We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Budgeting on a low income can feel like an uphill battle, but it’s absolutely possible with the right strategies!

Whether you’re dealing with unexpected expenses, trying to stretch your paycheck, or simply wanting to save more, I’ve got you covered.

Did you know that nearly 40% of Americans struggle to cover a $400 emergency expense?

It’s a tough situation, but by following some practical tips and making small adjustments, you can manage your finances better and work towards financial stability.

I’ll walk you through understanding your financial situation, creating a basic budget, and finding ways to reduce expenses.

We’ll also explore methods to increase your income, smart savings strategies, and effective debt management.

Plus, I’ll highlight some valuable community resources that can provide additional support.

Let’s dive in and explore how you can make the most of every dollar, reduce financial stress, and build a secure financial future!

Understanding Your Financial Situation

Assess Your Current Income & Expenses

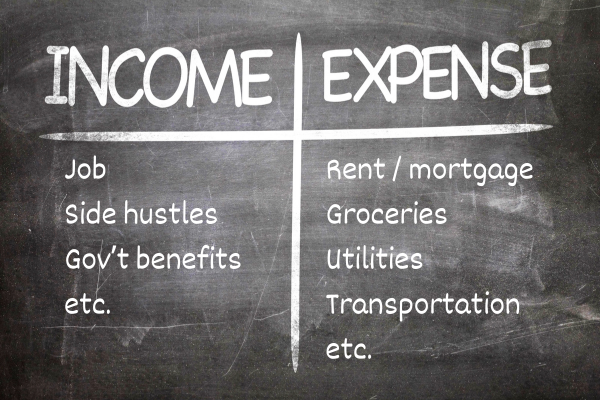

The first step in budgeting on a low income is knowing exactly how much money you have coming in and going out.

Start by listing all your sources of income. This includes your job, any side hustles, government benefits, and any other money you receive regularly.

Next, make a list of your expenses. Write down everything you spend money on each month, such as rent, groceries, utilities, transportation, and any other bills or regular costs.

Track Your Spending Habits For A Month

To get a clear picture of where your money is going, track your spending for a month. Write down every single purchase, no matter how small.

You can use a notebook, a spreadsheet, or a budgeting app to keep track.

At the end of the month, review your list to see where your money went. This will help you spot patterns and identify areas where you might be able to cut back.

Identify Areas Where You Can Cut Costs

After you’ve tracked your spending, look for expenses that you can reduce or eliminate.

Are you spending a lot on dining out or buying coffee? Could you save money by cooking at home more often?

Maybe you can find cheaper alternatives for some of your monthly bills, like switching to a lower-cost cell phone plan or cutting out subscriptions you don’t use.

Set Realistic Financial Goals

Setting goals is a great way to stay motivated and focused on your budgeting journey.

Start with small, achievable goals like saving $50 a month or reducing your grocery bill by $20.

As you get more comfortable with your budget, you can set bigger goals, like saving for an emergency fund or paying off a specific amount of debt.

Write down your goals and keep them somewhere visible to remind yourself why you’re budgeting.

By understanding your financial situation, you’re taking the first crucial step toward better money management.

Knowing where your money comes from and where it goes helps you make informed decisions and find areas for improvement.

With this foundation, you can create a budget that works for you, even on a low income.

Creating A Basic Budget

Importance Of A Zero-Based Budget

When you’re budgeting on a low income, every dollar counts. A zero-based budget is a great way to make sure every dollar has a purpose.

This type of budget means that your income minus your expenses equals zero. In other words, you plan where every dollar will go before you spend it.

This helps you stay in control and avoid overspending.

How To Allocate Funds For Essentials

Start by listing your essential expenses. These are things you absolutely need to pay for each month, like rent, utilities, groceries, and transportation.

These should be the first items in your budget. Make sure you cover these basics before allocating money to anything else.

If your income doesn’t cover all your essentials, look for ways to cut costs or find extra income.

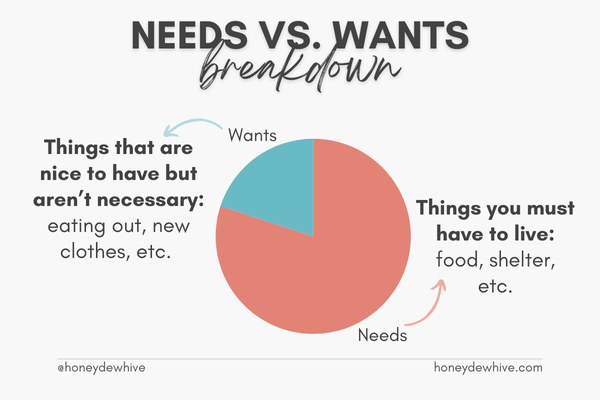

Separating Needs From Wants

One of the biggest challenges in budgeting is separating needs from wants.

Needs are things you must have to live, like food and shelter. Wants are things that are nice to have but aren’t necessary, like eating out or buying new clothes.

When you’re on a tight budget, focus on your needs first. It’s okay to treat yourself occasionally, but make sure it fits into your budget without taking away from your essentials.

Tips For Sticking To Your Budget

Once you’ve created your budget, the next step is sticking to it. Here are some tips to help you stay on track:

- Use Cash for Discretionary Spending: Withdraw cash for your discretionary spending (like entertainment and dining out) and stop spending when the cash is gone.

- Keep Track of Your Spending: Regularly update your budget to reflect your spending. This helps you see if you’re staying within your limits.

- Be Flexible: Life happens, and unexpected expenses come up. If you need to adjust your budget, do it. Just make sure you’re not overspending in other areas.

- Celebrate Small Wins: Reward yourself for sticking to your budget, even if it’s just a small treat. This can keep you motivated.

Creating a basic budget is a key step in managing your money effectively, especially when you’re budgeting on a low income.

By using a zero-based budget, prioritizing your essentials, and separating needs from wants, you can make sure your money goes where it’s needed most.

Stick to your budget with these helpful tips, and you’ll be on your way to financial stability.

Reducing Expenses

Practical Ways To Cut Down On Utilities & Groceries

Cutting down on utilities and groceries can save you a lot of money each month.

For utilities, try using energy-efficient light bulbs, unplugging electronics when not in use, and setting your thermostat a little lower in winter and higher in summer. These small changes can add up over time.

For groceries, make a shopping list and stick to it. Plan your meals around what’s on sale and use coupons whenever possible.

Buying in bulk can also save money, especially on items you use frequently. Consider generic brands – they’re often just as good as name brands but cost less.

Finding Affordable Housing Options

Housing is usually the biggest expense in a budget, so finding affordable housing can make a big difference.

If you’re renting, look for a place that’s within your budget, even if it means downsizing or moving to a different neighborhood.

You might also consider getting a roommate to share the cost of rent and utilities.

If you own your home, explore refinancing your mortgage to get a lower interest rate. Also, check if you qualify for any housing assistance programs in your area.

Using Public Transportation Or Carpooling

Transportation costs can add up quickly, especially if you’re driving a lot. Using public transportation is often cheaper than owning and maintaining a car.

Check out your local bus or train routes and see if they can get you where you need to go.

If public transportation isn’t an option, consider carpooling with friends or coworkers. Sharing rides can cut down on gas and maintenance costs, and it’s better for the environment too!

Tips For Saving On Entertainment & Leisure Activities

You don’t have to spend a lot of money to have fun. Look for free or low-cost activities in your community, like parks, museums, and community events.

Many libraries offer free movie rentals and access to e-books and audiobooks.

If you enjoy dining out, try to limit it to special occasions. Cooking at home can be just as enjoyable, especially if you try new recipes or cook with friends and family.

RECOMMENDED READ: 10 NO SPEND WEEKEND IDEAS (FREE NO SPEND CHALLENGE PRINTABLE)

For other leisure activities, look for deals and discounts, and don’t forget to use any memberships or passes you might have.

Reducing expenses is a crucial part of budgeting on a low income. By cutting down on utilities and groceries, finding affordable housing, using public transportation or carpooling, and saving on entertainment, you can free up more money for your essentials and savings.

These small changes can make a big difference in your budget and help you achieve financial stability.

Increasing Your Income

Side Hustles That Can Supplement Your Income

When you’re budgeting on a low income, finding ways to bring in extra money can make a big difference.

Side hustles are a great way to supplement your income without needing to commit to another full-time job.

You could offer services like babysitting, dog walking, or house cleaning. If you have a talent for crafts or graphic design, you could sell handmade or digital items on Etsy.

Tutoring, freelancing, or delivering groceries and food are also popular side hustles that can fit into your schedule.

Exploring Part-Time Job Opportunities

Another way to increase your income is by taking on a part-time job. Look for jobs that have flexible hours so you can work around your main job or other commitments.

Retail, food service, and gig economy jobs like driving for a rideshare company often offer part-time positions.

Even a few extra hours a week can add up and help you cover your expenses or save for the future.

Selling Unused Items For Extra Cash

Take a look around your home – do you have items you no longer use or need? Selling these items can bring in some extra cash.

You can sell clothes, electronics, furniture, and more online through platforms like eBay, Facebook Marketplace, or local buy-and-sell groups.

Not only will you make money, but you’ll also declutter your home, which is a win-win!

Taking Advantage of Community Resources and Assistance Programs

Many communities offer resources and assistance programs that can help you save money, freeing up your income for other needs.

Look for food banks, clothing drives, and other local programs that provide free or low-cost goods and services.

You can also check if you qualify for government assistance programs like SNAP (Supplemental Nutrition Assistance Program) or LIHEAP (Low Income Home Energy Assistance Program).

These programs are designed to help people on a low income and can provide a significant financial boost.

Increasing your income while budgeting on a low income can help you meet your financial goals faster.

Whether through side hustles, part-time jobs, selling unused items, or taking advantage of community resources, there are many ways to boost your earnings.

Every bit of extra income can help you create a more stable financial future.

Smart Savings Strategies

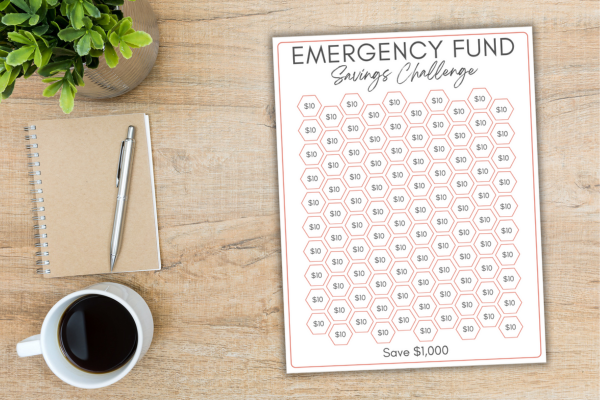

Setting Up An Emergency Fund

One of the most important steps in budgeting on a low income is setting up an emergency fund.

An emergency fund is money you set aside for unexpected expenses like car repairs, medical bills, or other emergencies. Even if you can only save a little bit each month, it adds up over time.

Aim to save at least $500 to start, and gradually build it up to cover three to six months’ worth of expenses.

This fund will give you peace of mind and prevent you from going into debt when unexpected costs arise.

Utilizing Savings Apps & Tools

There are many apps and tools designed to help you save money easily.

Apps like Acorns and Oportun automatically save small amounts of money for you, while others like Honey and Rakuten help you find discounts and cashback offers on your purchases.

These tools can make saving money a breeze by doing the work for you. Find the ones that best fit your lifestyle and start using them to boost your savings without even thinking about it.

RECOMMENDED READ: 9 PROVEN MONEY SAVING TECHNIQUES FOR EVERY BUDGET

Tips For Saving Money On Everyday Purchases

Saving money on everyday purchases can free up extra cash in your budget. Here are some tips to help you save:

- Buy in Bulk: Purchase items you use often in larger quantities to save money in the long run.

- Use Coupons: Look for coupons online or in your local newspaper for discounts on groceries and household items.

- Shop Sales: Plan your shopping around sales and special promotions.

- Buy Generic: Generic or store-brand products are often just as good as name brands but cost less.

These simple changes can add up to significant savings over time.

Importance Of Automating Your Savings

Automating your savings is one of the easiest ways to ensure you consistently save money.

Set up automatic transfers from your checking account to your savings account each month. Even small, regular transfers can make a big difference.

By automating your savings, you make it a habit without even thinking about it. This method helps you prioritize saving and ensures you’re always putting money aside for future needs.

For better interest rates, consider using a high-yield savings account (HYSA) like the ones offered by Ally Bank, which can help your savings grow faster.

Smart savings strategies are crucial when you’re budgeting on a low income.

By setting up an emergency fund, using savings apps, finding ways to save on everyday purchases, and automating your savings, you can build a strong financial foundation.

These strategies make saving money easier and help you reach your financial goals faster.

Start implementing these tips today and watch your savings grow!

Managing Debt On A Low Income

Prioritizing High-Interest Debt

When you’re budgeting on a low income, it’s important to tackle your high-interest debt first.

High-interest debt, like credit card debt, can quickly grow and become unmanageable. Focus on paying off these debts as fast as possible to reduce the amount of interest you pay over time.

Make minimum payments on all your debts, but put any extra money toward the debt with the highest interest rate.

This strategy, known as the avalanche method, will save you the most money in the long run.

Strategies For Negotiating Lower Interest Rates

Did you know you can sometimes lower your interest rates just by asking?

Call your creditors and ask if they can reduce your interest rate. Explain your situation and highlight your efforts to make payments on time.

Many creditors are willing to work with you, especially if it means they will get their money back.

A lower interest rate can make a big difference in how quickly you can pay off your debt.

Consolidating Debts For Easier Management

Debt consolidation can be a helpful tool for managing multiple debts.

By combining all your debts into one loan with a single monthly payment, you can make it easier to keep track of what you owe.

Look for a debt consolidation loan with a lower interest rate than your current debts. This can simplify your finances and potentially lower your monthly payments.

Just be sure to read the terms carefully and avoid any fees that could offset your savings.

Understanding Debt Relief Options

If you’re struggling to manage your debt, it’s important to know there are options available to help.

Debt relief programs, such as debt settlement or credit counseling, can offer solutions tailored to your situation.

Credit counseling agencies can help you create a debt management plan, which may lower your interest rates and waive fees.

Debt settlement involves negotiating with creditors to reduce the total amount you owe.

While these options can affect your credit score, they can provide a path to becoming debt-free when used responsibly.

Managing debt on a low income is challenging, but with the right strategies, it’s possible.

Prioritize paying off high-interest debt, negotiate lower interest rates, and consider consolidating your debts for easier management. Understand your debt relief options and seek help if you need it.

By taking these steps, you can reduce your debt burden and work towards financial stability.

Remember, every effort you make brings you closer to being debt-free and financially secure.

Utilizing Community Resources

Finding Local Food Banks & Assistance Programs

When you’re budgeting on a low income, community resources can be a lifesaver.

Local food banks are a great place to start. They provide free groceries to families in need, which can help you stretch your budget further.

Many communities also have assistance programs that offer help with rent, utilities, and other necessities.

Check with local government offices, churches, and community centers to find out what resources are available in your area.

Accessing Free Financial Counseling Services

Managing your finances can be tough, but you don’t have to do it alone.

Many communities offer free financial counseling services that can help you create a budget, manage debt, and plan for the future.

These services are often provided by non-profit organizations and are designed to help people like you achieve financial stability.

Look for organizations like the National Foundation for Credit Counseling (NFCC) or local community action agencies for free or low-cost financial advice.

Utilizing Public Libraries For Free Resources & Entertainment

Public libraries are an amazing resource that often goes overlooked.

Besides books, libraries offer free access to computers, the internet, and educational programs. You can borrow movies, audiobooks, and even attend free classes and workshops.

Libraries also provide a quiet place to study or work, and they often have programs for kids, making them a great resource for families.

Best of all, everything is free!

Joining Community Support Groups

Sometimes, the best support comes from people who understand what you’re going through.

Community support groups can provide emotional support, practical advice, and a sense of community. Look for groups focused on financial health, parenting, or other areas where you could use some extra help.

These groups can be found at community centers, online, or through local organizations.

Sharing experiences and tips with others in similar situations can be incredibly encouraging and helpful.

Utilizing community resources is a smart way to make the most of your budget when you’re on a low income.

From food banks and financial counseling to public libraries and support groups, there are many ways your community can help you save money and find support.

Don’t hesitate to reach out and take advantage of these valuable resources. They can make a big difference in your financial journey and help you build a more secure future.

Frequently Asked Questions About Budgeting On A Low Income

1. How to survive on a low income budget?

To survive on a low income budget, focus on the essentials first.

Create a budget that covers your basic needs like housing, utilities, food, and transportation.

Cut out unnecessary expenses, look for ways to reduce costs, and find extra income through side hustles or part-time jobs.

Use community resources like food banks and assistance programs to help make ends meet.

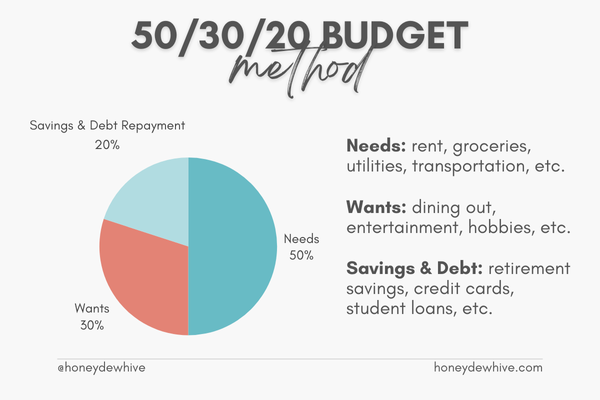

2. What is the 50/30/20 budget rule?

The 50/30/20 budget rule is a simple way to manage your money.

It suggests dividing your after-tax income into three categories: 50% for needs (essentials like rent and groceries), 30% for wants (non-essential expenses like dining out), and 20% for savings and debt repayment.

This helps ensure you’re covering your basics while also saving for the future.

3. How to budget when you don’t make enough money?

When you don’t make enough money, prioritize your essential expenses first.

Look for ways to cut costs and eliminate non-essential spending. Try to increase your income through side hustles or part-time jobs.

Seek out community resources and assistance programs that can help with food, housing, and other necessities.

4. How do you budget when you’re bad with money?

If you’re bad with money, start with a simple budget.

Track all your income and expenses to see where your money is going. Use cash for discretionary spending to avoid overspending.

Consider using budgeting apps to help you stay organized.

Start small by setting realistic financial goals and gradually improving your money management skills.

Seek help from financial counseling services if needed.

Final Thoughts

Budgeting on a low income might seem challenging, but with the right approach, it’s definitely achievable.

By understanding your financial situation, creating a realistic budget, and making smart adjustments to your spending and saving habits, you can make ends meet and even set aside money for future goals.

Remember, every small step counts.

Start by assessing your income and expenses, then craft a budget that prioritizes your needs and cuts unnecessary costs.

Look for ways to boost your income, no matter how small, and focus on building an emergency fund to safeguard against unexpected expenses.

Utilize community resources and support systems available to you – they can make a significant difference.

Take control of your financial future today by implementing these strategies.

With persistence and a proactive mindset, you’ll find that managing your finances becomes less daunting and more empowering.

If you found these tips helpful, be sure to check out more resources on budgeting and personal finance on our blog.

You’ve got this, and we’re here to help every step of the way!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!