We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Managing money as a couple can be both rewarding and challenging.

Did you know that financial disagreements are one of the top reasons couples argue? It’s true! Money matters can be a major source of tension, but they can also be a fantastic opportunity for growth and connection.

Budgeting for couples is all about turning potential stress into success by building a strong financial foundation together.

In this guide, I’ll share essential tips and strategies to help you and your partner navigate finances, from setting goals to choosing the right budgeting tools.

We’ll explore how to align your financial aspirations, communicate effectively about money, and create a budget that reflects both your individual and shared priorities.

Let’s dive in and discover how budgeting can bring you closer and set you on the path to financial harmony!

Understanding The Importance Of Budgeting As A Couple

Budgeting is like a roadmap for your money. It shows you where you’re going and how to get there without getting lost along the way.

For couples, budgeting is super important because it helps you both know what’s happening with your finances.

Let’s explore why budgeting together is key to a happy financial future.

Why Budgeting Is Crucial For Couples’ Financial Success

Budgeting is crucial because it helps you manage your money wisely. When you budget together, you can see exactly where your money is going each month.

This makes it easier to pay bills on time, save for future goals, and even have some fun without worrying about overspending.

By having a plan, you can avoid those tricky money problems that can cause stress and arguments.

Benefits Of Budgeting Together: Trust, Transparency & Teamwork

When couples budget together, it builds trust. You both know what’s happening with your money, so there are no surprises. This openness, or transparency, helps you work as a team.

Imagine being on a sports team where everyone knows the game plan. You’ll play better together!

Budgeting as a team helps you tackle financial challenges, like paying off debt or saving for a big purchase, together.

Plus, you get to celebrate your financial wins as a team!

Common Financial Challenges Couples Face

Even the best teams face challenges. One common challenge for couples is different spending habits.

Maybe one person loves to save while the other enjoys spending on little treats. Without a budget, these differences can cause tension.

Another challenge is unexpected expenses, like car repairs or medical bills. If you don’t have a budget, these surprises can really throw you off track.

By budgeting together, you can be prepared for these bumps in the road.

Remember, budgeting is about working together to build the future you both dream about.

When you’re on the same page financially, you can avoid stress and focus on what really matters—enjoying life together!

Setting Shared Financial Goals

Setting shared financial goals is like planning a big adventure with your partner.

You both decide where you want to go, how you’ll get there, and what exciting things you’ll do along the way.

Let’s talk about how to set these goals together so you can achieve your dreams!

How To Align Your Individual Goals With Your Partner’s

Start by talking with your partner about what’s important to each of you. Maybe you want to buy a house, take a dream vacation, or save for a rainy day.

Write down your individual goals and see where they overlap. When you know what you both care about, you can create shared goals that make you both happy.

It’s like building a puzzle—each piece fits together to make a complete picture.

Creating Short-Term & Long-Term Financial Goals Together

Think about what you want to achieve in the short term and the long term.

Short-term goals are things you want to accomplish soon, like saving for a weekend getaway or buying a new laptop.

Long-term goals take more time, like saving for retirement or buying a house.

Make a list of these goals and prioritize them. Ask yourselves, “What do we want to achieve first?”

Having both short-term and long-term goals helps you stay focused and motivated.

Tips For Prioritizing & Adjusting Goals Over Time

Life can be unpredictable, and sometimes plans change. That’s okay! The key is to be flexible with your goals.

Regularly check in with each other to see how you’re doing. Celebrate when you reach a goal and talk about any new goals you might have.

If something unexpected happens, like a surprise expense, be ready to adjust your goals. Think of it like steering a ship—sometimes you need to change direction to stay on course.

By setting shared financial goals, you and your partner can work together toward a bright future.

Whether you’re saving for something big or just trying to manage your everyday expenses, having clear goals makes everything feel more achievable.

Keep talking, keep planning, and watch your dreams come to life!

Effective Communication About Money

Talking about money can feel awkward, but it’s one of the most important things you can do as a couple. When you communicate well about finances, you build trust and understanding.

Here’s how you can make money talks a regular and positive part of your relationship.

The Importance Of Open & Honest Financial Discussions

Being open and honest about money means sharing everything—your income, expenses, debts, and even your money worries.

When you’re transparent with each other, it’s easier to make decisions and solve problems together.

Think of it like being on a team. You need to know the score to play the game well.

By being honest, you can support each other and work towards your financial goals as a team.

How To Have Productive Money Conversations Without Conflict

Money talks don’t have to turn into arguments! Here are some tips to keep things positive:

- Pick the right time: Choose a time when you’re both relaxed and not distracted. Avoid money talks when you’re stressed or upset.

- Listen to each other: Make sure you both have a chance to speak and listen to what the other person has to say. It’s important to understand each other’s viewpoints.

- Stay calm: If things get tense, take a break and come back to the conversation later. Remember, you’re on the same team!

- Focus on solutions: Instead of blaming each other for money problems, work together to find solutions. Ask questions like, “How can we fix this?” or “What can we do differently?”

Strategies For Regular Financial Check-ins

Regular check-ins are a great way to stay on top of your finances and avoid surprises. Here’s how to make them work:

- Schedule it: Set a specific day and time each month for your money check-in. Treat it like a date night but with a financial twist!

- Review your budget: Go over your income, expenses, and goals. See how well you’re sticking to your budget and make adjustments if needed.

- Celebrate successes: Did you pay off a debt or reach a savings goal? Celebrate those wins together!

- Plan for the future: Talk about any changes coming up, like a new job or vacation plans, and how they might affect your budget.

By communicating effectively about money, you can avoid misunderstandings and build a stronger relationship.

Remember, money talks are all about teamwork and working together to reach your goals.

Keep the conversation going and enjoy the journey!

Choosing The Right Budgeting Method

Finding the right budgeting method is like picking the best tool for a job. You want something that fits your lifestyle and helps you manage your money easily.

Let’s explore some popular budgeting methods for couples and how to choose the one that works best for you!

Different Budgeting Methods For Couples: Zero-Based, Envelope & 50/30/20

Zero-Based Budgeting: With this method, you start each month by giving every dollar a job. You plan out where every bit of money goes—bills, groceries, savings, and even fun stuff—until you have zero dollars left unassigned.

It’s a great way to track every penny and make sure nothing is wasted.

Envelope Budgeting: This is an old-school but effective method. You divide your money into different envelopes for each category, like food, entertainment, and bills.

Once an envelope is empty, that’s it—you can’t spend any more in that category until next month.

It’s a hands-on way to control spending and stick to your budget.

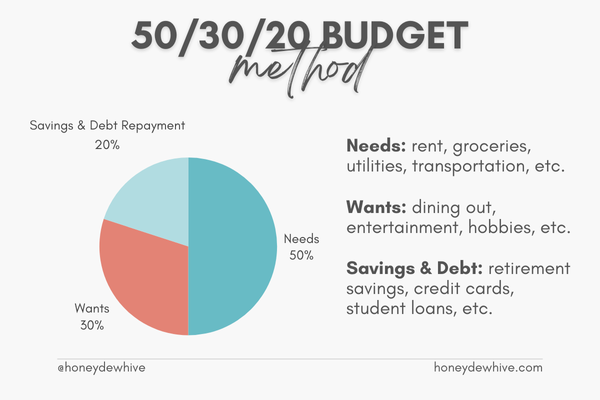

50/30/20 Budgeting: This simple method divides your income into three parts: 50% for needs (like rent and groceries), 30% for wants (like dining out and hobbies), and 20% for savings and debt repayment.

It’s a flexible way to manage your money without getting too detailed.

How To Choose A Budgeting Style That Fits Your Lifestyle

When choosing a budgeting method, think about what feels right for you and your partner. Do you like detailed plans, or do you prefer something simpler? Here’s how to decide:

- Think about your goals: If you’re saving for a big purchase, like a house, a detailed method like zero-based budgeting might be best. If you want more freedom, the 50/30/20 method could be a better fit.

- Consider your habits: Are you good at sticking to plans, or do you need more structure to stay on track? Choose a method that matches your habits and makes budgeting easy.

- Talk it over: Discuss with your partner which method you both feel comfortable with. The best budget is one you can both agree on and stick to!

Pros & Cons Of Each Budgeting Method

Every budgeting method has its strengths and weaknesses. Here’s a quick rundown:

- Zero-Based Budgeting:

- Pros: Very detailed, helps you track every penny.

- Cons: Takes time to set up and manage each month.

- Envelope Budgeting:

- Pros: Easy to understand, helps control spending.

- Cons: Not as flexible, requires discipline to stick to.

- 50/30/20 Budgeting:

- Pros: Simple and flexible, easy to follow.

- Cons: Less detailed, might not work for very tight budgets.

Choosing the right budgeting method can make managing your finances a lot easier and more enjoyable.

Remember, the best method is the one that works for both of you and helps you reach your financial goals

So, give these methods a try and find the perfect fit for your lifestyle!

Utilizing Budgeting Tools & Apps

Budgeting tools and apps are like having a personal money coach right in your pocket! They can help you track spending, set goals, and stick to your budget with ease.

Let’s explore some popular apps for couples and see how technology can make budgeting together a breeze.

Popular Budgeting Apps For Couples To Manage Finances

There are so many great apps out there that can help you manage your money. Here are a few favorites:

- YNAB (You Need A Budget): YNAB is great for zero-based budgeting. It helps you plan where every dollar will go, and it offers helpful workshops to teach you how to budget better.

- Goodbudget: This app is based on the envelope budgeting method. You can create virtual envelopes for different spending categories and share them with your partner to stay on the same page.

- EveryDollar: Made by Dave Ramsey’s team, this app makes it easy to set up a monthly budget and track your expenses. It’s user-friendly and helps you focus on giving every dollar a purpose.

How Technology Can Simplify Joint Budgeting Efforts

Using apps and technology can make budgeting as a couple easier and more fun. Here’s how:

- Real-time updates: Many apps update your spending in real-time, so you always know where your money is going. No more guessing or surprises at the end of the month!

- Shared access: Most budgeting apps allow you to share accounts with your partner. This means you both have access to the same information, keeping everything transparent and easy to manage.

- Goal tracking: Apps often have features that let you set and track savings goals. You can see your progress and stay motivated as you work towards your financial dreams together.

Tips For Tracking Expenses & Staying On Budget

Here are some tips to make the most out of budgeting tools and apps:

- Set up alerts: Use alerts to remind you of bill payments and to warn you when you’re getting close to your spending limits.

- Review regularly: Take some time each week to review your budget and spending. This helps you stay on track and make adjustments if needed.

- Stay flexible: Life changes, and so can your budget. Use your app to easily adjust your budget categories as your needs change.

- Celebrate milestones: When you reach a savings goal or stay on budget for a month, celebrate! Use these victories to keep you motivated and excited about budgeting.

Budgeting tools and apps can take the stress out of managing money as a couple.

By using technology to track your finances, you can focus on what really matters—enjoying life together and achieving your goals!

Creating A Joint Budget Plan

Creating a joint budget plan is like drawing a map for your financial journey together. It helps you know where you’re going and how to get there without any detours.

Let’s look at how to build a budget plan that works for both you and your partner.

Steps To Create A Budget Plan That Works For Both Partners

Creating a budget together starts with a few simple steps:

- List your income: Start by adding up all the money you both make each month. This includes salaries, bonuses, and any other income sources. Knowing your total income helps you figure out how much you can spend and save.

- Identify your expenses: Make a list of all your monthly expenses. This includes things like rent, groceries, utilities, and any subscriptions you have. Don’t forget to include fun things like going out or hobbies!

- Set your goals: Decide what you want to save for. This could be a vacation, a new car, or building an emergency fund. Setting goals gives you something to work toward and helps you stay motivated.

- Create your budget: Divide your income into different categories for spending and saving. Make sure you have enough for all your needs, some of your wants, and a bit for your savings goals.

- Review and adjust: Check your budget regularly to see how you’re doing. If something isn’t working, don’t be afraid to make changes. Your budget should be flexible to fit your life.

RECOMMENDED READ: 7 COMMON BUDGETING MISTAKES & HOW TO AVOID THEM

Deciding How To Split Expenses: 50/50 vs. Income-Based Approaches

When it comes to sharing expenses, there are a couple of ways to do it:

- 50/50 split: This is where you both pay half of the expenses. It’s simple and fair if your incomes are similar.

- Income-based split: If one of you makes more money, you might want to split expenses based on income. For example, if one partner makes 60% of the total income, they pay 60% of the expenses. This can make things feel more balanced.

Talk with your partner about which approach feels right for you. The goal is to find a method that both of you are comfortable with.

How To Handle Individual & Joint Expenses

It’s important to know which expenses are shared and which are individual. Here’s how to handle them:

- Joint expenses: These are things like rent, groceries, and utilities that you both use. They should be included in your shared budget plan.

- Individual expenses: These are personal items, like hobbies or gifts for friends. You can each have a separate budget for these to spend however you like.

By separating expenses, you can enjoy some financial independence while still working together on big goals.

Creating a joint budget plan helps you and your partner stay organized and focused on your financial future.

Remember, the best budget is one that supports both of you and helps you achieve your dreams together.

Handling Debt & Building Savings Together

Handling debt and building savings together can feel like a big challenge, but with teamwork and a good plan, you can make it happen!

Let’s look at how you and your partner can tackle debt and save for the future together.

Strategies For Paying Off Debt As A Couple

Paying off debt is like climbing a mountain—it’s tough but rewarding when you reach the top. Here are some strategies to help you conquer debt together:

- Make a list of debts: Write down all the debts you owe, including credit cards, student loans, and car payments. Knowing what you owe helps you make a plan to pay it off.

- Prioritize your debts: Decide which debts to pay off first. Some people like to start with the smallest debt for quick wins (the snowball method), while others prefer to tackle the highest interest debt first (the avalanche method). Choose what works best for you both.

- Create a payment plan: Decide how much you can pay each month toward your debts. Stick to your plan and try to pay a little extra if you can. Every bit helps!

- Celebrate small victories: Every time you pay off a debt, celebrate! It’s a big step toward financial freedom and deserves a little recognition.

Building An Emergency Fund Together

An emergency fund is like a safety net for your finances. It helps you handle unexpected expenses, like car repairs or medical bills, without stress.

Here’s how to build one together:

- Set a goal: Aim to save at least three to six months’ worth of living expenses. This gives you a cushion in case something unexpected happens.

- Start small: Begin by saving a little bit each month. Even $50 or $100 can add up over time. The key is to start saving regularly.

- Automate savings: Set up automatic transfers to your savings account. This way, you won’t forget to save, and your fund will grow without much effort.

- Keep it separate: Keep your emergency fund in a separate account, so you’re not tempted to spend it on non-emergencies.

Tips For Saving For Future Goals, Like Buying A House Or Vacation

Once your emergency fund is in place, you can start saving for fun future goals:

- Set specific goals: Decide what you’re saving for, like a house down payment or a dream vacation. Having a clear goal makes it easier to stay motivated.

- Make a savings plan: Figure out how much you need to save each month to reach your goal. Use a savings calculator to help you plan.

- Track your progress: Keep an eye on your savings and celebrate milestones along the way. Seeing your progress can keep you excited about reaching your goal.

- Be flexible: Life can change, so be ready to adjust your savings plan if needed. The important thing is to keep moving toward your goals.

RECOMMENDED READ: 9 PROVEN MONEY SAVING TECHNIQUES FOR EVERY BUDGET

By handling debt and building savings together, you and your partner can create a secure and happy financial future.

Remember, it’s all about teamwork and staying focused on your dreams.

Frequently Asked Questions About Budgeting For Couples

1. What is a realistic budget for a couple?

A realistic budget for a couple depends on your income, expenses, and financial goals. Start by listing all your income sources and expenses, including rent or mortgage, groceries, utilities, transportation, and savings.

A common approach is the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment.

Adjust these percentages based on your specific situation to create a budget that works for both of you.

2. How do couples budget together?

Couples can budget together by having open discussions about their finances and goals.

Start by listing all income and expenses and then agree on a budgeting method, such as zero-based, envelope, or 50/30/20 budgeting.

Use budgeting apps or tools to track spending and regularly review your budget together to ensure you’re on track.

Communication and teamwork are key to successful budgeting as a couple.

3. How do most couples split finances?

Most couples split finances in a way that feels fair to both partners.

Common approaches include a 50/50 split, where each partner contributes equally to joint expenses, or an income-based split, where each partner contributes a percentage based on their income.

Some couples also keep some personal finances separate for individual spending while sharing joint expenses.

The best method is the one that both partners agree on and feel comfortable with.

4. How much does the average couple spend per month?

The average couple’s monthly spending varies based on location, lifestyle, and income. On average, couples in the U.S. might spend between $4,000 and $6,000 per month, covering housing, food, transportation, healthcare, and entertainment.

It’s important to create a budget that reflects your unique situation and allows you to manage your money wisely.

Final Thoughts

Budgeting for couples is not just about managing money; it’s about building a life together based on trust, transparency, and shared goals.

By implementing these strategies, you can improve your financial well-being and strengthen your relationship.

Remember, communication is key—keep those conversations going, and revisit your budget regularly to ensure you stay on track.

Celebrate your financial wins, big and small, and support each other through challenges.

Whether you’re planning a dream vacation, buying a home, or simply saving for a rainy day, working together towards financial success can deepen your connection and create a more fulfilling partnership.

Ready to start budgeting as a team? Let’s make it happen, and watch how your relationship thrives as you build a brighter financial future together!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

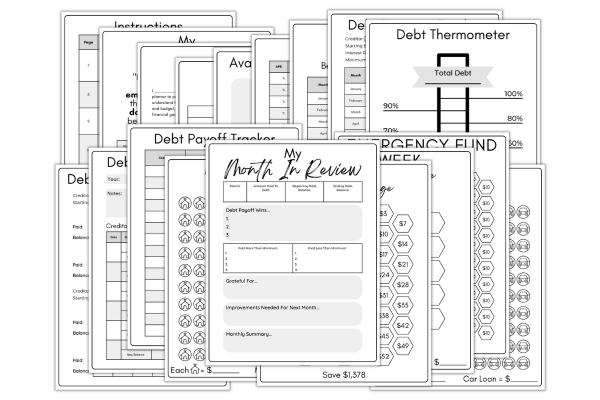

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!