We partner with some awesome companies that offer products that help our readers achieve their goals! If you purchase through our partner links, we get paid for the referral at no additional cost to you! Read our disclosure for more information.

Managing your money doesn’t have to be complicated or overwhelming! If you’re tired of feeling lost when it comes to your finances, the 70-20-10 budget rule might be exactly what you need.

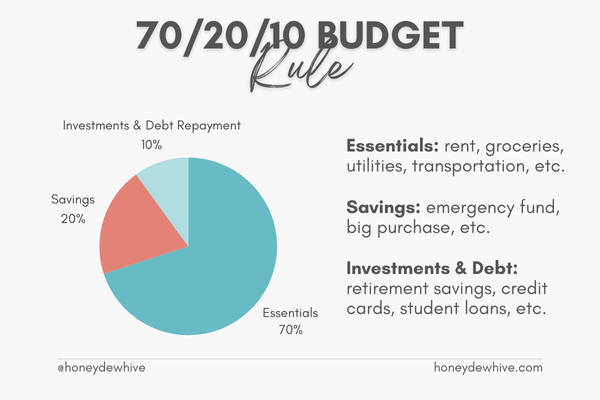

This straightforward budgeting formula breaks down your income into three simple categories: 70% for essentials, 20% for savings, and 10% for investments or debt repayment.

Unlike other budgeting methods that might seem too restrictive or complex, the 70-20-10 rule offers flexibility while ensuring you cover all the important bases.

Whether you’re just starting out on your financial journey or looking for a fresh approach to managing your money, this rule is designed to keep you on track without the stress.

Let’s explore how the 70-20-10 budget rule works, why it’s so effective, and how you can easily implement it to achieve financial success.

Ready to take control of your finances? Let’s get started!

What Is The 70-20-10 Budget Rule?

The 70-20-10 budget rule is a simple way to manage your money. It divides your income into three parts to help you stay on top of your finances without feeling overwhelmed.

Here’s how it works:

70% For Essentials

This is the biggest part of your budget, covering all your essential needs like rent or mortgage, utilities, groceries, transportation, and other necessary expenses.

These are the things you can’t live without, so they take up the largest portion of your income.

The idea is to make sure you’re spending enough to cover these costs, but not so much that you don’t have room for saving or investing.

20% For Savings

The next 20% of your income goes straight into savings. This could be for an emergency fund, a big purchase you’ve been planning for, or simply saving for the future.

By putting money aside regularly, you’re building a safety net that can help you avoid debt and achieve your financial goals.

It might not seem like much at first, but over time, these savings can really add up.

10% For Investments & Debt Repayment

The final 10% is used for investments or paying off debt. If you have high-interest debt, like credit card debt, focus on paying that down first.

Once your debt is under control, or if you don’t have any, you can start investing this money to help it grow over time.

This might mean putting money into a retirement account, buying stocks, or even investing in yourself through education or skills training.

The 70-20-10 budget rule is easy to follow because it’s flexible and doesn’t require detailed tracking of every single expense. It’s all about creating a balance—covering your needs, saving for the future, and investing in long-term growth.

Whether you’re just getting started with budgeting or looking for a new way to manage your money, the 70-20-10 rule is a great place to begin.

How To Implement The 70-20-10 Budget Rule In Your Life

Implementing the 70-20-10 budget rule is easier than you might think! It’s all about dividing your income into three simple categories: essentials, savings, and investments or debt repayment.

Here’s a step-by-step guide to help you get started:

1. Calculate Your Monthly Income

First, figure out how much money you bring in each month. This includes your paycheck, any side hustle income, or other sources of regular money.

Knowing your total income is important because it helps you know exactly how much you have to work with.

2. Allocate 70% To Essentials

Next, take 70% of your income and set it aside for your essential expenses. This covers things like your rent or mortgage, utilities, groceries, transportation, and any other must-pay bills.

For example, if you make $3,000 a month, 70% would be $2,100. Try to make sure all your essential costs fit within this amount.

If they don’t, you might need to look for ways to cut back, like finding cheaper alternatives or reducing some of your bills.

3. Set Aside 20% For Savings

Now, take 20% of your income and put it into savings. This could be for an emergency fund, saving for a big goal like buying a house, or just building up your savings for the future.

Using the same $3,000 example, 20% would be $600.

Set up an automatic transfer to a savings account so you’re not tempted to spend this money on other things.

4. Use 10% For Investments & Debt Repayment

Finally, the last 10% of your income should go toward investments or paying off debt. If you have credit card debt or other high-interest debt, focus on paying that off first.

Once that’s done, or if you don’t have debt, you can start investing this money to grow your wealth over time. For our $3,000 income example, 10% would be $300.

This could go into a retirement account, stocks, or even into learning new skills that can help you earn more in the future.

5. Track Your Spending & Adjust As Needed

As you start following the 70-20-10 budget rule, it’s important to keep an eye on your spending. Make sure you’re sticking to the percentages and not overspending in one category.

If you find that your budget isn’t working perfectly, don’t worry! It’s okay to make adjustments to fit your lifestyle and financial goals better.

6. Stay Consistent

The key to making the 70-20-10 budget rule work is consistency. Stick to the plan each month, and over time, you’ll see your savings grow, your debt shrink, and your financial confidence soar.

By breaking your income into these three simple categories, you can take control of your finances without feeling stressed or overwhelmed.

The 70-20-10 budget rule is all about balance—ensuring that you’re covering your needs, building your savings, and investing in your future.

Give it a try and see how it can make a difference in your financial life!

Why The 70-20-10 Budget Rule Works

The 70-20-10 budget rule works because it’s simple, flexible, and easy to stick with.

It’s designed to help you manage your money in a way that feels manageable and balanced, without needing to track every single penny.

Here’s why this budget rule is so effective:

It Creates Balance In Your Finances

The 70-20-10 budget rule divides your income into three clear parts, making sure that your money is spread out in a balanced way.

You’re not spending too much on fun stuff or saving so little that you never reach your goals.

With 70% going to essentials, 20% to savings, and 10% to investments or debt repayment, you’re covering all the important areas without neglecting any part of your financial life.

It Promotes Consistent Saving & Investing

One of the best things about the 70-20-10 budget rule is that it encourages regular saving and investing.

By setting aside 20% of your income for savings and 10% for investments or paying off debt, you’re making sure that you’re building a solid financial foundation.

This consistency helps you build up your savings over time, reduce debt, and grow your wealth without having to think too much about it.

It’s Easy To Understand & Follow

The 70-20-10 rule is straightforward and easy to understand, which makes it simple to follow. You don’t need a complicated spreadsheet or budgeting app to make it work.

All you need is a basic understanding of your income and expenses, and you’re ready to start.

This simplicity is key because it means you’re more likely to stick with it over the long term.

It Adapts To Your Changing Financial Situation

Another reason the 70-20-10 budget rule works so well is that it’s flexible. If your income goes up or down, you can easily adjust the amounts you’re allocating to each category.

Plus, if your financial goals change—like if you need to save more for a big purchase or pay off debt faster—you can tweak the percentages to fit your needs.

This flexibility means that the budget can grow and change with you, keeping you on track no matter what life throws your way.

It Encourages Good Financial Habits

Following the 70-20-10 rule helps you develop good financial habits, like saving regularly and living within your means.

These habits are the foundation of financial success, and the more you practice them, the stronger they become.

Over time, you’ll find that managing your money becomes second nature, and you’ll feel more confident in your financial decisions.

It Reduces Financial Stress

Finally, the 70-20-10 budget rule can help reduce financial stress. Knowing that your money is being managed in a balanced way gives you peace of mind.

You’re not worrying about whether you’ll have enough to cover your bills or if you’re saving enough for the future.

Instead, you can feel confident that you’re on the right path, which makes it easier to relax and enjoy life.

In short, the 70-20-10 budget rule works because it’s simple, effective, and adaptable.

It helps you create a balanced financial life, build good habits, and reduce stress, all while making sure you’re saving and investing for your future.

Whether you’re just starting out or looking for a new way to manage your money, this budget rule is a powerful tool that can help you achieve financial success.

Adjusting The 70-20-10 Rule To Fit Your Financial Goals

The great thing about the 70-20-10 budget rule is that it’s flexible enough to fit your unique financial goals.

Everyone’s financial situation is different, and sometimes, you need to make adjustments to ensure your budget works for you.

Here’s how you can tweak the 70-20-10 rule to better align with your goals:

1. Customize The Percentages

While the standard 70-20-10 split is a great starting point, it’s not set in stone.

If you’re trying to pay off debt faster, for example, you might want to allocate more than 10% of your income to debt repayment and less to savings temporarily.

On the other hand, if you’re focused on building your savings quickly, you could increase the savings portion to 25% or 30%, adjusting the other categories accordingly.

The key is to find a balance that works for your current priorities.

2. Consider Your Income Level

Your income level might influence how you adjust the 70-20-10 rule.

If you have a higher income, you might find that 70% for essentials is more than you need. In that case, you could reduce the percentage for essentials and increase your savings or investments.

Conversely, if your income is lower, you might need to allocate a bit more to cover your essentials, even if that means saving a little less for now.

The goal is to make sure your budget is realistic and manageable.

3. Factor In Your Life Stage

Your financial needs change as you go through different stages of life, and your budget should reflect that.

If you’re just starting out in your career, you might focus more on building an emergency fund and paying off student loans, which could mean adjusting the rule to 60-25-15 or something similar.

If you’re nearing retirement, you might shift more towards saving and investing, with a 50-30-20 split.

Think about where you are in life and what financial goals are most important to you right now.

4. Plan For Big Financial Goals

If you have a big financial goal in mind, like buying a house or starting a business, you might need to make temporary adjustments to the 70-20-10 rule.

For example, you could increase your savings rate to 30% or more to reach your goal faster. Once you’ve hit your target, you can go back to the original rule or find a new balance that fits your next goal.

Remember, your budget is a tool to help you achieve your dreams, so don’t be afraid to adjust it as needed.

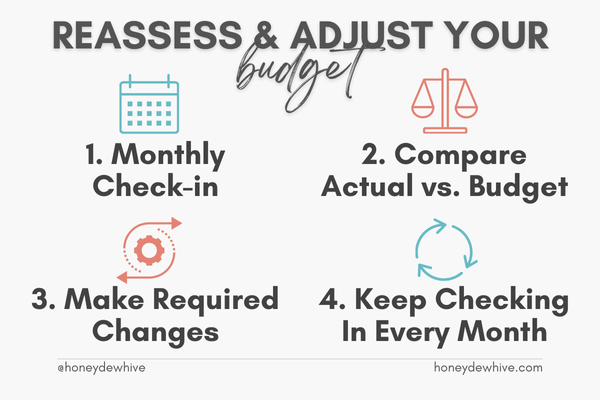

5. Reevaluate Regularly

Your financial situation and goals can change over time, so it’s important to reevaluate your budget regularly.

At least once a year, or whenever there’s a major change in your life (like a new job, marriage, or a big purchase), take a fresh look at your budget. Ask yourself if the 70-20-10 rule is still working for you or if it needs a tweak.

By staying flexible and adjusting your budget when necessary, you’ll be better equipped to stay on track and reach your financial goals.

6. Don’t Forget To Reward Yourself

Budgeting shouldn’t be all about restrictions. It’s important to include some fun in your financial plan too!

If you’re hitting your savings goals and paying off debt, consider rewarding yourself by temporarily adjusting the budget to include a little extra spending money.

This could mean shifting the rule to 65-20-15 for a month to enjoy a special treat or experience.

Just make sure it’s a temporary change and that you get back on track afterward.

Adjusting the 70-20-10 budget rule is all about making it work for your specific needs and goals.

Whether you’re saving for something big, paying off debt, or just trying to live more comfortably, tweaking the percentages can help you create a budget that truly fits your life.

The most important thing is to stay flexible, keep your goals in mind, and remember that your budget is there to support you, not stress you out!

The 70-20-10 Budget Rule vs. Other Budgeting Methods

The 70-20-10 budget rule is a simple and flexible way to manage your money, but it’s not the only budgeting method out there.

There are several other popular methods, each with its own strengths and weaknesses.

RECOMMENDED READ: 10 SIMPLE BUDGETING METHODS FOR BEGINNERS

Let’s take a look at how the 70-20-10 budget rule stacks up against some of these other approaches:

The 70-20-10 Budget Rule vs. The 50/30/20 Budget Rule

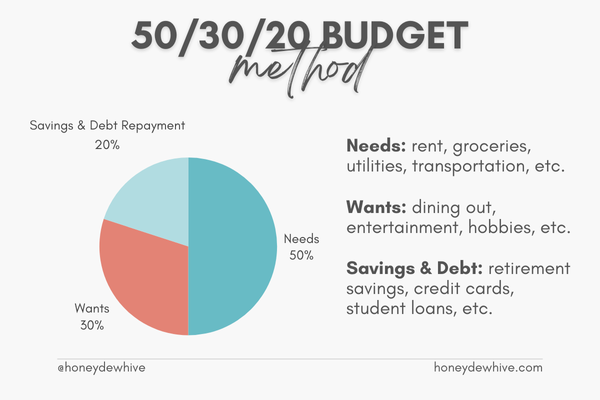

The 50/30/20 budget rule is another popular method, and it’s similar to the 70-20-10 rule in that it divides your income into categories.

With the 50/30/20 rule, 50% of your income goes to essentials, 30% to discretionary spending, and 20% to savings.

While both methods aim to balance your spending, saving, and investing, the 70-20-10 rule is often better for those who want to prioritize investments or debt repayment, as it specifically allocates 10% for that purpose.

On the other hand, the 50/30/20 rule gives you more room for flexible spending, which might appeal to people who want to enjoy their money more in the short term.

The 70-20-10 Budget Rule vs. Zero-Based Budgeting

Zero-based budgeting is a method where you allocate every dollar of your income to a specific purpose, so your income minus expenses equals zero.

This method requires detailed tracking of all your spending and can be very effective for people who want to have full control over every dollar.

However, it can also be time-consuming and overwhelming for some.

The 70-20-10 budget rule is simpler and less time-intensive because it doesn’t require you to track every expense down to the last penny.

Instead, it gives you broad categories to work within, making it easier to stick to without getting bogged down in the details.

The 70-20-10 Budget Rule vs. The Envelope System

The envelope system is a cash-based budgeting method where you put your budgeted amounts into different envelopes for each spending category.

Once the money in an envelope is gone, you can’t spend any more in that category until the next month.

This method can be very effective for controlling spending, especially if you tend to overspend in certain areas.

However, it requires you to carry cash and manage physical envelopes, which isn’t always convenient in today’s digital world.

The 70-20-10 budget rule, on the other hand, is more modern and flexible, allowing you to manage your money with digital tools while still keeping spending under control.

The 70-20-10 Budget Rule vs. The Pay-Yourself-First Method

The pay-yourself-first method focuses on prioritizing savings by setting aside money for your savings goals before paying any other expenses.

This method is great for those who struggle to save consistently because it forces you to make savings a top priority.

However, it doesn’t provide as much guidance on how to manage the rest of your income.

The 70-20-10 budget rule combines the pay-yourself-first approach with a clear structure for handling the rest of your money, ensuring that you’re not only saving but also managing your expenses and investments wisely.

The 70-20-10 Budget Rule vs. Percentage-Based Budgeting

Percentage-based budgeting is a broad term for any budgeting method that allocates a certain percentage of your income to different categories, like the 50/30/20 rule or the 70-20-10 rule.

The main difference is in the specific percentages and categories used. What sets the 70-20-10 budget rule apart is its focus on balancing essentials, savings, and investments or debt repayment.

This makes it a versatile and well-rounded option that can work for a wide range of financial situations, while still being easy to adjust as needed.

Pros & Cons Of The 70-20-10 Budget Rule

The biggest advantage of the 70-20-10 budget rule is its simplicity and flexibility. It’s easy to understand, doesn’t require detailed tracking, and can be adjusted to fit your financial goals.

However, it may not work as well for those who need more detailed control over their spending or who prefer a more hands-on approach to budgeting.

If you’re someone who wants to make sure every dollar is accounted for, you might prefer a method like zero-based budgeting or the envelope system.

Choosing The Best Budgeting Method For You

Ultimately, the best budgeting method is the one that works for you and your lifestyle.

If you’re looking for a simple, flexible way to manage your money that still prioritizes savings and investments, the 70-20-10 budget rule is a great choice.

But if you need more structure or want to focus on different aspects of your finances, one of the other methods might be a better fit.

The most important thing is to find a budget that you can stick with and that helps you achieve your financial goals.

The 70-20-10 budget rule offers a balanced, easy-to-follow approach to managing your money.

Whether you’re just starting out or looking for a new way to handle your finances, it’s worth giving the 70-20-10 rule a try to see how it can work for you.

Final Thoughts

The 70-20-10 budget rule is more than just a budgeting method—it’s a roadmap to financial stability and success.

By allocating your income into three clear categories, you can ensure that your essential needs are met, your savings grow consistently, and your financial future is secured through smart investments or debt reduction.

This budget rule is particularly powerful because it’s adaptable to various income levels and life stages. This makes it a go-to strategy for anyone looking to simplify their financial management.

Remember, the key to making the 70-20-10 rule work is consistency and regular evaluation. As your financial situation and goals evolve, don’t hesitate to adjust the percentages to better suit your needs.

The journey to financial freedom starts with a single step—why not take that step today by trying out the 70-20-10 budget rule?

With a little discipline and commitment, you’ll be well on your way to achieving your financial goals and living the life you’ve always dreamed of!

Want More Honeydew Hive?

If you enjoyed this article and want more helpful advice and inspiration, be sure to subscribe to Honeydew Hive for even more great content!

When you subscribe, you’ll receive our free Ultimate Budget Makeover Planner – the exact roadmap I used to pay off over $30K in debt!

Stay tuned for more tips, inspiration, and practical advice to make managing your finances easier and more enjoyable. Don’t miss out – subscribe now and join the Honeydew Hive community!