We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Managing money can often feel overwhelming, especially when life throws unexpected expenses your way.

If you’re an iPhone user, you have a powerful tool in your pocket that can transform how you handle your finances: budgeting apps.

These apps have evolved significantly over the years, becoming essential allies in helping people save more, spend wisely, and achieve their financial dreams.

With so many options available, how do you know which app is the right fit for you?

Whether you’re aiming to save for a vacation, pay off debt, or simply track your daily expenses, there’s an app tailored to your needs.

In fact, a recent survey revealed that individuals who regularly use budgeting apps report feeling more confident and in control of their financial lives.

So, let’s explore the best budgeting apps for iPhone users and help you find the perfect match to make your financial journey smoother and more rewarding.

Why Use A Budgeting App On Your iPhone?

Budgeting apps on your iPhone make managing your money easier and more fun!

Here are some reasons why using a budgeting app can be a great idea:

- Convenience of Managing Finances on-the-Go:

With a budgeting app, your financial plan is always in your pocket. You can check your budget and track your spending anytime, whether you’re at home or on the go. It’s like having a financial helper that’s ready whenever you need it! - Real-Time Updates and Notifications:

Budgeting apps give you real-time updates on your spending and send you notifications. This means you’ll always know where your money is going, helping you make smart choices. If you spend a little too much on snacks or shopping, your app can remind you to stay on track! - Enhanced Security Features Compared to Traditional Methods:

Budgeting apps offer enhanced security features that help protect your information. Your data is safe with password protection and encryption, which is much safer than keeping track of expenses on paper. - Syncing Across Devices for Seamless Budgeting:

Most budgeting apps sync across all your devices. Whether you’re using your iPhone, iPad, or computer, you can access your budget anytime, anywhere. This makes it super easy to keep everything updated and organized.

Using a budgeting app on your iPhone helps you manage your money in a simple and effective way.

You’ll feel more in control of your finances and be able to focus on what truly matters: achieving your financial goals and enjoying life!

Top Budgeting Apps For iPhone

When it comes to budgeting apps for your iPhone, there are so many great choices that can help you manage your money.

Each app has its own unique features, so let’s look at some of the best ones available!

EveryDollar

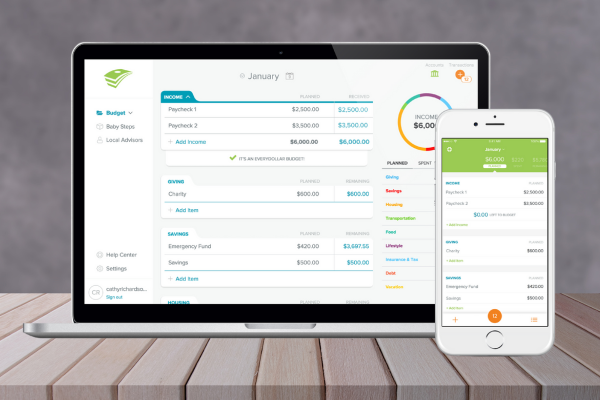

EveryDollar is a great app for those who love keeping things simple. It helps you plan out where every dollar of your income goes, making sure you stay on track with your budget. It’s perfect for zero-based budgeting, which means you plan how to use all of your income each month. Plus, it connects with your bank account to keep your budget updated.

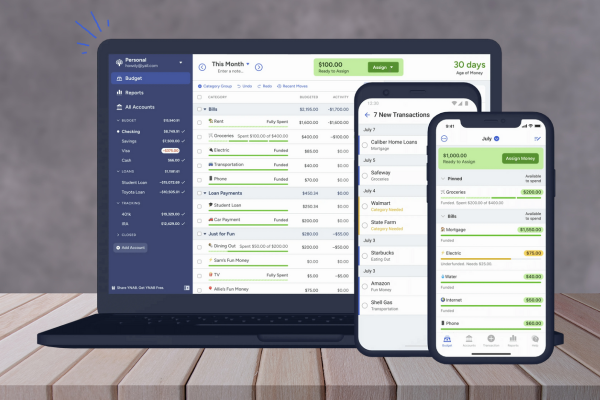

YNAB (You Need A Budget)

YNAB is a popular app that teaches you to be proactive with your money. It helps you assign every dollar a job, so you’re ready for bills, savings, and unexpected expenses. YNAB is great for anyone who wants to learn more about managing their finances and sticking to a plan. The app offers lots of educational resources and a supportive community to help you succeed.

PocketGuard

PocketGuard is perfect if you want a simple way to see how much you can spend. It automatically tracks your bills, expenses, and income, showing you how much money you have left after taking care of the essentials. It’s great for people who want a quick glance at their finances without too much detail.

GoodBudget

If you like the idea of envelope budgeting, GoodBudget is for you! This app uses a digital envelope system to help you plan your spending. You can set aside money for different categories, just like putting cash in envelopes. It’s a fun and organized way to keep track of your money, and you can share budgets with family members to work together.

These top budgeting apps for iPhone offer a range of features to fit different needs.

Whether you want a simple budget planner or a detailed financial tool, there’s an app here that can help you take control of your finances.

Try them out and see which one works best for you!

EveryDollar: Straightforward Budgeting

EveryDollar is a great budgeting app for iPhone users who want to keep things simple and organized.

Developed by Ramsey Solutions, it’s perfect for those who like a straightforward approach to budgeting.

Let’s see why EveryDollar might be the right app for you!

- Easy to Use: EveryDollar has a user-friendly interface that makes budgeting easy for everyone. With just a few taps, you can set up your budget and start tracking your expenses. The design is clean and simple, so you won’t feel overwhelmed when managing your money.

- Zero-Based Budgeting: The app uses a zero-based budgeting system, which means you give every dollar a purpose. At the start of each month, you plan how you’ll spend or save every single dollar you earn. This method helps you stay on track and avoid overspending, ensuring you’re always prepared for upcoming expenses.

- Syncs with Bank Accounts: EveryDollar lets you connect your bank accounts, so your budget stays updated automatically. This feature makes it easy to track your spending in real-time and see exactly where your money is going. You can feel confident knowing your budget is always accurate and up-to-date.

- Free Version and Premium Features: EveryDollar offers a free version with all the basic tools you need to start budgeting. If you want more advanced features, like automatic bank syncing and detailed reports, you can upgrade to EveryDollar Plus. This premium option provides even more insights into your financial habits and helps you make informed decisions about your money.

- Pros and Cons: EveryDollar is excellent for people who want a simple and effective budgeting tool. It’s especially useful if you’re new to budgeting and want to learn the basics. However, some features require a paid subscription, which might not be ideal if you’re looking for a completely free app.

EveryDollar is a fantastic choice if you’re looking for a budgeting app that’s easy to use and helps you manage your money effectively.

With its straightforward approach, you can stay on top of your finances and work towards your financial goals with confidence.

YNAB (You Need A Budget): A Proactive Approach

YNAB, short for “You Need A Budget,” is one of the best budgeting apps for iPhone users who want to take a proactive approach to their finances.

This app is all about being prepared and in control of your money.

Let’s dive into what makes YNAB a fantastic choice!

- Proactive Budgeting and Financial Planning: YNAB helps you plan ahead by giving every dollar a job. Instead of just tracking what you’ve already spent, YNAB encourages you to think about how you want to use your money before you spend it. This way, you can plan for bills, savings, and fun activities without feeling stressed.

- Unique Methodology for Managing Money Effectively: YNAB uses four simple rules to guide your budgeting: 1) Give every dollar a job, 2) Embrace your true expenses, 3) Roll with the punches, and 4) Age your money. These rules help you build a buffer, so you’re spending money you earned last month, making it easier to handle unexpected expenses and avoid living paycheck to paycheck.

- Educational Resources and Community Support: YNAB offers a wealth of educational resources, including workshops, guides, and a supportive online community. Whether you’re new to budgeting or a seasoned pro, you can find helpful tips and advice to improve your financial skills. The YNAB community is full of people sharing their experiences and cheering each other on, which can make budgeting feel less daunting and more fun.

- Pros and Cons: YNAB is great for those who want to be more hands-on with their budget. The proactive approach helps you make smarter decisions with your money, but it does require a bit of time and effort to set up and maintain. The app has a subscription fee, which might be a downside for some users, but many find the benefits well worth the cost.

YNAB is perfect for anyone looking to take control of their finances with a proactive mindset.

By using YNAB’s simple rules, you can reduce stress, build savings, and gain confidence in managing your money.

It’s not just about tracking expenses—it’s about creating a budget that works for you and helps you reach your financial goals!

PocketGuard: Simplified Budget Management

PocketGuard is an excellent budgeting app for iPhone users who want to keep their finances simple and stress-free.

This app is all about showing you how much money you can safely spend while keeping your bills and savings goals in mind.

Let’s explore why PocketGuard might be the right choice for you!

- Easy Setup with Secure Bank Connection: PocketGuard makes it super easy to get started. You can connect your bank accounts securely, and the app will automatically track your income, bills, and expenses. This means you don’t have to worry about manually entering transactions—it’s all done for you!

- Real-Time Tracking of Spending and Savings: One of PocketGuard’s best features is its real-time tracking. It shows you exactly how much money you have left to spend after considering your bills and savings goals. This feature helps you avoid overspending and makes budgeting a breeze.

- Insights into Recurring Expenses and Monthly Bills: PocketGuard helps you keep track of your monthly bills and recurring expenses. The app gives you a clear picture of where your money is going, making it easier to spot areas where you might want to cut back or save more.

- Pros and Cons of Using PocketGuard: PocketGuard is fantastic for anyone who wants a quick and easy way to manage their money. The app’s “In My Pocket” feature shows you what’s left to spend after taking care of essentials, so you can make informed spending decisions. However, if you’re looking for detailed budgeting or financial planning tools, you might find PocketGuard a bit basic.

PocketGuard is perfect for iPhone users who prefer a simple and effective way to manage their money.

With real-time updates and automatic tracking, you’ll always know how much you can safely spend while staying on top of your financial goals.

It’s a great app for anyone who wants to simplify budgeting and focus on what really matters!

GoodBudget: Envelope Budgeting For The Digital Age

GoodBudget is a fantastic budgeting app for iPhone users who love the traditional envelope budgeting method but want the convenience of a digital tool.

It helps you plan your spending and stay on top of your finances without carrying cash around.

Let’s take a look at what makes GoodBudget a great choice!

- Digital Envelope Budgeting System: GoodBudget uses the envelope system to help you manage your money. You create digital envelopes for different spending categories, like groceries, entertainment, and savings. Each time you earn money, you fill your envelopes, and as you spend, you track it against your budget. This helps you stay organized and know exactly how much you have left to spend in each category.

- Share Budgeting Plans with Family Members: One of GoodBudget’s coolest features is that you can share your budget with family members. This makes it easy to work together on financial goals and ensure everyone is on the same page. It’s perfect for couples or families who want to manage their money as a team!

- Ideal for Cash-Based Budgeters: GoodBudget is great for people who like the feel of cash budgeting but want to go digital. It helps you keep track of your spending without the hassle of dealing with physical cash. You can easily adjust your envelopes as your financial situation changes, making it a flexible and convenient option.

- Pros and Cons of Using GoodBudget: GoodBudget is excellent for anyone who wants to use the envelope method without carrying cash. It’s simple to set up and use, making it a great tool for beginners and experienced budgeters alike. However, the free version limits the number of envelopes you can create, so you might need to upgrade to a paid plan for more features.

GoodBudget is an ideal choice for iPhone users who want to keep their finances organized using the envelope method.

With its easy-to-use system and the ability to share with family members, you can take control of your money and reach your financial goals together.

RECOMMENDED READ: BUDGETING FOR COUPLES: TIPS FOR MANAGING FINANCES TOGETHER

Whether you’re saving for a big purchase or just trying to keep track of daily expenses, GoodBudget has you covered!

Choosing The Right Budgeting App For You

Choosing the best budgeting app for your iPhone can make a big difference in how you manage your money.

With so many options available, it’s important to find one that fits your needs and lifestyle. Here’s how you can pick the right app for you:

Factors To Consider: Features, Cost, Ease Of Use

When selecting a budgeting app, think about what features are most important to you. Do you need an app that helps with simple budgeting, or are you looking for advanced tools like investment tracking?

Consider the cost, too. Some apps offer free versions, while others require a subscription for extra features.

And don’t forget ease of use! Make sure the app is easy to navigate and understand so that budgeting feels simple and enjoyable.

Assessing Your Financial Goals & Lifestyle Needs

Your financial goals and lifestyle can help determine which app is best for you.

If you’re focused on saving money, look for an app with strong savings tools. If you’re planning for the future, consider one with retirement planning features.

Think about your spending habits and what will help you stay on track, whether it’s alerts, reminders, or detailed reports.

Free vs. Paid Apps: What’s Worth The Investment?

Free apps can be a great starting point if you’re new to budgeting, as they offer basic features without any cost. However, paid apps often provide more detailed insights, advanced tools, and personalized advice.

Consider trying out a free version first, then decide if upgrading is worth it for you.

The right app should make you feel more in control of your finances and help you achieve your goals.

Choosing the right budgeting app is all about finding the one that works best for you.

Whether you need a simple tool to track daily expenses or a comprehensive financial planner, there’s an app out there that can help.

Take the time to explore different options and see which one fits your needs. With the right app by your side, budgeting can become an easy and rewarding part of your life!

Frequently Asked Questions About iPhone Budgeting Apps

1. What is the best free budget app for iPhone?

The best free budget app for iPhone is EveryDollar.

It offers an easy-to-use interface and uses the zero-based budgeting method, helping you allocate every dollar of your income.

While the free version provides all the basic features you need to start budgeting, you can upgrade to the paid version for additional features like bank syncing.

2. What is the #1 budgeting app?

The #1 budgeting app is often considered to be YNAB (You Need A Budget).

YNAB is known for its proactive budgeting approach and unique methodology that helps users give every dollar a job.

With its educational resources and community support, YNAB helps users build strong financial habits and achieve their financial goals.

It does require a subscription, but many users find it well worth the investment.

3. What is the best free app for tracking daily expenses?

The best free app for tracking daily expenses is PocketGuard.

It automatically tracks your income, bills, and expenses in real-time, making it easy to see how much you have left to spend.

PocketGuard’s “In My Pocket” feature shows you exactly how much money you can safely use for daily expenses, helping you avoid overspending.

Final Thoughts

In a world where financial stress is all too common, the right budgeting app can be a game-changer.

These apps not only help you track your spending and save money but also empower you to take control of your financial future.

From the simplicity of EveryDollar to the proactive approach of YNAB, each app offers unique tools that cater to different needs and preferences.

Remember, the key to financial success is finding a system that works for you and sticking to it. With a variety of free and paid options available, there’s no reason not to give one of these top-rated budgeting apps a try.

Downloading the right app could be the first step toward a more organized, stress-free financial life. So take the leap, explore your options, and start budgeting your way to financial peace of mind today!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!