How to Create a Budget That Actually Works for Your Life

Let’s be honest—when most people hear the word budget, their brain immediately jumps to one thing: restriction.

Cut the fun. Cut the lattes. Cut the life you actually enjoy.

No wonder so many of us avoid it or feel like we’re doing it wrong.

The truth? Budgeting doesn’t have to be rigid or miserable. In fact, if your budget feels like punishment…it’s not the right budget for you.

A budget should work for your life, not against it. It should reflect your real priorities, your real expenses, and yes—your real dreams. Not someone else’s version of “doing it right” that you saw in a color-coded chart on Pinterest.

In this post, I’m walking you through exactly how to create a budget that works for you—your schedule, your income, your values. No more one-size-fits-all advice. No more shame if things haven’t worked in the past.

This is budgeting with your real life in mind—and it’s about to get a whole lot easier.

Why Most Budgets Fail (and What to Do Differently)

If you’ve ever made a budget, stuck to it for three days, and then totally abandoned it…you’re not alone.

Most budgets fail for one simple reason: they don’t fit real life.

They’re too strict. Too complicated. Too aspirational.

They assume you’ll never eat out, never forget a bill, and never need a Target run after a rough day. Spoiler: you will.

Here’s the truth most people don’t talk about: Your budget should feel like a support system—not a punishment.

It should reflect your actual life, not a Pinterest-perfect version of what budgeting “should” look like.

Let’s change the approach:

- Instead of cutting out everything that brings you joy → budget for it.

- Instead of pretending you’ll meal prep every night for the next 30 days → budget for takeout once a week.

- Instead of feeling guilty about spending → get curious about your habits and give every dollar a job that makes sense for you.

This is exactly the shift we walk through in the 7-Day Budgeting Basics Challenge. If you’ve ever felt like budgeting just “doesn’t work for you,” that challenge will show you a better way—one that’s sustainable and tailored to your life.

And if you’re ready to do a full refresh and rebuild your budget from the ground up? The $27 Budget Reset Bundle walks you through every single step to get there—without the overwhelm.

Step One: Get Clear on Where Your Money’s Actually Going

Before you can create a budget that works, you have to know exactly what’s happening with your money right now.

No more guessing. No more “I think I spend around $500 on groceries.” This step is all about getting honest, without judgment.

If you’ve ever felt like budgeting doesn’t work for you, it might be because you’re building it on incomplete (or totally made-up) numbers.

Start by Grabbing These 3 Things:

- Your last 1–2 months of bank statements

- Your paycheck(s) or income details

- A notebook, spreadsheet, or printable planner

(Don’t overthink the setup—just pick what feels easiest for you right now.)

Once you’ve got those in front of you, it’s time to start breaking down your real numbers.

Figure Out Your Real Monthly Take-Home Income

Look at what actually lands in your bank account after taxes, insurance, and retirement contributions. If you have multiple income streams—side hustles, child support, freelance gigs—include all the ones you rely on regularly.

Tip: Use the average from the past 2–3 months if your income fluctuates.

List Your Fixed Monthly Expenses

These are the bills you know are coming each month—rent/mortgage, car payments, phone bill, subscriptions, insurance, and minimum debt payments.

Make a full list and write down the due dates so you can build a budget that works with your cash flow, not against it.

Track Your Variable Spending (This Is Where Most Budgets Blow Up)

Scroll through your last 1–2 months of bank statements and categorize what you actually spent on:

- Groceries

- Dining out

- Gas

- Shopping

- “Little things” (Target runs, coffee shops, digital purchases, etc.)

You don’t need to feel bad about any of it. You just need to see it. This is where the leaks often are—and once you see them, you can plug them.

Don’t Forget Your Debt Payments

If you’re making extra payments on credit cards, loans, or BNPL plans (like Klarna or Afterpay), include those here too. They impact your cash flow and need to be part of your budget picture.

Need Help Organizing All of This?

You don’t have to figure this out on your own.

The Budget Boss Blueprint is a 50+ page workbook that helps you dig even deeper, track everything, and start building a budget that fits your life.

The Ultimate Budget Makeover Planner is a free printable bundle that walks you through each of these categories—perfect if you’re a pen-and-paper person who loves a checklist.

Choose a Budgeting Method That Matches Your Lifestyle

There’s no one-size-fits-all way to budget. If you’ve tried a method that felt overwhelming, restrictive, or just plain annoying…it wasn’t you—it was the method.

The key to creating a budget that works is picking a system that actually fits your life, personality, and income flow.

So let’s walk through a few popular budgeting styles and help you find your match.

Zero-Based Budgeting

This method gives every single dollar a job. You start with your monthly income, subtract all expenses (fixed, variable, savings, debt), and end with zero.

- Best for: Type-A folks who love structure and detail

- Why it works: You know exactly where every dollar is going

- Watch out for: It can feel intense if your income or expenses change a lot month to month

If you love color-coding, spreadsheets, or having total control, this might be your budgeting soulmate.

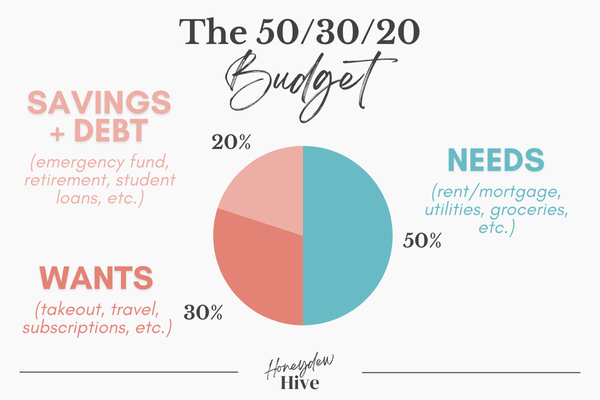

50/30/20 Budgeting

This method breaks your income into three simple chunks: 50% needs, 30% wants, 20% savings + debt payoff.

- Best for: Beginners or anyone who hates micromanaging their money

- Why it works: Super flexible and easy to follow

- Watch out for: It might not be specific enough if you have a lot of irregular expenses or goals

This one’s great if you want a bird’s-eye view of your money without having to track every coffee run.

Budgeting by Paycheck

You create a new mini-budget every time you get paid (weekly, biweekly, etc.). Instead of planning for the whole month, you assign bills, expenses, and savings goals to each paycheck.

- Best for: Anyone with biweekly income, hourly pay, or variable income

- Why it works: Keeps your budget aligned with your actual cash flow

- Watch out for: You’ll need to check in more frequently and plan bill due dates carefully

This method is super practical if monthly budgeting has ever left you scrambling halfway through the month.

Not Sure Which One to Pick? Try One and Tweak It.

You don’t have to commit for life. Budgeting is an experiment. Start with one method, see how it feels for a few weeks, and adjust as needed.

If you need help building a budget from the ground up—and you want it to feel doable, not overwhelming—the 7-Day Budgeting Basics Challenge will walk you through simple daily steps to create a plan that actually fits your life.

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

Build in the Things You Actually Care About

If your budget only covers rent, groceries, and bills…no wonder it feels like a drag.

A budget that works isn’t just about surviving—it’s about living. And that means building in the things that light you up, even if they don’t seem “essential” on paper.

Your joy is allowed to take up space in your budget.

Here are a few categories most people forget to include—but absolutely should:

- Fun money (even $20 a month makes a difference!)

- Travel + getaways

- Holidays, birthdays, and gifting

- Self-care or hobbies

- Seasonal expenses (like back-to-school, Halloween costumes, or summer camps)

- Emergency coffee runs + “life happens” moments

When you budget for things that make you happy, you’re way more likely to actually stick to your plan. Why? Because it won’t feel like punishment. It’ll feel like support.

And if you’re not sure how to make space for these things without blowing your budget? The Budget Reset Bundle is made for that.

It helps you map out your real life—not just bills—and gives you the tools to track everything with intention.

Track It (Without Letting It Take Over Your Life)

You don’t need to obsess over every dollar to have a budget that works.

But you do need to pay attention. Otherwise, your money will do its own thing—and spoiler: it’s usually not the thing you wanted it to do.

Think of tracking like checking your GPS while driving. You don’t stare at it the whole time…but you do glance down regularly to make sure you’re still headed where you want to go.

Pick a tracking rhythm that works for you:

- Daily tracking – great if you love data or tend to overspend

- Weekly check-ins – perfect for most people (I recommend this one!)

- Monthly reviews – bare minimum if you want to keep an eye on patterns

Choose your tracking style:

- Pen and paper

- Budgeting apps

- Color-coded spreadsheets (my fave)

- Highlighter and bank statement combo (super simple and visual)

There’s no wrong way to track—just the way that works best for your brain. If it’s too complicated, you won’t do it. And that defeats the whole purpose.

Need a simple way to stay consistent? The 7-Day Budgeting Basics Challenge walks you through setting up a system that doesn’t feel overwhelming, so you can actually keep up with it.

Adjust Monthly (Because Life Happens)

Here’s something a lot of budgeting advice forgets to mention: your budget will change. A lot. And that’s not a failure—it’s a sign you’re paying attention.

Life doesn’t stay the same every month, so your budget shouldn’t either.

You’ll have unexpected expenses, surprise income, forgotten events, and last-minute Target runs. (Yep, again with Target.)

Do a Monthly Money Reset

This doesn’t have to be complicated—it can literally be 20 minutes with your planner, a snack, and your favorite playlist. Check in on:

- What went over budget

- What you didn’t end up needing

- What’s coming up next month that you can plan for now

Even better? Build in a “life happens” buffer so the unexpected doesn’t wreck your entire plan.

Give Yourself Permission to Edit

Your budget isn’t written in stone—it’s a living document.

So if your income changes? Adjust it. If you overspent in one category? Shift things around. If something’s not working? Try a new method.

That’s not quitting. That’s adapting.

If you’re ready to build a monthly budget that flows with your real life—not one that falls apart every time something shifts—the Budget Boss Blueprint gives you the exact tools to do just that.

Build a Buffer + Emergency Fund

Let’s be real: life loves to throw curveballs. And nothing wrecks a perfectly planned budget faster than a flat tire, a forgotten birthday gift, or a surprise medical bill.

That’s why every solid budget needs two safety nets: a buffer and an emergency fund.

RECOMMENDED READ: The Best Money-Saving Challenges to Grow Your Savings Faster

Start With a Simple Buffer

A buffer is a small cushion in your checking account—think $100–$300—to protect you from going negative if something pops up unexpectedly.

- It’s not your emergency fund.

- It’s not for “fun spending.”

- It’s just a little breathing room so your entire budget doesn’t fall apart over one unexpected expense.

Think of it as financial air bags.

Then Build Your Emergency Fund

This is your “just in case” stash—money you don’t touch unless it’s truly necessary (car repairs, job loss, medical bills, etc.).

- If you’re just starting out, aim for $500 to $1,000

- Long-term goal: 3–6 months of essential expenses

And no, you don’t need to save it all at once. Start with $20. Then $50. Then $100. Progress matters more than perfection.

Make Saving Feel Doable (and Even Fun)

You know I love a good visual tracker—because watching your savings grow makes it way easier to stay motivated.

That’s exactly why I included multiple emergency fund trackers and visual savings challenges inside the Budget Reset Bundle. It helps you build your buffer and savings goals one small, manageable step at a time.

Celebrate Wins (Even the Small Ones)

Budgeting isn’t just about bills and numbers—it’s about progress. And if you don’t see or celebrate that progress, it’s easy to feel like it’s not working.

But it is working.

Small Wins Lead to Big Results

- You tracked your spending this week? That’s a win.

- You said no to an impulse buy? That’s a win.

- You saved $20 in your buffer fund? That’s a win.

- You remembered to update your budget instead of giving up on it? Huge win.

Progress isn’t always loud or dramatic. Most of the time, it’s quiet and steady—and it’s exactly what leads to long-term financial change.

Create a Way to Visually Track Your Progress

Humans are wired for momentum. So when you can see your growth, you’re way more likely to keep going.

You can:

- Use a printable savings tracker

- Color in a chart each time you meet a goal

- Make a “budget win” list in your planner or phone

- Drop $5 into a “reward jar” every time you follow through

This is why I love including visual tools inside my printables and planners. Inside the Budget Reset Bundle, you’ll find savings challenges, emergency fund trackers, and printable worksheets that help you see your progress as you go.

Because when you celebrate your wins, you stay in the game.

Final Thoughts: You Don’t Need a Perfect Budget—Just One That Works for You

If budgeting has felt like a battle in the past, you’re not alone. Most of us were never taught how to create a budget that actually works for our lives—we were handed rigid rules, spreadsheets that made our eyes glaze over, and advice that didn’t leave room for real life.

But now you know better.

You’ve learned that budgeting isn’t about restriction—it’s about intention.

It’s not about getting it right the first time—it’s about building something flexible, supportive, and sustainable.

So whether you’re starting fresh, recovering from a budgeting fail, or just ready to finally feel in control of your money, remember this: Your budget doesn’t have to look like anyone else’s. It just has to work for you.

And if you’re ready for the next step, here are some tools that can help you get started:

- Download the free Ultimate Budget Makeover Planner to organize your income and expenses

- Start building momentum with the 7-Day Budgeting Basics Challenge

- Get the full system in one place with the Budget Reset Bundle

- Or dig into the numbers with structure using the Budget Boss Blueprint

You’ve got this—and I’ll be cheering you on every step of the way.