How to Organize Your Finances in 5 Simple Steps

Let’s be honest—trying to manage your finances when everything feels disorganized is exhausting.

You’ve got bills due on different days, random notes scattered across apps and sticky pads, and no real idea where your money is actually going each month. It’s no wonder it feels stressful.

But here’s the good news: getting your finances organized doesn’t have to be complicated. You don’t need a finance degree, a complicated spreadsheet, or hours of free time every week.

You just need a simple system that works for you—one that gives every dollar a job and every expense a home.

In this post, I’m going to show you exactly how to organize your finances in five manageable steps.

These are the same steps I use in my own routine, and they’ve helped me go from overwhelmed to in control when it comes to my money.

And if you want some extra support while you follow along, you can download my free Ultimate Budget Makeover Planner to help you get started right now.

Let’s break it down step by step.

Step 1: Know What’s Coming In and Going Out

You can’t organize your finances if you don’t know what’s actually happening with your money. That’s why the very first step is all about getting clear on your income and your expenses.

Start by writing down:

- Every source of income you receive each month (paychecks, freelance work, side hustles, child support, etc.)

- Every regular expense you have—things like rent or mortgage, utilities, groceries, gas, subscriptions, credit card payments

Don’t worry about being perfect here—just list out everything you know is coming in and going out. The more honest you are, the more accurate your financial picture will be.

Then, take a look at your totals:

- Are you spending more than you earn?

- Are you unsure where a chunk of your money is going each month?

This step alone is often eye-opening. Awareness is the foundation of financial organization.

Once you know what you’re working with, you can start making smart decisions with confidence.

Want an easy way to do this all in one place? Download my free Ultimate Budget Makeover Planner—it has printable worksheets to help you track your income and expenses clearly, so you can stop guessing and start planning.

Step 2: Create a Simple, Centralized Budget

Once you’ve got a clear picture of what’s coming in and going out, the next step is to put it all in one place—a simple, centralized budget you can actually stick with.

Too many people try to manage their money using a mix of mental notes, receipts, random apps, and scattered spreadsheets. That kind of chaos makes it easy to forget due dates, overspend, or lose track of goals.

Instead, choose one method and keep everything there. Whether it’s printable worksheets, a Google Sheet, or a notebook doesn’t matter—what matters is consistency.

Your budget should show:

- How much income you’re working with

- All your fixed and variable expenses

- How much you’re allocating toward savings, debt, and goals

Keep it simple. You don’t need to track every single dollar to the penny (unless you want to).

RECOMMENDED READ: A Beginner’s Guide to Creating a Monthly Budget

What matters most is having a clear system that shows you where your money is going and gives you a plan for each paycheck.

Need help building that system from scratch?

My Budget Boss Blueprint walks you through exactly how to set up a budget that works for your life—with step-by-step guidance and tools that make it easy to stay organized month after month.

It’s not about perfection—it’s about creating a system you’ll actually use.

Step 3: Organize Your Accounts and Payment Dates

Ever missed a bill simply because you forgot it was due? You’re not alone. One of the easiest ways to reduce financial stress is to get your accounts and due dates organized in one central spot.

Start by making a list of:

- All your financial accounts (checking, savings, credit cards, loans, etc.)

- All your monthly bills and subscriptions (along with the exact due dates)

- How each bill is paid—is it on autopay, do you pay manually, or is it connected to a specific account?

From there, you can build a simple system to stay on top of it all:

- Create a monthly money calendar that outlines what’s due and when

- Set reminders in your phone or calendar app for bills that aren’t automated

- Consider renaming your bank accounts (if your bank allows it) so you know what each one is for—for example, “House Bills” or “Savings for Summer Trip”

This step is all about visibility. When you can see your financial setup laid out in front of you, you’re less likely to be surprised by a random charge or due date.

If you need a simple way to keep track of everything in one place, the Budget Boss Blueprint includes printable bill trackers, due date logs, and monthly check-in pages to help you stay organized and on top of your entire money routine.

Getting organized now means fewer missed payments—and a lot less stress later.

Ready to Finally Take Control of Your Money?

The Budget Reset Bundle gives you everything you need to stop the paycheck-to-paycheck cycle, create a real budget that actually works, and start saving fast. No fluff — just real tools for real change.

Step 4: Prioritize and Tackle Any Debt

Debt can feel like one of the biggest barriers to financial peace—but once you start organizing it, it becomes much more manageable.

Instead of avoiding it or letting it stay scattered across statements and apps, this step is about bringing it all into one clear, actionable view.

Start by listing out:

- Each debt you owe (credit cards, personal loans, medical bills, student loans, etc.)

- The total balance, interest rate, and minimum monthly payment for each

- Any extra payments you’ve made recently or plan to make

Seeing the full picture of your debt can feel intimidating at first, but it’s the key to making real progress.

From here, you can choose a debt payoff strategy that works for you—whether that’s the snowball method (smallest balance first) or the avalanche method (highest interest rate first).

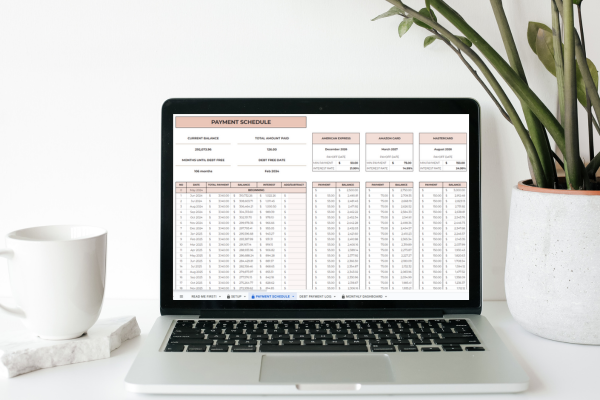

If you want a super simple way to track your progress and stay motivated along the way, check out my Debt Snowball Spreadsheet. It does all the math for you, so you can focus on making progress—and watching your balances shrink.

The goal here isn’t to wipe out all your debt overnight. It’s to make a plan you can stick to—and feel proud of every time you make a payment.

Step 5: Automate, Review, and Adjust Regularly

Once you’ve built a clear, organized financial system, the next step is to keep it running smoothly—without burning out or starting over every month.

That’s where automation and regular reviews come in.

Start by automating what you can:

- Set up automatic bill payments for fixed expenses like rent, utilities, or subscriptions

- Schedule automatic transfers to savings or debt payoff accounts

- Use calendar reminders for bills that can’t be automated

Automation doesn’t mean you’re off the hook—but it does take away the mental load of remembering every single due date or savings goal.

Next, schedule a quick money check-in once a week or once a month. During this time, you can:

- Review your budget

- Track progress toward savings or debt goals

- Adjust any categories that need tweaking (like groceries or gas)

- Plan for upcoming irregular expenses

If you’re saving for future expenses like car repairs, vacations, or holiday gifts, it might also be helpful to use sinking funds.

I created a Sinking Funds Spreadsheet that makes it easy to plan and track these kinds of savings goals—especially if you want to stay organized throughout the year.

The goal of this step is to stay consistent and reduce money stress over time.

By automating what you can and checking in regularly, you’ll catch small issues early—and feel more confident managing your finances every month.

Final Thoughts: Financial Organization Creates Peace of Mind

Getting your finances organized doesn’t mean having every dollar perfectly categorized or never making a money mistake again.

It simply means creating a system that helps you feel more in control—and less overwhelmed.

When you know what’s coming in, where your money is going, and what your priorities are, it’s so much easier to make confident decisions. You stop reacting to money stress and start responding with a plan.

And the best part? You don’t have to do it all at once.

Even one small step—like tracking your bills or writing down your income—can have a huge impact.

Financial clarity is built one step at a time.

If you’re ready to take that first step, I’ve created a free tool to help you get started.

Download my free Ultimate Budget Makeover Planner to organize your income, expenses, and goals all in one place. It’s the exact tool I wish I had when I was trying to figure out how to manage my money without the overwhelm.

You’ve got this—and I’m cheering you on every step of the way.