We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Budgeting is a big deal when it comes to managing your money. For beginners, it can seem confusing and hard to start.

But don’t worry! There are many simple budgeting methods that can help you take control of your finances, reduce stress, and reach your goals.

In this blog post, I’ll share 10 easy budgeting methods that are perfect for beginners.

Whether you’re looking to save more, spend less, or just understand where your money goes, there’s a method here for you.

Let’s dive in and find the best budgeting method for you!

Why Budgeting Matters

Budgeting might seem like a chore, but it’s actually a powerful tool that can change your life.

By using simple budgeting methods, you can gain control over your money, achieve your goals, and feel less stressed about your finances. Here’s why budgeting is so important:

Financial Control & Awareness

A budget helps you understand where your money is going. It’s like having a map that shows you exactly how you spend your money each month.

This way, you can see if you’re spending too much on things like eating out or if you have enough to save for something special.

Goal Achievement

Budgeting is great for helping you reach your goals.

Want to save for a new bike, a vacation, or even college? A budget gives you a clear plan to set aside money each month for these goals.

It helps you stay focused and make sure your money is going towards what matters most to you.

Stress Reduction

Worrying about money can be really stressful. But when you use a budget, you have a plan.

This means fewer surprises and more peace of mind. You’ll feel more in control and less anxious about unexpected expenses.

Budgeting helps you be prepared and feel more confident about your finances.

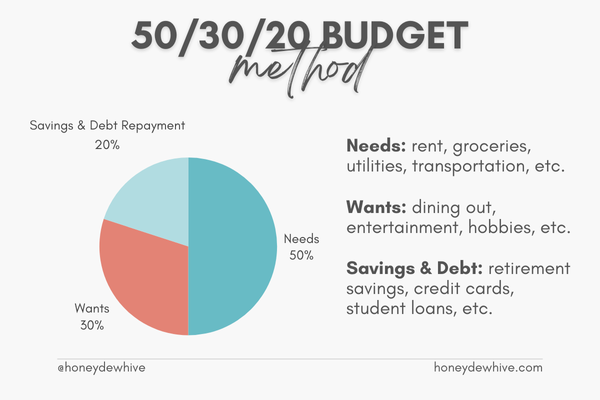

Method 1: The 50/30/20 Budget

The 50/30/20 budget is one of the simplest budgeting methods out there. It divides your income into three main categories:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

How To Implement

- Calculate your monthly income after taxes.

- Multiply your income by 0.50 to find out how much you should spend on needs. Needs include things like rent, groceries, utilities, and transportation.

- Multiply your income by 0.30 to determine your budget for wants. Wants are things like dining out, entertainment, and hobbies.

- Multiply your income by 0.20 to see how much to save or use for paying off debt. This money goes into savings accounts, emergency funds, or towards any debts you have.

Pros & Cons

Pros:

- Simple to understand and use.

- Provides a balanced way to manage your money.

- Helps you save and pay off debt regularly.

Cons:

- Might not fit everyone’s financial situation perfectly.

- Needs and wants can sometimes overlap, making it tricky to categorize expenses.

- Requires discipline to stick to the percentages.

Method 2: Zero-Based Budgeting

Zero-based budgeting is a method where every dollar of your income is given a specific job.

By the end of the month, your income minus your expenses should equal zero. This means you plan out where every dollar goes, so nothing is left unaccounted for.

How To Implement

- Calculate your monthly income after taxes.

- List all your expenses for the month, including needs, wants, savings, and debt repayment.

- Assign a dollar amount to each expense until you have used up all your income.

- Adjust your budget as needed to make sure your income minus expenses equals zero.

- Track your spending throughout the month to stay on budget.

Pros & Cons

Pros:

- Gives you complete control over your money.

- Helps you identify unnecessary spending.

- Ensures every dollar is used wisely.

Cons:

- Can be time-consuming to set up and maintain.

- Requires detailed tracking of all expenses.

- May need frequent adjustments to stay balanced.

Method 3: Envelope System

The envelope system is one of the classic budgeting methods that uses physical or digital envelopes to manage your money.

Each envelope is assigned to a specific expense category, like groceries, entertainment, or transportation. You only spend the money that’s in each envelope for that category.

Digital vs. Physical Envelopes

- Physical envelopes:

- Withdraw cash for your budget categories.

- Label envelopes with each category name.

- Put the designated amount of cash into each envelope.

- Spend only what’s in the envelope for that category.

- Digital envelopes:

- Use a budgeting app that supports the envelope system.

- Create virtual envelopes for each category.

- Allocate your budgeted amounts to these virtual envelopes.

- Track your spending through the app.

Pros & Cons

Pros:

- Easy to understand and use.

- Helps you stick to your budget since you can only spend what’s in each envelope.

- Makes you more aware of your spending habits.

Cons:

- Carrying cash can be inconvenient and less secure.

- Digital envelopes require a reliable app and regular tracking.

- Not ideal for online purchases or automatic payments.

Method 4: Pay Yourself First

The “Pay Yourself First” budgeting method focuses on prioritizing your savings before anything else.

When you receive your income, the first thing you do is set aside money for savings and investments. This ensures that you’re consistently building your financial future.

How To Implement

- Set a savings goal: Decide how much you want to save each month. This could be a fixed amount or a percentage of your income.

- Automate your savings: Set up automatic transfers to your savings account as soon as your paycheck is deposited. This way, you won’t forget or be tempted to spend the money elsewhere.

- Adjust your budget: After saving, use the remaining income to cover your needs and wants. Make sure to prioritize essential expenses.

RECOMMENDED READ: 9 PROVEN MONEY SAVING TECHNIQUES FOR EVERY BUDGET

Pros & Cons

Pros:

- Encourages regular saving, which helps build wealth over time.

- Makes saving a priority, reducing the temptation to spend on non-essentials.

- Simple to implement with automated transfers.

Cons:

- Can be challenging if you have irregular income or unexpected expenses.

- Requires discipline to adjust spending after saving.

- Might need to occasionally dip into savings if not enough is left for essential expenses.

Method 5: Reverse Budgeting

Reverse budgeting is one of the simplest budgeting methods. Instead of tracking every expense, you focus on saving a specific amount first. Once you’ve saved your desired amount, you can spend the rest of your income as you like.

How To Implement

- Determine your savings goal: Decide how much you want to save each month.

- Save first: As soon as you get your income, put the savings amount into a separate account.

- Spend the rest: After saving, use the remaining money for your needs and wants without worrying too much about tracking every expense.

Pros & Cons

Pros:

- Very simple and easy to follow.

- Ensures you meet your savings goals every month.

- Less time-consuming since you don’t need to track every expense.

Cons:

- May lead to overspending if you don’t keep an eye on your remaining funds.

- Not ideal for those with variable incomes or unexpected expenses.

- Lacks detailed insight into your spending habits.

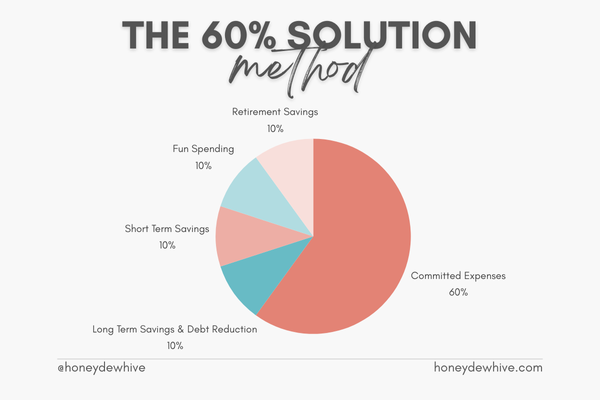

Method 6: The 60% Solution

The 60% Solution is one of the budgeting methods that divides your income into simple, easy-to-manage percentages. Here’s how it breaks down:

- 60% for committed expenses

- 10% for retirement savings

- 10% for long-term savings or debt reduction

- 10% for short-term savings

- 10% for fun spending

How To Implement

- Calculate your monthly income after taxes.

- Divide your income based on the percentages:

- 60% for committed expenses: This includes all your regular bills and essential expenses like rent, groceries, utilities, and insurance.

- 10% for retirement savings: Put this amount into a retirement account like a 401(k) or IRA.

- 10% for long-term savings or debt reduction: Use this for big savings goals or paying off debt faster.

- 10% for short-term savings: This can be for an emergency fund or upcoming expenses like a vacation.

- 10% for fun spending: Enjoy this money on things like dining out, entertainment, and hobbies.

Pros & Cons

Pros:

- Simple and easy to follow.

- Balances saving, spending, and debt reduction.

- Encourages saving for both short-term and long-term goals.

Cons:

- The 60% for committed expenses might not work for everyone, especially if your fixed costs are high.

- Requires discipline to stick to the percentages.

- May need adjustments if your income or expenses change.

Method 7: Values-Based Budgeting

Values-based budgeting helps you spend money on what truly matters to you.

Instead of following strict categories, you focus on aligning your spending with your personal values and priorities.

How To Implement

- Identify your values: Think about what’s most important to you. This could be family, education, health, travel, or anything else you deeply care about.

- List your expenses: Write down all your monthly expenses.

- Match expenses to values: Compare your spending with your values. Are you spending money on things that matter to you? If not, adjust your budget to better reflect your priorities.

- Set goals: Create financial goals based on your values. For example, if health is a priority, you might want to allocate more money to healthy groceries and gym memberships.

- Track and adjust: Regularly review your spending to ensure it aligns with your values and make adjustments as needed.

Pros & Cons

Pros:

- Helps you feel more satisfied and fulfilled with your spending.

- Makes it easier to cut out unnecessary expenses.

- Encourages mindful and intentional spending.

Cons:

- Requires regular self-reflection and adjustments.

- Can be harder to categorize expenses.

- Might take time to fully align spending with values.

Method 8: Incremental Budgeting

Incremental budgeting is where you take your previous budget and make small adjustments to it.

Instead of starting from scratch each month, you review your past budget and tweak it based on changes in your income or expenses.

When To Use This Method

Incremental budgeting is great if you have a pretty stable income and regular expenses.

It works well for people who don’t want to overhaul their budget every month but still want to make sure they’re staying on track.

Pros & Cons

Pros:

- Saves time since you’re building on your existing budget.

- Easy to adjust for small changes in income or expenses.

- Helps you stay consistent with your budgeting habits.

Cons:

- May not catch larger spending issues or necessary changes.

- Can lead to complacency if you’re not carefully reviewing your budget.

- Less flexible for those with variable incomes or expenses.

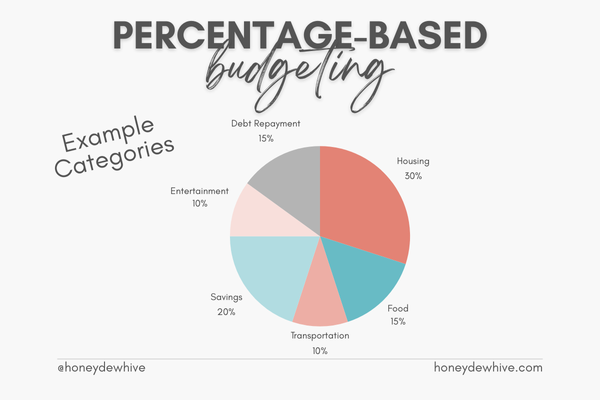

Method 9: Percentage-Based Budgeting

With the percentage-based budgeting method you divide your income into different categories by percentage.

This approach helps you manage your money by allocating a set percentage of your income to various spending and saving categories.

Customizing Percentages

- Determine your monthly income after taxes.

- Create your categories: Common categories include housing, food, transportation, savings, entertainment, and debt repayment.

- Assign percentages to each category. For example:

- 30% for housing

- 15% for food

- 10% for transportation

- 20% for savings

- 10% for entertainment

- 15% for debt repayment

- Adjust as needed: Customize the percentages to fit your personal needs and financial goals. You can change the percentages based on what’s important to you.

Pros & Cons

Pros:

- Simple and easy to understand.

- Flexible and customizable to fit your financial situation.

- Helps ensure all areas of your finances are covered.

Cons:

- May not work well for those with variable incomes.

- Requires regular review and adjustments.

- Can be challenging to stick to fixed percentages, especially with unexpected expenses.

Method 10: Bullet Journal Budget

The bullet journal budget is one of the most creative budgeting methods. It involves using a bullet journal to track your income and expenses.

This method is perfect for people who enjoy being artistic and want a personalized way to manage their money.

Setting Up A Bullet Journal Budget

- Choose a journal: Pick a notebook that you like and feel comfortable using.

- Create your spreads: Design pages for tracking your income, expenses, savings, and financial goals. You can use different layouts, colors, and drawings to make it fun and engaging.

- Track your spending: Write down every expense and income entry in your journal. Use symbols, charts, and graphs to visualize your spending habits.

- Review and adjust: Regularly go through your bullet journal to see how well you’re sticking to your budget and make any necessary changes.

Pros & Cons

Pros:

- Allows for creativity and personalization.

- Makes budgeting more enjoyable and engaging.

- Provides a clear and visual way to track your finances.

Cons:

- Can be time-consuming to set up and maintain.

- Requires consistency in tracking every expense.

- May not be ideal for those who prefer digital tools.

How To Choose The Right Budgeting Method?

Choosing the right budgeting method is important to make sure it fits your lifestyle and helps you reach your financial goals. Here are some tips to help you decide which budgeting method is best for you:

A. Assessing Personal Financial Situation

First, take a good look at your financial situation. Consider your income, expenses, and financial goals. Ask yourself questions like:

- How much do I earn each month?

- What are my regular expenses?

- Do I have any debts to pay off?

- What are my short-term and long-term financial goals?

Understanding your financial situation will help you pick a budgeting method that suits your needs.

B. Considering Lifestyle & Preferences

Think about your lifestyle and personal preferences. Some budgeting methods require more time and effort, while others are simpler and more straightforward. Ask yourself:

- Do I prefer using cash or digital tools?

- How much time can I dedicate to budgeting each week?

- Do I enjoy being creative with my budgeting, or do I prefer a more structured approach?

Choosing a method that aligns with your lifestyle will make it easier to stick to your budget.

C. Experimenting With Different Methods

It’s okay to try out different budgeting methods to see which one works best for you.

Start with one method and give it a try for a month or two. If it doesn’t work, don’t get discouraged! You can always switch to another method until you find the one that fits your needs.

Remember, the goal is to find a budgeting method that helps you manage your money effectively and comfortably.

By assessing your financial situation, considering your lifestyle, and experimenting with different budgeting methods, you’ll find the right approach to take control of your finances and achieve your goals.

Tips For Budgeting Success

Using a budget can make a big difference in managing your money, but it’s important to follow some key tips to ensure success. Here are some simple tips to help you stay on track:

A. Start Small & Build Habits

Don’t try to overhaul your entire financial life overnight. Start with small, manageable changes.

Focus on one or two spending areas where you can cut back. As you get comfortable with budgeting, you can gradually make bigger changes.

B. Use Technology To Your Advantage

There are lots of great apps and online tools that can help you budget. These tools can track your spending, categorize expenses, and remind you of upcoming bills.

Find an app that works for you and make budgeting easier and more efficient.

C. Regular Review & Adjustment

It’s important to regularly review your budget to see how you’re doing. Set aside time each week or month to go over your expenses and make adjustments if needed.

This helps you stay on track and make sure your budgeting method is working for you.

D. Celebrate Milestones

Budgeting can be challenging, so it’s important to celebrate your successes. When you reach a savings goal or pay off a debt, reward yourself with something small and enjoyable.

This keeps you motivated and makes budgeting feel more rewarding.

By starting small, using technology, regularly reviewing your budget, and celebrating your milestones, you can make any of the budgeting methods work for you.

These tips will help you stay on track and achieve your financial goals.

Frequently Asked Questions About Budgeting Methods

1. How often should I review my budget?

It’s a good idea to review your budget at least once a month. This helps you see if you’re on track and make any necessary adjustments.

If you’re just starting out, you might want to check in more frequently, like every week, to make sure you’re sticking to your plan.

2. Can I combine multiple budgeting methods?

Yes, you can! Sometimes combining different budgeting methods can work better for you.

For example, you might use the envelope system for daily expenses and the 50/30/20 budget for your overall monthly income.

Feel free to mix and match to find what works best for your situation.

3. What if I struggle to stick to a budget?

It’s normal to find budgeting challenging at first. If you’re struggling, try to identify what’s making it hard.

Are your goals realistic? Are you tracking your spending regularly? Make small adjustments and keep experimenting until you find a method that fits your lifestyle.

Remember, it takes time to build new habits, so be patient with yourself.

4. Are there any free budgeting tools for beginners?

Yes, there are many free tools available to help you with budgeting.

Apps like Mint, EveryDollar, and YNAB (You Need A Budget) offer free versions that can help you track your spending and manage your budget.

Online spreadsheets and printable budget planners are also great free resources.

5. How long does it take to see results from budgeting?

The time it takes to see results can vary depending on your goals and financial situation. Generally, you might start noticing positive changes within a few months.

You’ll likely see more significant results, like paying off debt or reaching savings goals, over a longer period, such as six months to a year.

The key is to stay consistent and keep reviewing your budget regularly.

Final Thoughts

Budgeting doesn’t have to be complicated or scary. With so many different budgeting methods to choose from, there’s bound to be one that fits your needs and lifestyle.

We’ve covered 10 simple budgeting methods that can help you take control of your money, reduce stress, and reach your financial goals.

Whether you choose the 50/30/20 budget, zero-based budgeting, the envelope system, or any other method, the key is to get started.

I encourage you to pick a method that sounds interesting and give it a try. Remember, it’s okay to experiment and switch methods if one doesn’t work for you.

The most important thing is to find a way to manage your money that you feel comfortable with and can stick to.

If you’ve tried any of these methods or have your own tips for budgeting success, I’d love to hear from you!

Share your experiences in the comments below and let’s help each other on the journey to financial freedom.

Happy budgeting!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!