencies

One of the most common budgeting mistakes is forgetting to save for emergencies. Life is full of surprises, and having an emergency fund can help you handle them without stress.

Role Of An Emergency Fund

An emergency fund is money set aside for unexpected expenses. Think of it as a financial safety net.

Whether it’s a sudden car repair, a medical bill, or an unexpected job loss, having an emergency fund means you can cover these costs without going into debt or disrupting your budget.

How Much To Save For Emergencies

So, how much should you save in your emergency fund? A good rule of thumb is to save three to six months’ worth of living expenses.

This might sound like a lot, but you don’t have to save it all at once. Start small and build up over time.

Strategies For Building An Emergency Fund

Building an emergency fund takes time and dedication, but here are some tips to help you get started:

- Start Small: Begin with a goal of saving $500 to $1,000. This can cover most minor emergencies.

- Set a Monthly Goal: Decide how much you can save each month. Even $20 or $50 a month adds up over time.

- Automate Savings: Set up an automatic transfer from your checking account to your savings account. This way, you save money without even thinking about it.

- Cut Back on Extras: Look for ways to cut back on non-essential spending. Use the money you save to boost your emergency fund.

RECOMMENDED READ: 9 PROVEN MONEY-SAVING TECHNIQUES FOR EVERY BUDGET

By remembering to save for emergencies and building a solid emergency fund, you can avoid the budgeting mistake of being unprepared for life’s unexpected events.

This helps keep your finances stable and gives you peace of mind.

Mistake #7: Overestimating Income

Overestimating your income is a common budgeting mistake that can lead to overspending and financial stress.

It’s important to be realistic about how much money you actually have.

Risks Of Overestimating Your Income

When you overestimate your income, you might think you have more money to spend than you really do.

This can lead to spending more than you earn, which results in debt and financial problems.

It’s like planning a big party and realizing halfway through that you don’t have enough food for everyone!

How To Calculate A Realistic Income

To avoid this mistake, you need to calculate a realistic income. Here’s how:

- Look at Your Paychecks: Check your last few paychecks to see how much you actually take home after taxes and deductions.

- Include All Income Sources: Add up all sources of income, such as a side job or freelance work. Make sure to use the amount you can count on regularly, not just occasional extra money.

- Average It Out: If your income varies, calculate an average. Add up your total income for the last six months and divide by six to get a monthly average.

Tips For Adjusting Your Budget If Income Fluctuates

If your income fluctuates, it can be tricky to budget. Here are some tips to help you manage:

- Create a Baseline Budget: Make a budget based on your lowest expected income. This ensures you can cover your essential expenses even in a bad month.

- Save the Extra: In months when you earn more, save the extra money. This helps cover expenses in months when your income is lower.

- Adjust Regularly: Review and adjust your budget every month based on your actual income. This keeps your budget realistic and helps you avoid overspending.

By avoiding the mistake of overestimating your income and being realistic about your earnings, you can create a budget that truly works for you.

This helps you stay on track and achieve your financial goals without unnecessary stress.

Frequently Asked Questions About Budgeting Mistakes

1. What is a common budget mistake?

A common mistake is not tracking all your expenses. This can lead to overspending because you don’t have a clear picture of where your money is going.

2. What is the 30 day rule in budgeting?

The 30 day rule in budgeting means waiting 30 days before making a big purchase. This helps you avoid impulse buying and gives you time to decide if you really need the item.

3. What is the 70 rule in budgeting?

The 70 rule in budgeting suggests using 70% of your income for living expenses, saving 20%, and using the remaining 10% for investments or debt repayment.

This helps you balance spending, saving, and investing.

4. What are 6 common budget mistakes you can’t afford to make?

Six common budget mistakes you can’t afford to make are:

- Not tracking all expenses

- Underestimating variable expenses

- Ignoring irregular expenses

- Failing to adjust your budget regularly

- Not having a financial goal

- Forgetting to save for emergencies

Final Thoughts

Budgeting doesn’t have to be hard, but avoiding common mistakes can make a big difference in your financial health.

By tracking all your expenses, accurately estimating variable costs, planning for irregular expenses, adjusting your budget regularly, setting clear financial goals, saving for emergencies, and being realistic about your income, you can create a budget that works for you.

Remember, the key to successful budgeting is consistency and flexibility. Keep an eye on your spending, review your budget often, and adjust as needed.

With these tips, you’ll be well on your way to achieving your financial goals and enjoying greater peace of mind.

Start today by reviewing your budget and making any necessary changes. Your future self will thank you!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!